JB Insights

WGC releases ‘India Gold Market – Reform and growth’

The World Gold Council (WGC) has published a new report titled ‘India Gold Market – Reform and growth’. The report explores the key factors that shape India’s gold demand and supply, as well as the challenges and opportunities for the future. The new report covers various aspects of India’s gold market, such as: The drivers of Indian gold demand, jewellery demand and trade, jewellery market structure, gold investment market and financialisation, bullion trade, gold refining and recycling, and gold mining in India.

In the report foreword, Juan Carlos Artigas, Global Head of Research, World Gold Council, said: “In 2017 we produced “India’s Gold Market – evolution and innovation’. A lot has changed since that report was published. This compendium of updated reports delves deeper into key factors that underpin India’s position as the second largest gold consumer in the world: it studies the drivers of gold demand and the perception of consumers; it examines the new investment landscape: and it considers the complex issue of gold supply.

“Few of the global events that have rocked societal and geopolitical stability could have been imagined when our 2017 report was published. That India has had to adapt is not surprising, but the rate at which change is happening in the country is, arguably, unprecedented.

“Despite – or perhaps because of – macroeconomic uncertainties, India’s population resolutely turns to gold. Weddings and festivals are key drivers of gold demand and the country is one of the world’s largest bar and coin markets. There is no doubt that gold retains prominence in the social and financial life of many Indians, both urban and rural.

“The years ahead will present challenges. But rather than thinking them onerous, we believe there is tremendous opportunity for gold. Regulation of India’s jewellery industry has already made huge strides in building consumer trusts. If new export markets can be developed, the current fragile platform – 90% of jewellery exports go to just five countries – will be diluted. More accessible banking offers a possibility to reach investors who have long understood gold’s safe-haven qualities but now find themselves negotiating a plethora of choice. And in the longer term, the Gold Monetisation Scheme, proposed legislative changes in the mining industry, and resolution of recycling traceability issues may reduce India’s reliance on imported gold.

“As we look ahead with optimism, the insights in this report will help us ensure that gold retains or even increases its relevance to India’s economy – generating further employment and continuing to play its roles as an adornment and an effective portfolio diversifier and hedge against inflation

JB Insights

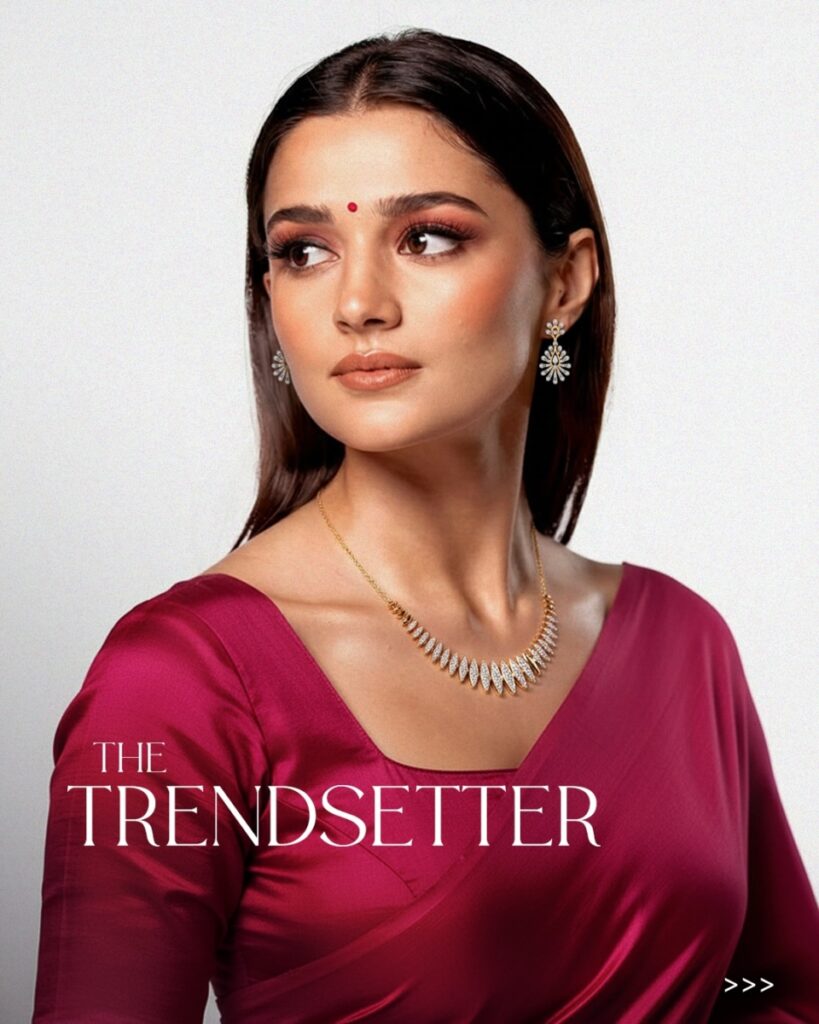

Women’s Day 2026: Jewellery Brands Celebrate Independence, Identity and Self-Expression

From milestone-driven collections to personalised styling and self-purchase narratives, jewellery brands across India are celebrating women’s independence, identity, and achievements this International Women’s Day.

International Women’s Day 2026 has prompted jewellery brands across India to launch campaigns that celebrate women’s empowerment, individuality, and personal achievements. Moving beyond traditional gifting narratives, many brands are positioning jewellery as a symbol of self-expression and personal milestones, reflecting the evolving role of women as independent buyers in the jewellery market.

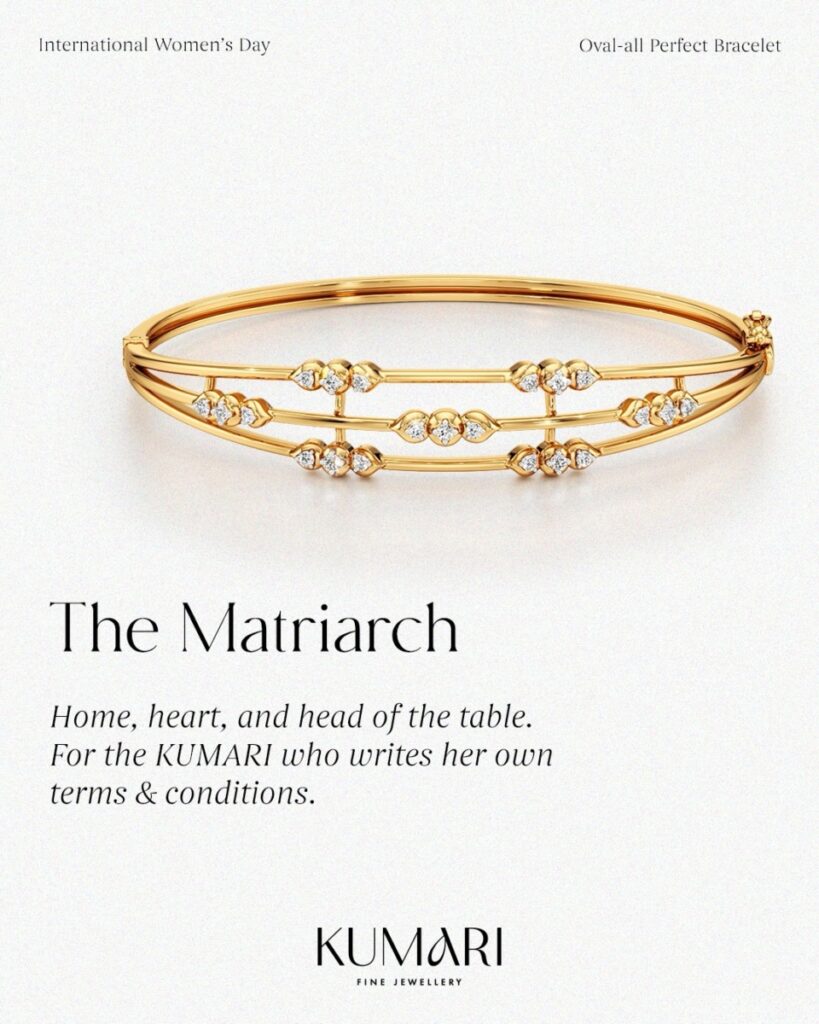

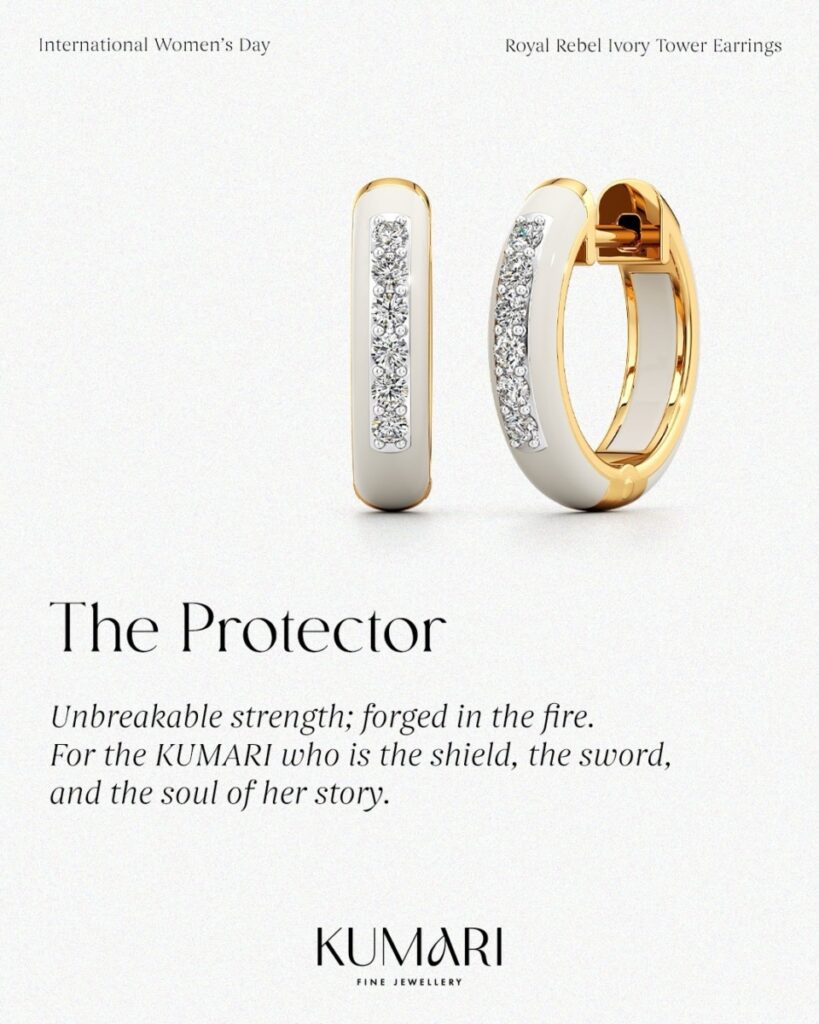

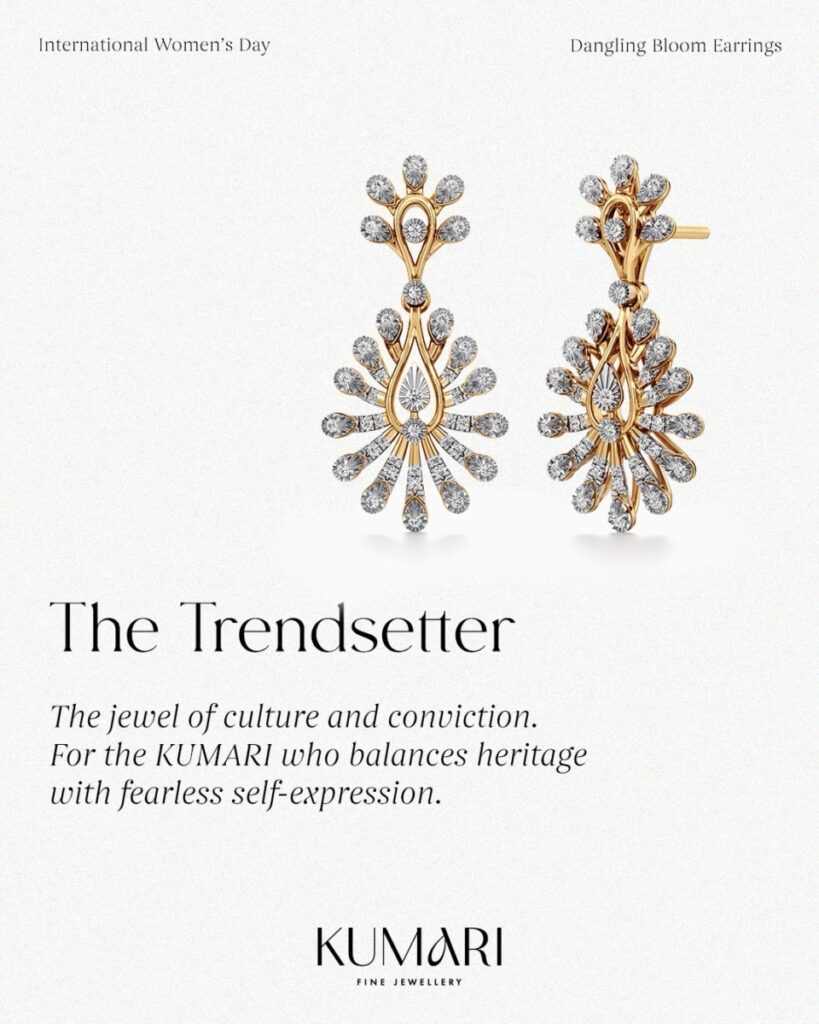

Kumari Fine Jewellery

Mumbai-based Kumari Fine Jewellery has introduced a Women’s Day showcase themed around the idea of the “Modern Indian Original.” The initiative focuses on financially independent women who mark their achievements with self-purchased jewellery. The showcase highlights lightweight gold pieces designed for everyday wear, reinforcing jewellery as both a style statement and a symbol of personal growth.

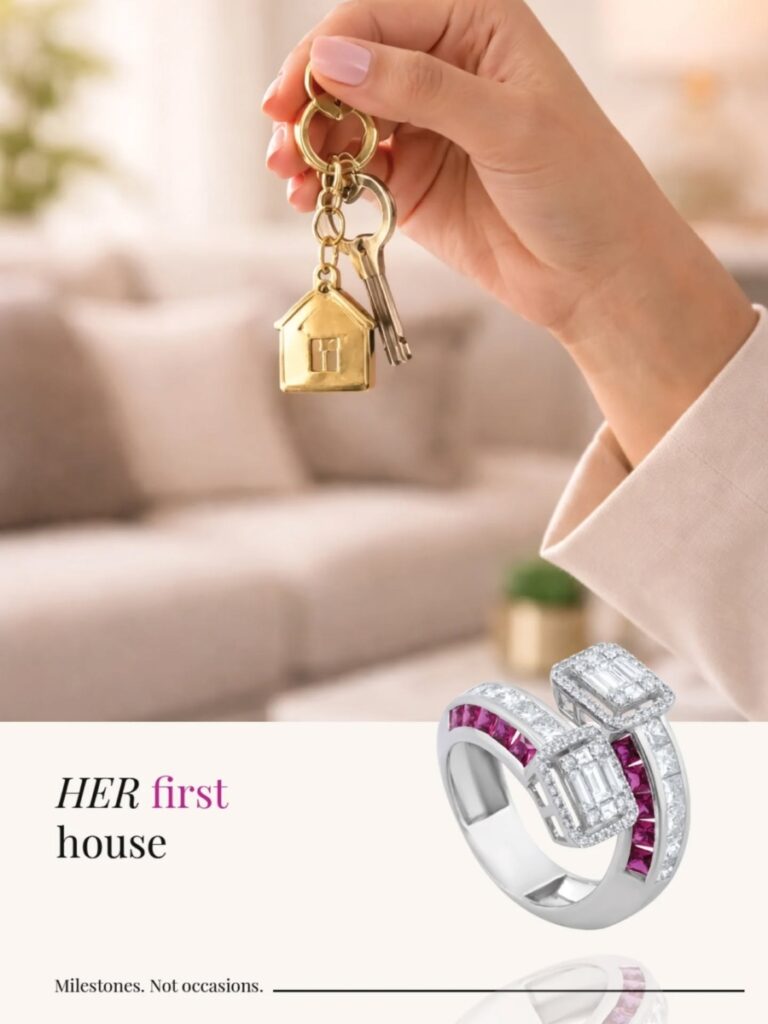

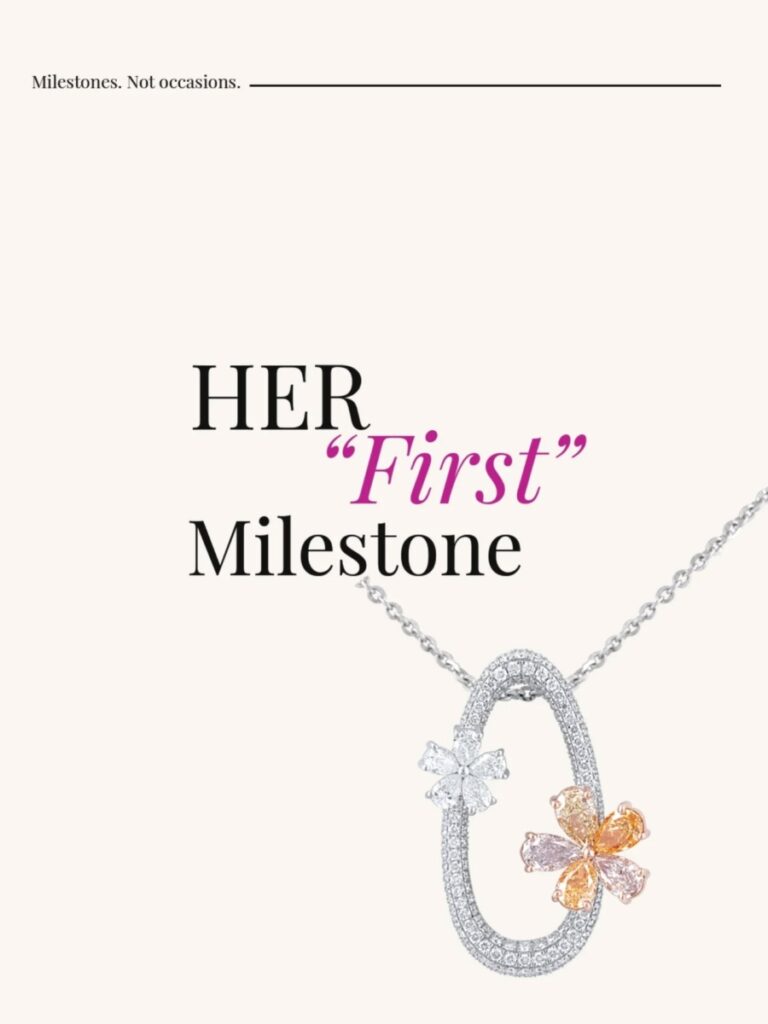

Dhirsons Jewellers

Delhi’s Dhirsons Jewellers has launched a campaign centred on celebrating milestones in a woman’s journey rather than traditional occasions. The initiative encourages women to recognise defining moments in their lives, positioning jewellery as a reflection of resilience, confidence, and self-belief.

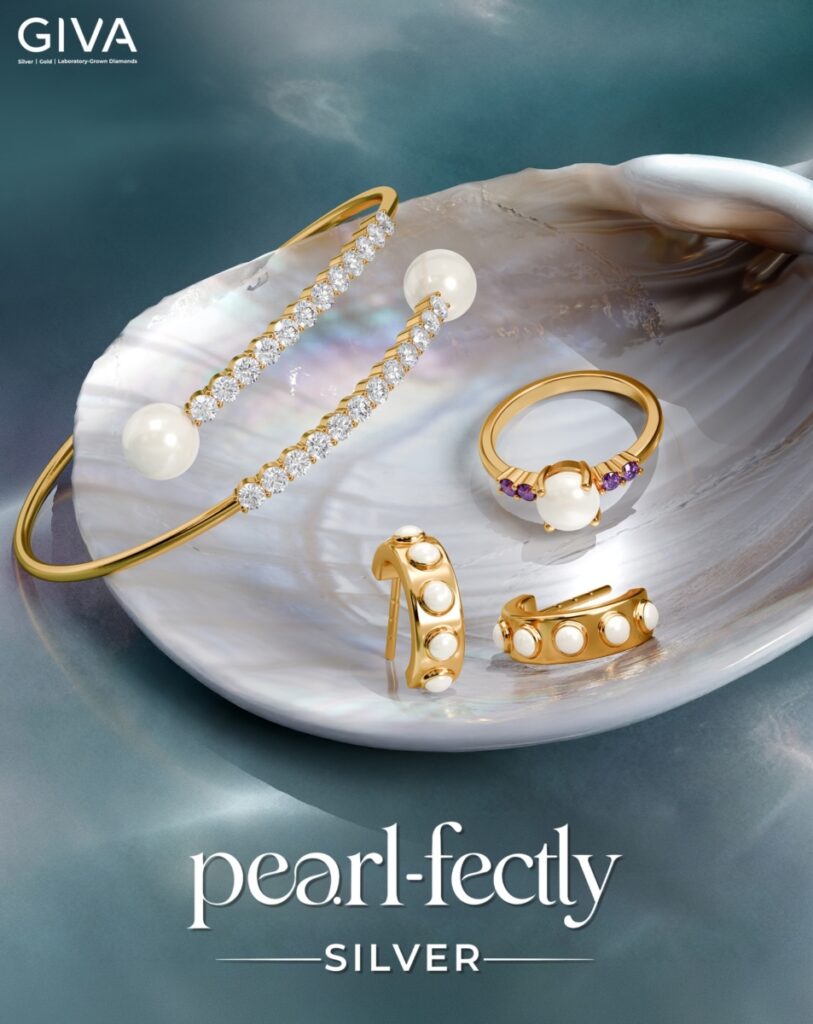

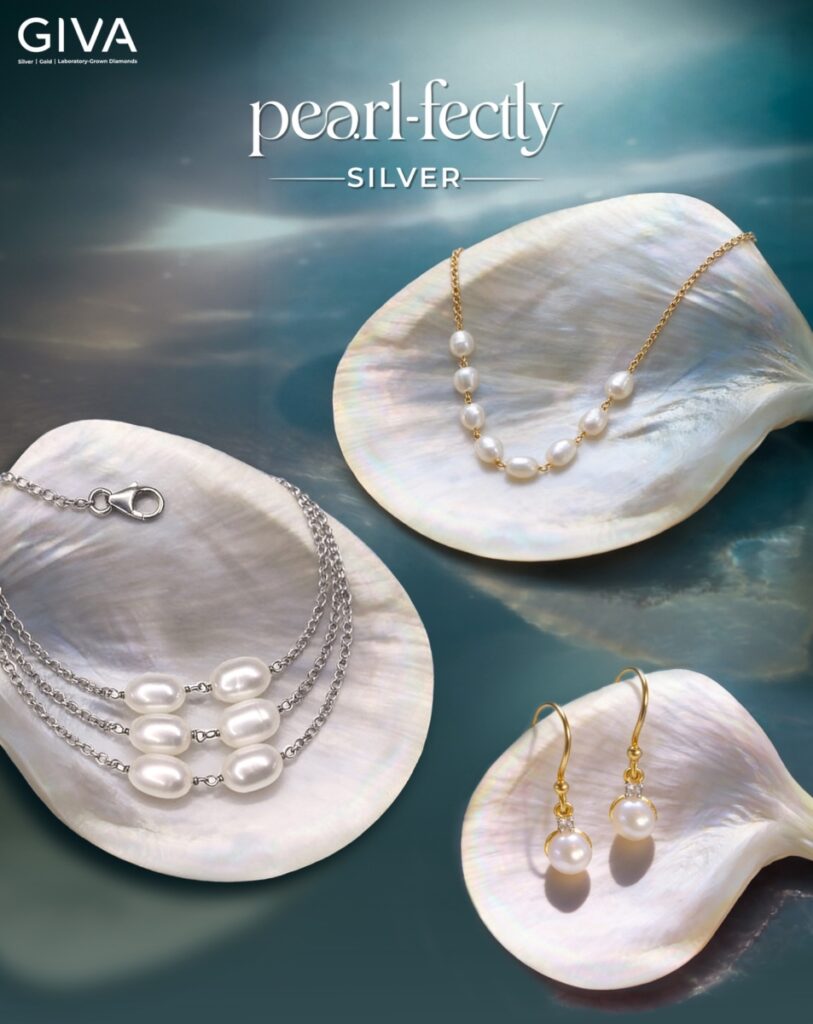

GIVA

Digital-first jewellery brand GIVA has unveiled a Women’s Day concept titled The Pearl Edit, focusing on timeless pearl jewellery that celebrates women who are building, leading, and redefining their paths. The campaign emphasises understated elegance while encouraging women to celebrate themselves through meaningful jewellery.

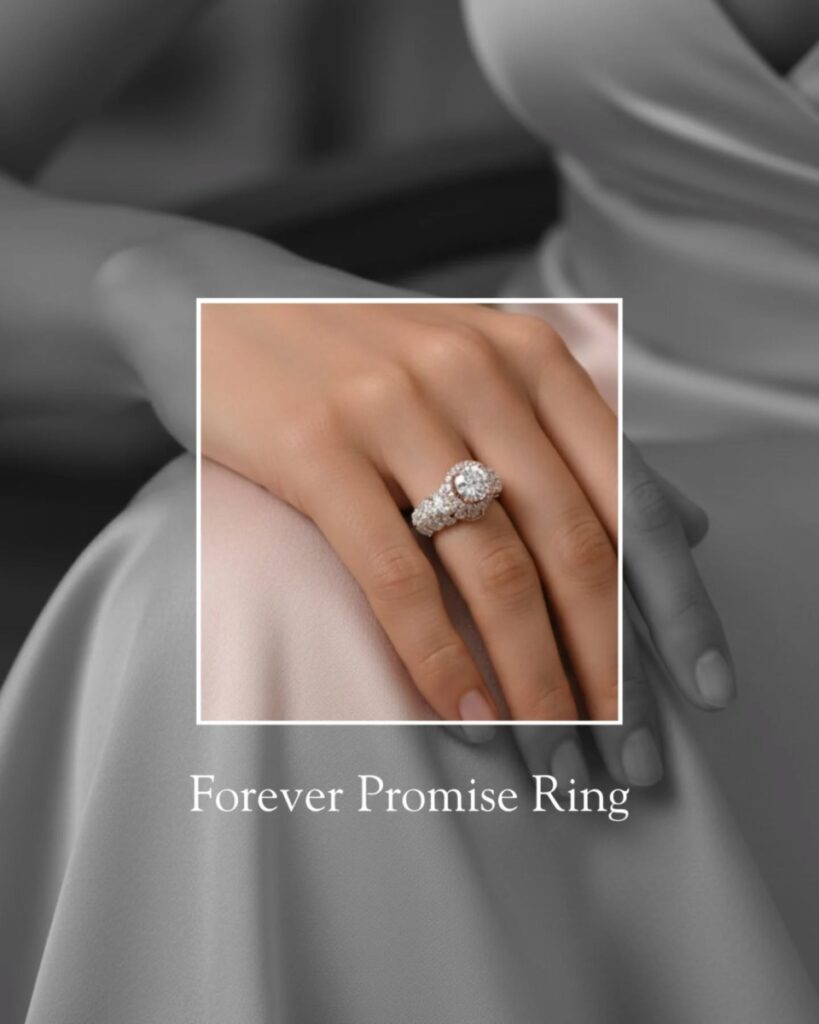

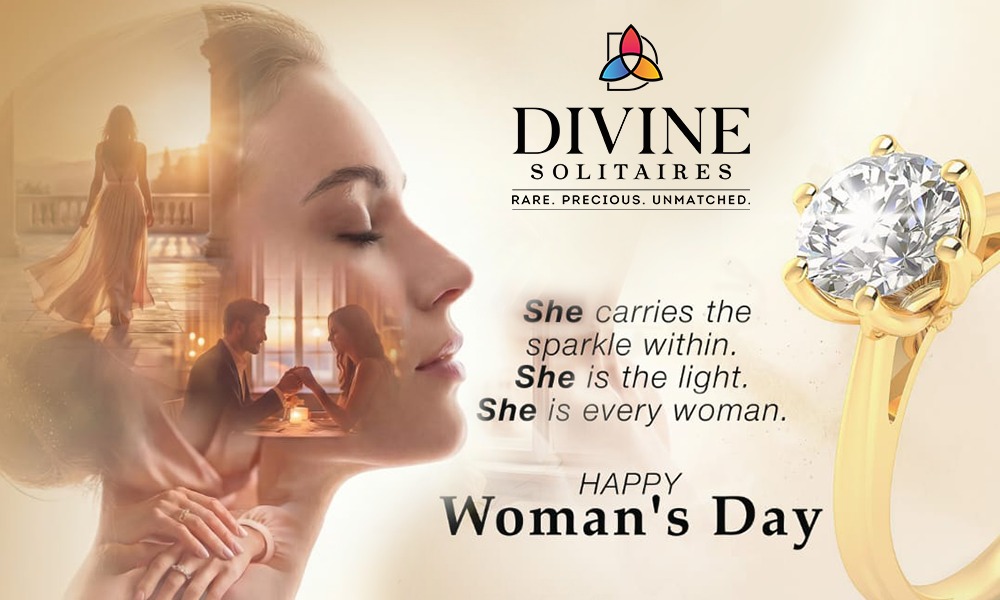

Divine Solitaires

Diamond jewellery brand Divine Solitaires has also introduced a Women’s Day campaign highlighting the emotional value of solitaire diamonds as symbols of personal milestones. The initiative focuses on recognising the journeys of women across roles—from professionals and entrepreneurs to mothers and mentors—while encouraging self-appreciation through jewellery.

Senco Gold & Diamonds

Technology-driven campaigns have also gained traction this year. Senco Gold & Diamonds has launched an initiative that integrates artificial intelligence into jewellery styling, enabling customers to discover pieces that match their personality and features. The concept highlights individuality while bringing digital innovation into the jewellery retail experience.

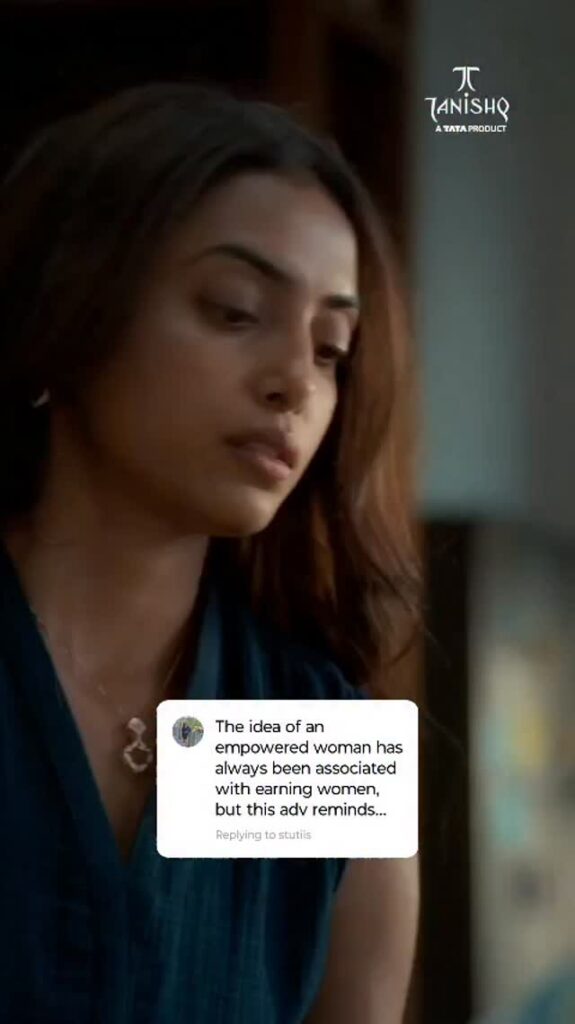

Tanishq

Large national brands are also participating in the Women’s Day narrative. Tanishq has continued its focus on celebrating modern womanhood through curated collections and storytelling campaigns that reflect the changing aspirations of contemporary women. The brand’s initiatives frequently highlight independence, confidence, and self-expression.

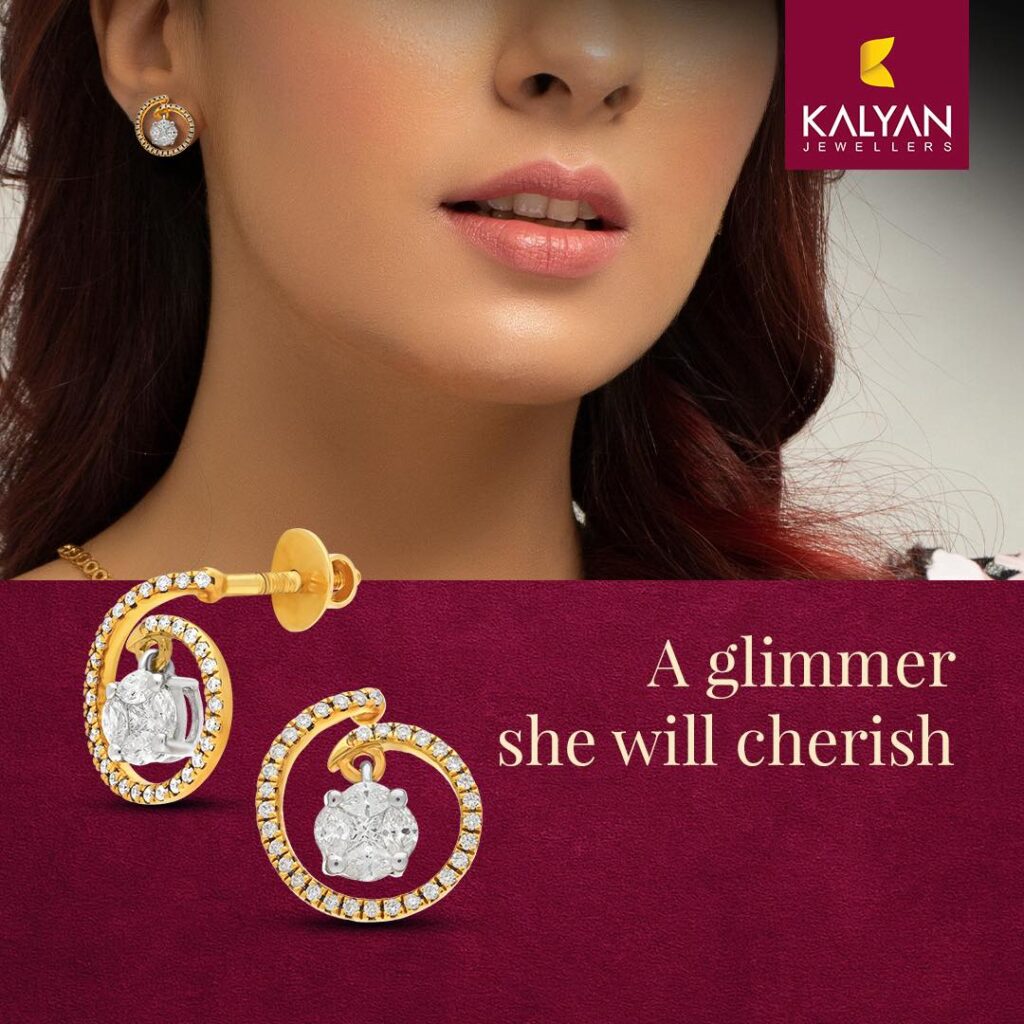

Kalyan Jewellers

Similarly, Kalyan Jewellers has aligned its messaging with women’s empowerment by supporting women-centric initiatives and partnerships, reinforcing the importance of recognising women’s achievements across different fields.

CaraLane

Other jewellery brands are also marking the occasion through special launches and themed collections. CaratLane has promoted contemporary diamond and gold jewellery collections designed for self-purchase and everyday styling, encouraging women to celebrate their personal milestones.

ORRA Fine Jewellery

Luxury diamond brand ORRA Fine Jewellery has highlighted modern diamond jewellery that symbolises confidence and individuality, targeting young professionals who view jewellery as a statement of identity.

Malabar Gold & Diamonds

Meanwhile, Malabar Gold & Diamonds has focused on campaigns that recognise women’s contributions to families, workplaces, and society, positioning jewellery as a tribute to their strength and achievements.

Across the industry, the Women’s Day celebration by many brands reflect a broader shift in consumer behaviour. Women are increasingly viewing jewellery not only as a traditional gift but also as a meaningful purchase that celebrates personal success, independence, and self-expression.

As jewellery brands continue to adapt to these changing aspirations, Women’s Day has become an important platform for storytelling, allowing brands to connect with modern consumers through themes of empowerment, individuality, and celebration of life’s defining milestones.

-

National News41 minutes ago

National News41 minutes agoNeha Kishorkumar Shah, Director, Chandukaka Saraf felicitates influencers at Lokmat Women Influencer Awards

-

GlamBuzz3 hours ago

GlamBuzz3 hours agoDe Beers Group Partners with Abhishek Sharma to Champion Natural Diamonds in India

-

International News4 hours ago

International News4 hours ago73rd Bangkok Gems and Jewelry Fair sets new record with 4.75 Billion Baht in trade value

-

National News6 hours ago

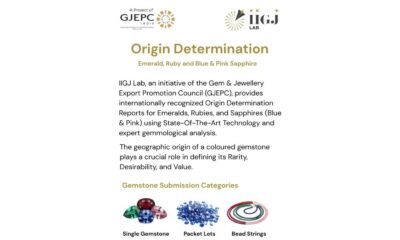

National News6 hours agoIIGJ Lab Jaipur Expands Origin Testing for Ruby, Emerald and Sapphire Lots & Strands