JB Insights

Success is driven by delivering exceptional design,aspirational products, innovation, quality and service

Nirav Bhansali, CEO- Prism Jewellery, speaking to JewelBuzz, provides deep insights into the dynamics of the global and domestic diamond sector, the challenges, opportunities, consumer trends and the way ahead.

Give us a current overview of the diamond sector.

The diamond sector went through its toughest period last year. It was one of the biggest slowdowns that the industry has faced in many, many years. And that came on the back of a very robust post -COVID era of 2021 -2022. But last year was really difficult. But now we are at the bottom of the cycle in terms of demand as well as in terms of the pricing. Last two months have shown very good resilience, prices have firmed up. In fact, in certain areas, we are seeing shortages in categories like smalls and some even in bigger sizes and fancies in certain shapes., So, it looks like that we are now at the bottom and the things will improve from here on.

Comment on the Indian diamond industry scenario.

Indian diamantaires have consistently demonstrated remarkable resilience and innovation, enabling the country to dominate the global diamond trade. This success stems from their risk-taking abilities, cost efficiencies, innovative approaches, and extensive global outreach.

The Indian diamond industry continues to thrive, demonstrating resilience in the face of global trade complexities. While jewellery exports encounter challenges in certain markets due to varying import duties, the export of loose diamonds remains largely unaffected by such barriers.

As a raw material, loose diamonds face limited import duties in most countries. This favourable trade environment significantly boosts exports. The export of loose diamonds from India remains strong due to limited import duties in most countries.

What is the mantra for the diamond industry’s growth?

For consistent growth and sustainable growth in the diamond sector, I think there is only one way. We need to focus on unique designs and innovation. We need to make very aspirational products that can compete with other categories like travel, like electronics, phones, and bags, luxury products. So if our products, our marketing, and everything is very innovative world class, I think we have a great opportunity. This is the only way we can capture a bigger share of the consumers wallet.

With a renewed emphasis on design excellence and evolving consumer preferences, the Indian diamond industry is well-positioned for a strong recovery– in terms of export numbers as well as prices and inventory levels.

Comment on youth consumer segment driving demand for diamonds.

The diamond industry can look forward to sustained growth, driven by a strong demand from Gen Z and Millennial consumers. Jewellery consistently ranks among the top 2-3 aspirational items for these generations, with diamonds holding a prominent position.

Data from major markets like the USA and Europe corroborate this trend. Surveys consistently indicate that Gen Z and Millennial women, in particular, view diamond jewellery as a highly coveted possession. This generation, with their appreciation for luxury and self-expression, will continue to be a significant driver of diamond demand for many years to come.

This positive outlook reinforces the industry’s confidence in the enduring appeal of diamonds across generations.

The natural diamonds v/s LGD discussions and debates continue. Your take on this issue?

The rise of lab-grown diamonds has emerged as a significant force within the global jewellery market, prompting a shift in the industry landscape. While initially perceived as a threat, industry leaders are increasingly viewing lab-grown diamonds as a distinct market segment with immense growth potential. It is seen not as a challenge but an opportunity.

Lab-grown diamonds are not a fad; they are here to stay. they represent a significant opportunity, with the potential to surpass natural diamonds in terms of carat volume in the coming years.

The United States provides a compelling example of this trend, with lab-grown diamonds now accounting for over 50% of the jewellery market. Similar shifts are observed globally, suggesting that lab-grown diamonds will become a dominant force in the near future.

However, industry leaders emphasize that lab-grown diamonds should not be viewed as a threat to the natural diamond market. Both segments cater to distinct consumer aspirations and price points. Natural diamonds will continue to hold significant emotional value and appeal to a discerning clientele.

The Indian diamond industry is actively embracing this evolving landscape. We are not only polishing lab-grown diamonds but also actively contributing to their growth

Lab-grown diamonds are poised to become a dominant force in the global jewellery market.

The Indian diamond industry is actively embracing lab-grown diamonds as a new market segment. Both natural and lab-grown diamonds will coexist, catering to distinct consumer segments and price points. The Indian industry is well-positioned to capitalize on the growth of the lab-grown diamond market through its expertise in polishing and manufacturing.

How is technology, including AI and blockchain, transforming the Indian diamond industry?

The Indian diamond industry is at the forefront of technological innovation, leveraging blockchain and AI to revolutionize operations. Blockchain adoption has enabled end-to-end visibility into the diamond supply chain, enhancing transparency and efficiency. The industry is currently in the early stages of AI adoption (AI 1.0) but anticipates rapid advancements that will transform production, distribution, and consumer engagement.

To fully harness AI’s potential, industry leaders advocate significant investments in AI research and development, aiming to build an ecosystem that drives growth and innovation. With a proven track record in adopting new technologies, the industry is well-positioned to integrate advanced AI seamlessly, further strengthening its global competitiveness.

It is anticipated that AI will soon become an indispensable tool for all industry players, further enhancing efficiency, transparency, and overall competitiveness.

Comment on government’s support for the diamond sector

The Indian government has played a pivotal role in supporting the diamond industry, significantly contributing to its global dominance. Through close collaboration with organizations like the Gem and Jewellery Export Promotion Council (GJEPC) and other industry bodies, the government has consistently addressed the sector’s needs and swiftly resolved challenges.

The government is actively working to address the challenges faced by the jewellery sector through the negotiation of bilateral trade agreements, such as the Special Economic Partnership Agreements (SEPAs) and Free Trade Agreements (FTAs).

This proactive and supportive approach has empowered the Indian diamond industry to overcome obstacles and maintain its market leadership worldwide. Industry leaders have expressed gratitude for the government’s commitment to fostering growth and innovation within the sector

Comment on ESG, social responsibility in the Indian diamond sector

The diamond sector, especially in India, is very, very conscious towards ESG. They are very strong on environment, social governance. They look after the people, they look after the community, society. Also, charity and philanthropy is very much on the agenda.

Indian diamantaires are at the forefront of social responsibility, actively contributing to charitable causes and embracing sustainability. Major industry players, including leading site holders, are transitioning their operations into zero-carbon and green units by leveraging renewable energy from non-conventional sources.

GJEPC is championing this transformation through its “One Earth” initiative, which promotes environmental awareness across the entire gems and jewellery sector—from large retailers to small-scale manufacturers.

What’s the strategy for growth at Prism Jewellery?

At Prism, we prioritize exceptional design and uncompromising quality, placing both at the core of our mission. Our commitment to creating distinct, innovative, and aspirational products is fuelled by cutting-edge technology and a relentless focus on delivering superior quality and service to our customers worldwide. We envision a bright future for Prism and the Indian diamond sector in the years ahead.

Whether natural or lab-grown, success in this industry ultimately hinges on delivering exceptional design, innovation, quality, and service. With this focus, Prism is well-positioned to capture a significant share of this thriving market, driving growth and success in the decade ahead.

What is in store for the diamond sector and the GJ industry? Provide us an outlook for the diamond sector.

The Indian market is a driving force in this category, with gems and jewellery contributing 10% to India’s GDP and growing at an annual rate of 10%. This robust momentum is expected to sustain for years to come, supported by the rapid opening of new stores and growing investor confidence. Successful IPOs and significant interest from private equity firms underline the sector’s vitality. Easy access to capital, coupled with innovation and consumers’ enduring preference for jewellery, makes this a golden period for the industry.

Across the broader gems and jewellery sector—including gold, silver, diamond-studded, and lab-grown categories—every segment holds immense potential and growth opportunities in the Indian market. Globally, while the growth pace is more modest, markets like the U.S. continue to expand steadily by 2-3% annually on a large base. This global demand highlights the enduring appeal of jewellery, even in a crowded luxury landscape.

Experts anticipate a robust year ahead, marked by higher export numbers, improved prices, and better inventory management, reinforcing India’s leadership in the global diamond sector.

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

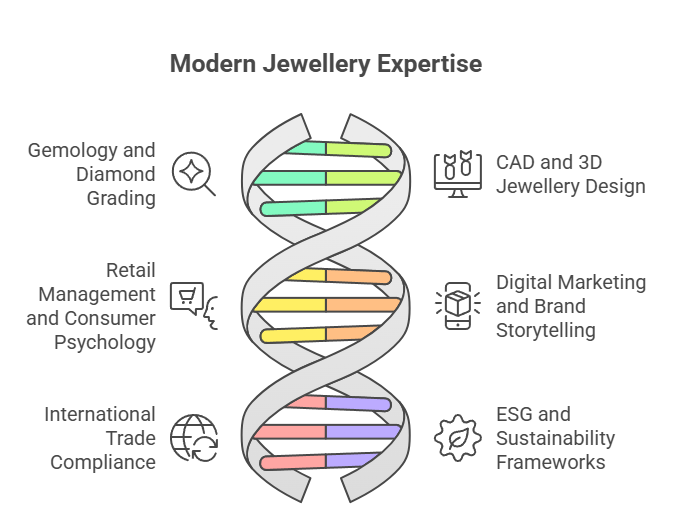

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

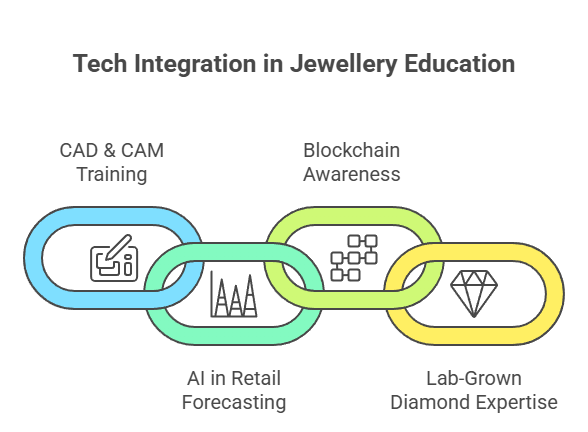

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

The Bridal Economy & Consumer Education

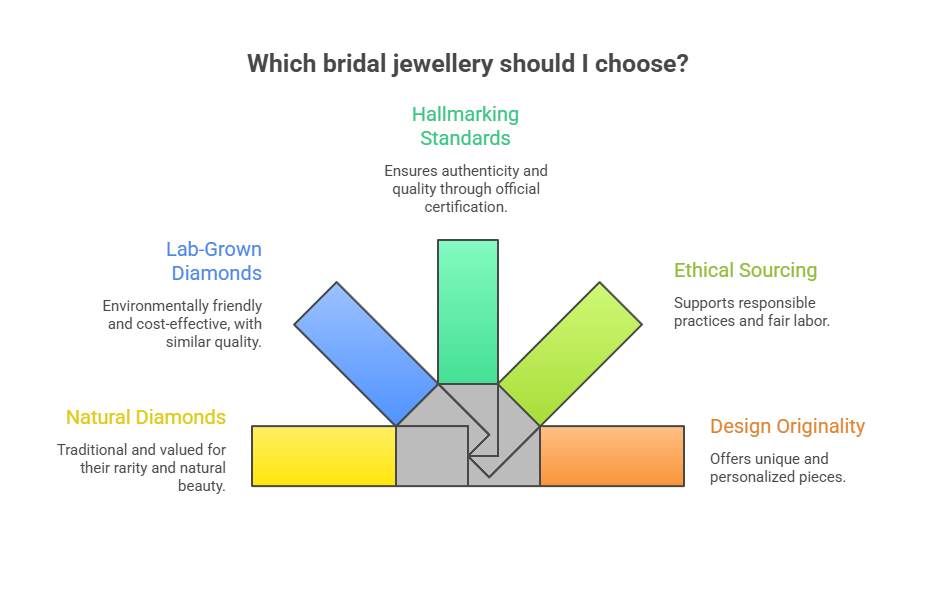

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

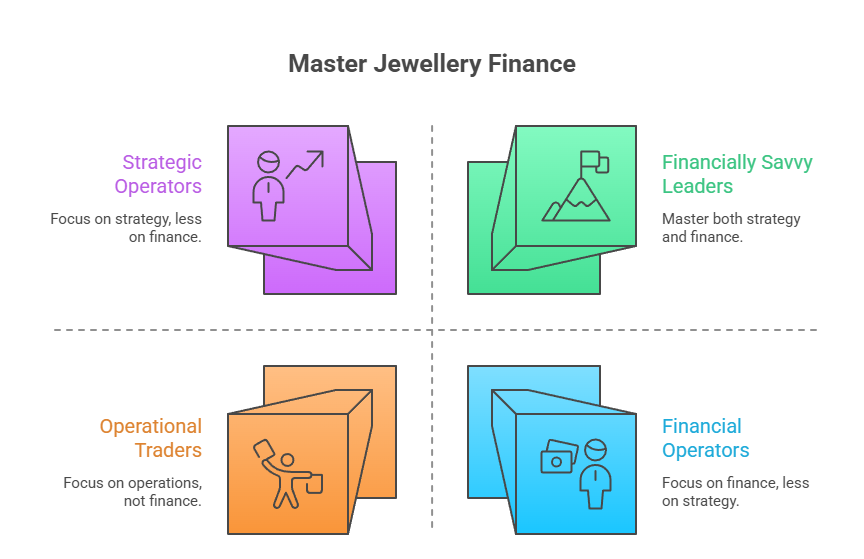

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

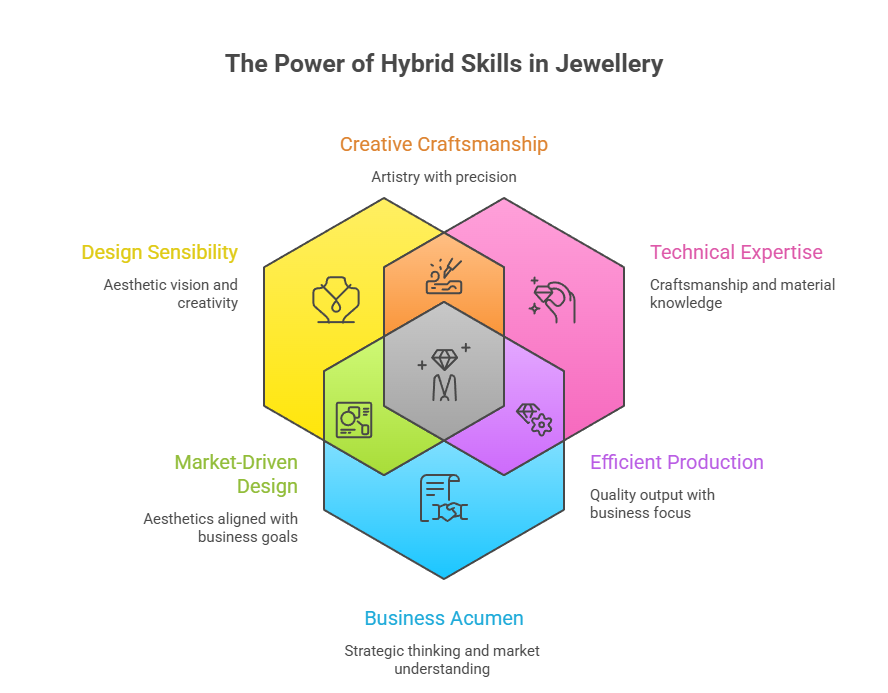

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz17 hours ago

BrandBuzz17 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News17 hours ago

National News17 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression