National News

Rising gold prices to shave a tenth off organised retailers’ volumes

Revenues to still grow in double digits; credit profiles supported by higher operating margins

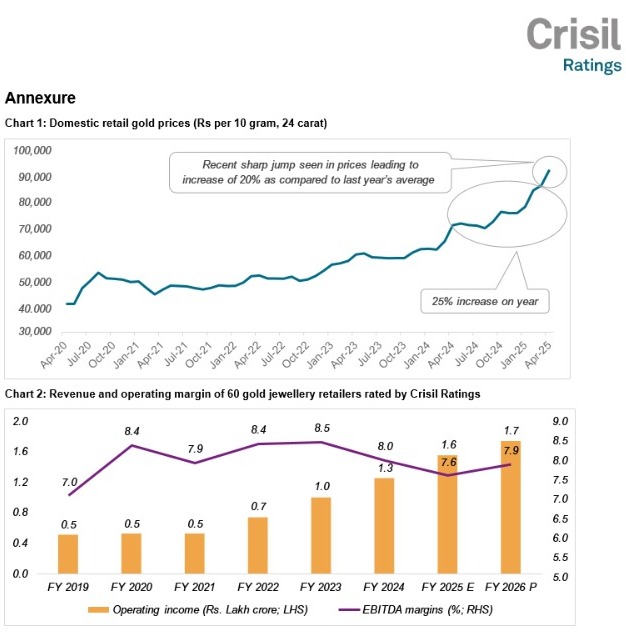

The continued rise in retail gold prices to an all-time high is expected to reduce the sales volume of organised gold jewellery retailers by 9-11% in fiscal 2026. However, with prices and realisations expected to be significantly higher on- year, revenues will still grow 13-15%.

This comes on the back of four straight years of more than 20% revenue growth, which has seen the industry grow 2.5 times since fiscal 2021. Volume, however, has remained subdued with consumers purchasing smaller quantities amid budget constraints due to higher prices.

An interplay of multiple factors is visible amid the continually rising gold prices. For one, as demand wanes, retailers are pushing sales through promotions and discounts amid increasing penetration in Tier 2 and 3 cities. The resultant increase in costs, however, will be more than covered by jewellery getting sold at prices higher than the purchase and making prices. Thus, operating profitability will rise 30-40 basis points (bps) on-year, driven by inventory gains.

The higher prices will also push up working capital borrowings for purchasing inventory for existing and planned stores. Nonetheless, leverage will remain under control and debt protection metrics healthy, supporting credit profiles.

A Crisil Ratings analysis of 60 gold jewellery retailers, which account for a third of the revenue of the organised jewellery sector, indicates as much.

In fiscal 2025, retailers took a 4-5% hit to volume as gold prices soared ~25% on-year (refer to Chart 1) amid geopolitical and economic concerns. As of mid-April 2025, gold prices are already ~20% higher than the average price in fiscal 2025. Thus, even if the prices move up only 4-5% from here, the average price will still be up 22-24% on-year for fiscal 2026.

Says Himank Sharma, Director, Crisil Ratings, “The recent jump in prices came just before the start of the festive and marriage seasons in the first half of April 2025, limiting the impact on demand thus far. However, as ticket sizes for buyers are likely to remain constant, caratage and grammage may reduce, as seen in the last four fiscals, impacting volumes. The demand, though lower, remains supported by duty cuts on gold imports announced last year.”

As such the implementation of Goods and Services Tax and Bureau of Indian Standards hallmark continue to push customers towards organised retailers, supporting revenue growth. Higher realisations will push another year of double- digit revenue growth for organised retailers, resulting in revenues of Rs.4.5-5.0 lakh crore for the industry.

Says Gaurav Arora, Associate Director, Crisil Ratings, “Despite the increasing debt, the capital structure of gold jewellery retailers will remain comfortable. Improved revenues and operating profitability will absorb the impact on debt protection metrics as well with median interest coverage seen healthy, over 6 times in fiscal 2026.”

The higher prices will have a two-way impact on retailers. One, with jewellery sold at prices higher than the purchase prices, resulting in an inventory gain of 20-30 bps, we expect the operating margin to break the declining trend of the last two fiscals and inch closer to the seven-year average of 7.8-8.0% in fiscal 2026 (refer to Chart 2). Two, the debt of gold jewellery retailers rated by Crisil Ratings will rise as the cost of inventory replenishment as well as new store inventory rises with higher prices, although higher revenue and profitability will provide cash flow towards store expansion.

That said, any sharp volatility in gold prices, changes in government regulations and import duties on gold, and consumer sentiment will bear watching.

National News

This Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

This Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey.

While jewellery is often associated with weddings and festivals, Dhirsons Jewellers, Dhiraj Dhir Group believes the most meaningful pieces are the ones that mark a woman’s personal milestones. This Women’s Day, the brand celebrates these moments with the theme “Honouring Milestones, Not Occasions.”

Moving beyond traditional celebrations, the brand highlights moments that truly define a woman’s journey. These personal achievements often go uncelebrated, yet they mark some of the most meaningful chapters in her life.

The campaign also introduces the idea of “a colour for every milestone.” Gold symbolises the woman who built her own foundation, reflecting strength and independence, while white represents the woman who chose to heal and begin again. Through this thought, Dhirsons Jewellers encourages women to recognise their journeys and celebrate the paths they have created for themselves.

Riva Dhir, Creative Director, Dhirsons Jewellers, Dhiraj Dhir Group, Lajpat Nagar said, “People often ask me what we create at Dhirsons, and my answer is simple, we don’t make jewellery for occasions, we create it for the milestones in a woman’s journey.

Over the years, I have seen women walk into our store at defining moments in their lives, celebrating a success, marking a hard-earned achievement, or simply choosing themselves for the first time. That is when I realised that jewellery is never just about gold or diamonds. It becomes a reminder of strength, growth, and a promise she once made to herself. That is why every piece we create is designed to outlive trends, because when a woman wears something truly meaningful, it becomes a part of her story.”

At its heart, the campaign celebrates the moments of courage, growth, and self-belief that shape a woman’s journey and recognises that these milestones deserve to be honoured and remembered when they happen.

-

National News1 hour ago

National News1 hour agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration