JB Insights

WGC releases ‘India Gold Market – Reform and growth’

The World Gold Council (WGC) has published a new report titled ‘India Gold Market – Reform and growth’. The report explores the key factors that shape India’s gold demand and supply, as well as the challenges and opportunities for the future. The new report covers various aspects of India’s gold market, such as: The drivers of Indian gold demand, jewellery demand and trade, jewellery market structure, gold investment market and financialisation, bullion trade, gold refining and recycling, and gold mining in India.

In the report foreword, Juan Carlos Artigas, Global Head of Research, World Gold Council, said: “In 2017 we produced “India’s Gold Market – evolution and innovation’. A lot has changed since that report was published. This compendium of updated reports delves deeper into key factors that underpin India’s position as the second largest gold consumer in the world: it studies the drivers of gold demand and the perception of consumers; it examines the new investment landscape: and it considers the complex issue of gold supply.

“Few of the global events that have rocked societal and geopolitical stability could have been imagined when our 2017 report was published. That India has had to adapt is not surprising, but the rate at which change is happening in the country is, arguably, unprecedented.

“Despite – or perhaps because of – macroeconomic uncertainties, India’s population resolutely turns to gold. Weddings and festivals are key drivers of gold demand and the country is one of the world’s largest bar and coin markets. There is no doubt that gold retains prominence in the social and financial life of many Indians, both urban and rural.

“The years ahead will present challenges. But rather than thinking them onerous, we believe there is tremendous opportunity for gold. Regulation of India’s jewellery industry has already made huge strides in building consumer trusts. If new export markets can be developed, the current fragile platform – 90% of jewellery exports go to just five countries – will be diluted. More accessible banking offers a possibility to reach investors who have long understood gold’s safe-haven qualities but now find themselves negotiating a plethora of choice. And in the longer term, the Gold Monetisation Scheme, proposed legislative changes in the mining industry, and resolution of recycling traceability issues may reduce India’s reliance on imported gold.

“As we look ahead with optimism, the insights in this report will help us ensure that gold retains or even increases its relevance to India’s economy – generating further employment and continuing to play its roles as an adornment and an effective portfolio diversifier and hedge against inflation

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

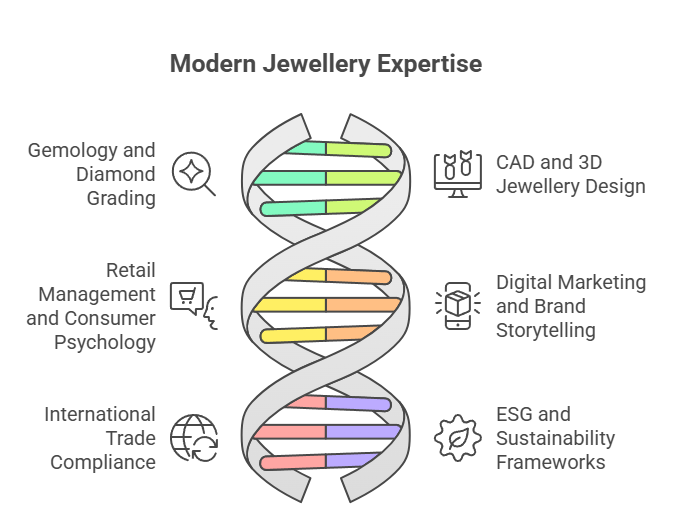

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

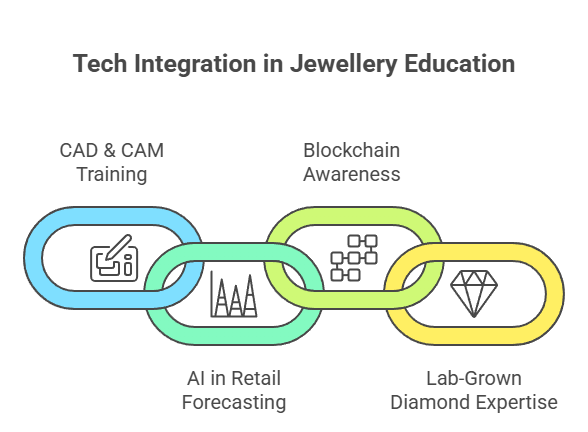

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

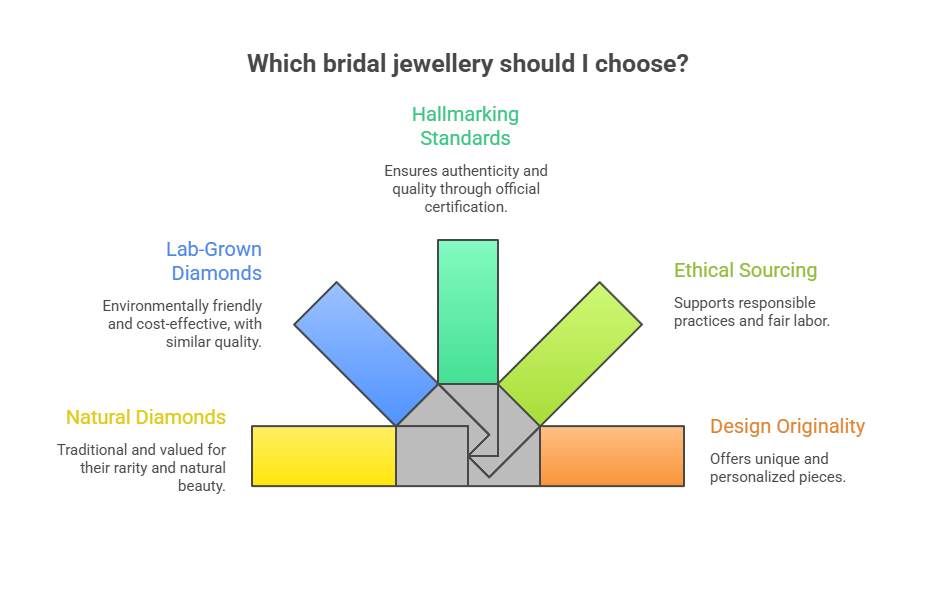

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

Financial Literacy in Jewellery

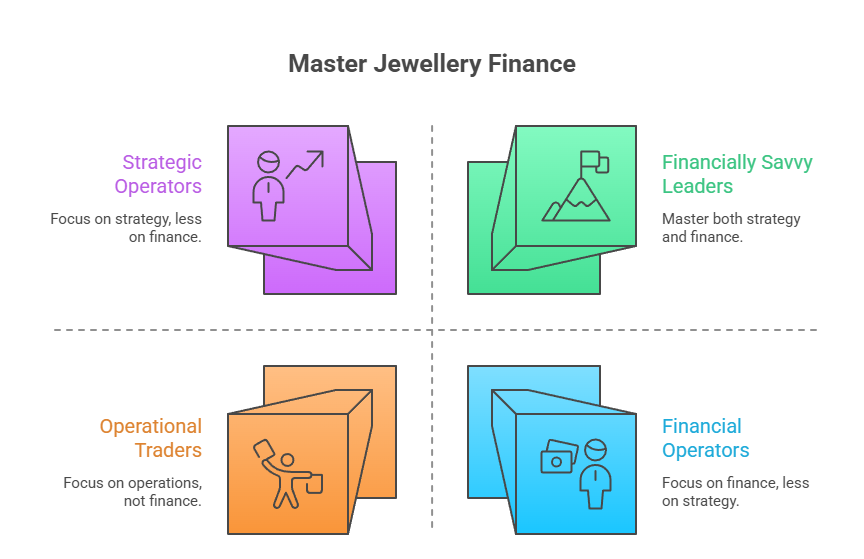

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

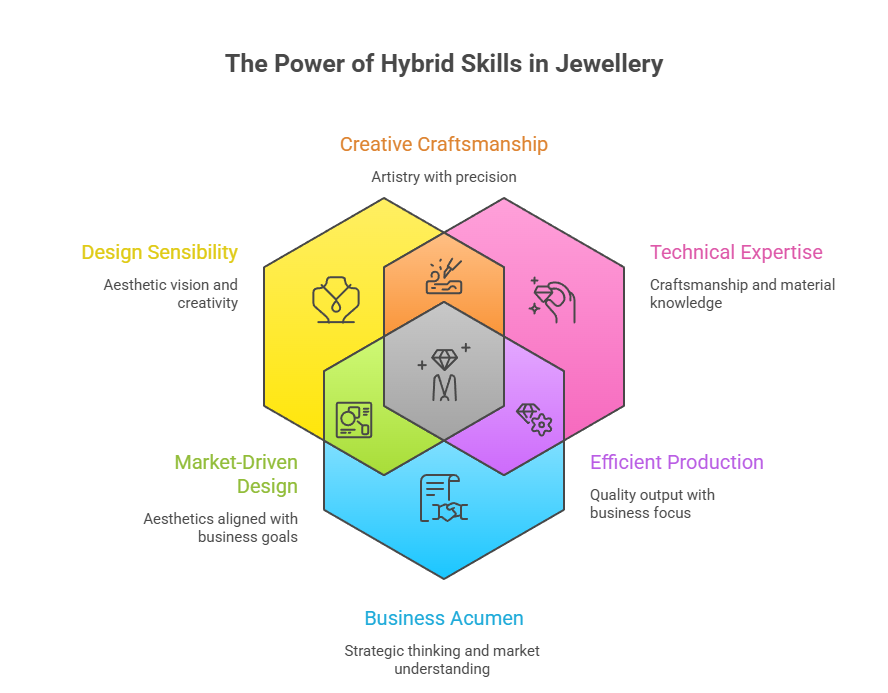

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

ShowBuzz2 days ago

ShowBuzz2 days agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

International News10 hours ago

International News10 hours agoThe HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

-

International News14 hours ago

International News14 hours agoGold surges as US-Israel-Iran tensions boost safe-haven demand

-

GlamBuzz12 hours ago

GlamBuzz12 hours agoRakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds