International News

Precious Metals well supported on safe-haven demand AUGMONT BULLION REPORT

Safe-haven demand: Precious metals found support as safe-haven demand strengthened amid rising geopolitical tensions. The United States increased its military presence in the Middle East, heightening concerns over a potential conflict with Iran. At the same time, Ukraine–Russia peace talks ended without any meaningful breakthrough, reinforcing global uncertainty and supporting demand for gold and silver.

Geopolitical Tensions:U.S. President Donald Trump warned that Iran must reach an agreement on its nuclear program within 10 days or face consequences, further intensifying geopolitical risks. This continued fragility has embedded a risk premium in global markets, underpinning precious metals.

Economic Data:On the economic front, minutes from the Federal Reserve’s January 27–28 meeting revealed a divided stance among policymakers. Some members signaled openness to rate hikes if inflation remains elevated, while others favored rate cuts should price pressures moderate. This policy uncertainty is likely to keep volatility elevated in the precious metals market.

Technical Triggers

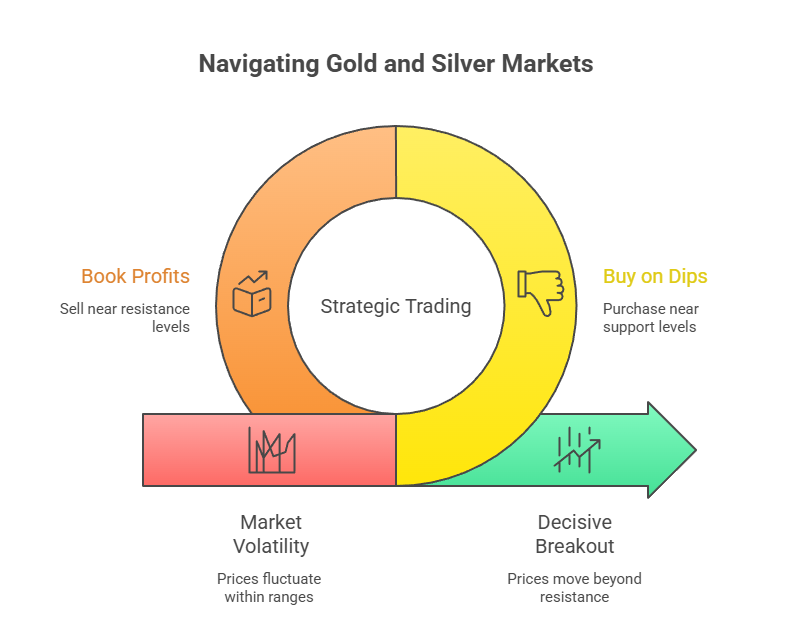

As indicated in the previous report, gold has rebounded from its key support level near $4,850 (~ Rs.1,50,000) and is now gradually advancing toward the resistance zone around $5,100 (~ Rs.1,60,000). One may consider a buy-on-dips strategy near support levels and book profits on rallies closer to resistance, until a decisive breakout occurs.

Silver has bounced from its support zone of $70–$90 (~ Rs.2,25,000). Prices are now heading toward the resistance levels of $85 (~ Rs.2,68,000) and $90 (~ Rs.2,85,000). Given the volatility in silver, a buy-on-dips and sell-on-rallies approach remains appropriate within the current trading range

Support and Resistance

| Metal | Market | Support Level | Resistance Level |

|---|---|---|---|

| Gold | International | $4850 / oz | $5100 / oz |

| Gold | India | ₹150,000 / 10 gm | ₹160,000 / 10 gm |

| Silver | International | $70 / oz | $85 / oz |

| Silver | India | ₹225,000 / kg | ₹265,000 / kg |

source: AUGMONT BULLION REPORT

International News

Precious Metals gain after FED minutes AUGMONT BULLION REPORT

Liquidity – Gold remains in a consolidation phase, largely due to thin liquidity conditions during the Lunar New Year holiday week. With major Asian markets — including mainland China, Hong Kong, Singapore, Taiwan, and South Korea — closed, trading volumes are subdued. The muted price action appears technical in nature rather than driven by any fundamental shift.

Economic Data – On the macro-economic front, minutes from the Federal Reserve’s January meeting indicated a divided policy stance. Some officials supported pausing further rate cuts until inflation shows clearer improvement, while others discussed the possibility of rate hikes, advocating a balanced outlook. Following this, traders reduced expectations for multiple rate cuts this year. Markets now await key GDP and PCE inflation data, which could shape future rate expectations.

Geopolitical Tensions – Geopolitical tensions involving Iran have resurfaced. Reports suggest that any potential U.S. military action, if talks fail, could evolve into a prolonged campaign. This development may provide underlying support to gold if risks escalate further.

Technical Triggers

As indicated in the previous report, gold has rebounded from its key support level near $4,850 (~ Rs.1,50,000) and is now gradually advancing toward the resistance zone around $5,100 (~ Rs.1,60,000). One may consider a buy-on-dips strategy near support levels and book profits on rallies closer to resistance, until a decisive breakout occurs.

Silver has bounced from its support zone of $70–$90 (~ Rs.2,25,000). Prices are now heading toward the resistance levels of $85 (~ Rs.2,68,000) and $90 (~ Rs.2,85,000). Given the high volatility in silver, a buy-on-dips and sell-on-rallies approach remains appropriate within the current trading range.

Support and Resistance

| Metal | Market | Support Level | Resistance Level |

|---|---|---|---|

| Gold | International | $4850 / oz | $5100 / oz |

| Gold | India | ₹150,000 / 10 gm | ₹160,000 / 10 gm |

| Silver | International | $70 / oz | $85 / oz |

| Silver | India | ₹225,000 / kg | ₹265,000 / kg |

-

International News22 hours ago

International News22 hours agoPrecious Metals gain after FED minutes AUGMONT BULLION REPORT

-

National News57 minutes ago

National News57 minutes agoGJEPC and Brazilian Jewellery Associations explore joint growth opportunities

-

DiamondBuzz17 hours ago

DiamondBuzz17 hours agoDe Beers Presents “Voyage Through the Diamond Realm” at India Art Fair 2026 Featuring Lakshmi Madhavan

-

National News19 hours ago

National News19 hours agoKataria Jewellers moves up the value chain with in-house manufacturing