International News

US Mother’s Day jewellery spending expected to reach $6.8 Billion

US retailers are forecasting strong sales around Mother’s Day this year, with total spending expected to reach $34.1 billion, according to the National Retail Federation (NRF) and Prosper Insights & Analytics.The projected total is slightly higher than last year’s figure of $33.5 billion, though it falls just short of the record $35.7 billion spent in 2023.

More than eight in ten US adults (84%) plan to mark the occasion, with average spending per person estimated at $259.04. This represents a modest increase of around $5 per shopper compared with 2024.

Within that impressive total, jewellery stands out as a top-tier gift category. The survey forecasts that consumers will spend a staggering $6.8 billion on jewellery for Mother’s Day this year. This places jewellery as the leading category in terms of total expenditure, surpassing popular choices like special outings ($6.3 billion), gift cards ($3.5 billion), flowers ($3.2 billion), and greeting cards ($1.1 billion).

Consumers are planning to spend an average of $259.04 on Mother’s Day gifts and celebrations, an increase of about $5 from 2024, contributing to the growth seen across various categories, including fine and fashion jewellery.

International News

Gold prices climbed above $4,250 ahead US ISM Manufacturing PMI release

US spot Gold prices climbed above $4,250 early Monday, touching a six-week high as investors turned cautious ahead of the upcoming US ISM Manufacturing PMI release. The yellow metal is poised for further upside momentum if it secures a sustained daily close above the crucial $4,250 resistance level.

The US Dollar opened December on a softer note, pressured by rising expectations that the Federal Reserve may announce a rate cut next week. Growing market confidence in easing monetary conditions has boosted the appeal of non-yielding assets such as gold.

Analysts note that a decisive break and close above $4,250 could reinforce bullish sentiment and pave the way for an extended rally in the days ahead. As global markets await fresh cues from the US economic calendar, gold continues to benefit from a favorable macroeconomic backdrop and robust safe-haven demand.

-

BrandBuzz9 hours ago

BrandBuzz9 hours agoMCA raises “small company” thresholds – up to ₹10 cr capital & ₹100 cr turnover from 1st December 2025, major relief for jewellery trade

-

JB Insights9 hours ago

JB Insights9 hours agoWomen Leaders Driving the Luxury Renaissance

-

National News13 hours ago

National News13 hours agoSHINESHILPI Announces the Launch of The Shine House, India’s Biggest B2B Jewellery Hub

-

National News12 hours ago

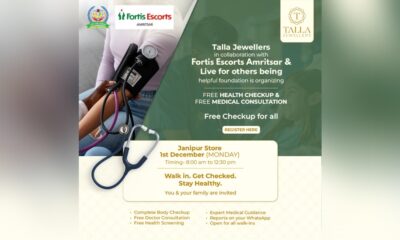

National News12 hours agoTalla Jewellers Successfully Hosts Free Health Checkup Camp with Fortis Escorts Amritsar and Live For Others Foundation