National News

PM Narendra Modi & PM Keir Starmer visit India GJ pavilion themed India Crafts Reimagined

Prime Minister Shri Narendra Modi and the Prime Minister of the United Kingdom, Keir Starmer met with business leaders from India and the UK following the signing of the historic India – UK Comprehensive Economic and Trade Agreement [CETA].

Leading Industry captains from both sides from the health, pharmaceuticals, gems and jewellery, automobiles, energy, manufacturing, telecom, technology, IT, logistics, textiles and financial services sectors were present in the meeting. These sectors contribute significantly to employment generation and inclusive economic development in both countries.

During the visit at the gems & jewellery pavilion themed, India Crafts Reimagined – Kirit Bhansali, Chairman-GJEPC hosted both, India & UK’s Prime Ministers. They informed and explained about India’s legacy of craftsmanship by Kirit Bhansali. Shri Narendra Modi and Keir Starmer unveiled GJEPC’s, Gem of a Partnership – book. They also spent quality time admiring the exquisite Indian jewellery on display.

The two leaders walked through a showcase featuring an impressive line-up of flagship products and innovations from both nations. The exhibits included gems and jewellery, engineering goods, quality consumer products and advanced technological solutions.

GlamBuzz

Rakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

A celebration of understated luxury, luminous sparkle, and modern sophistication crafted for moments that matter.

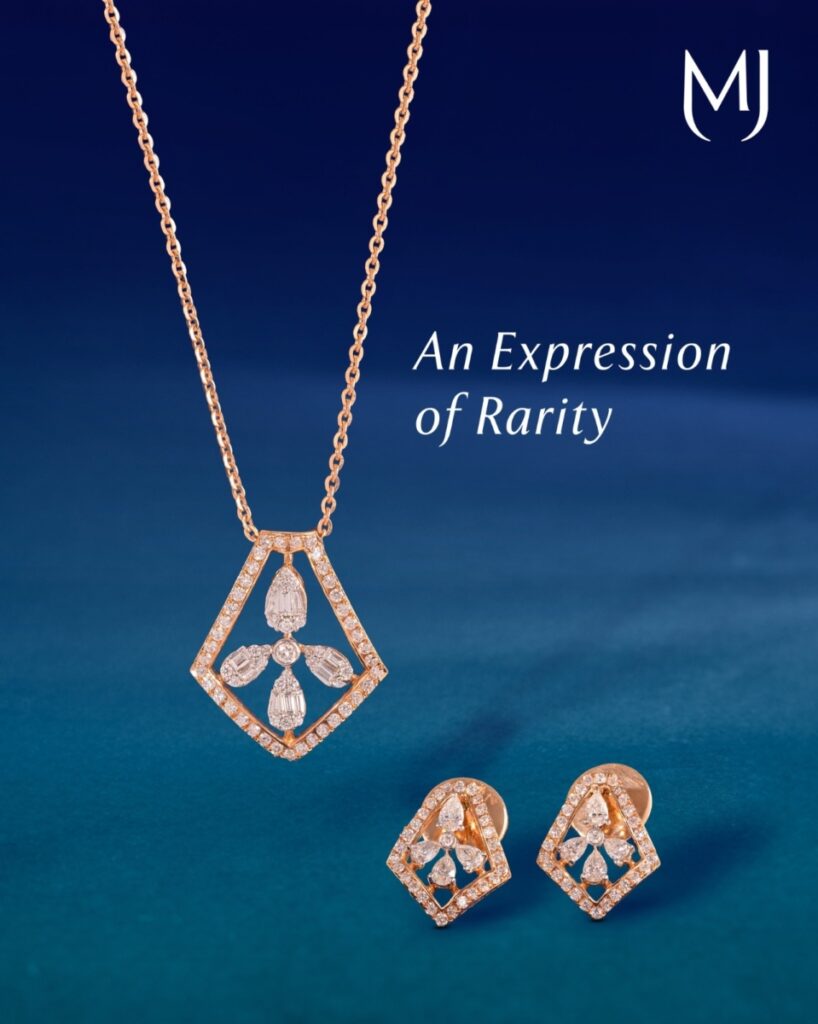

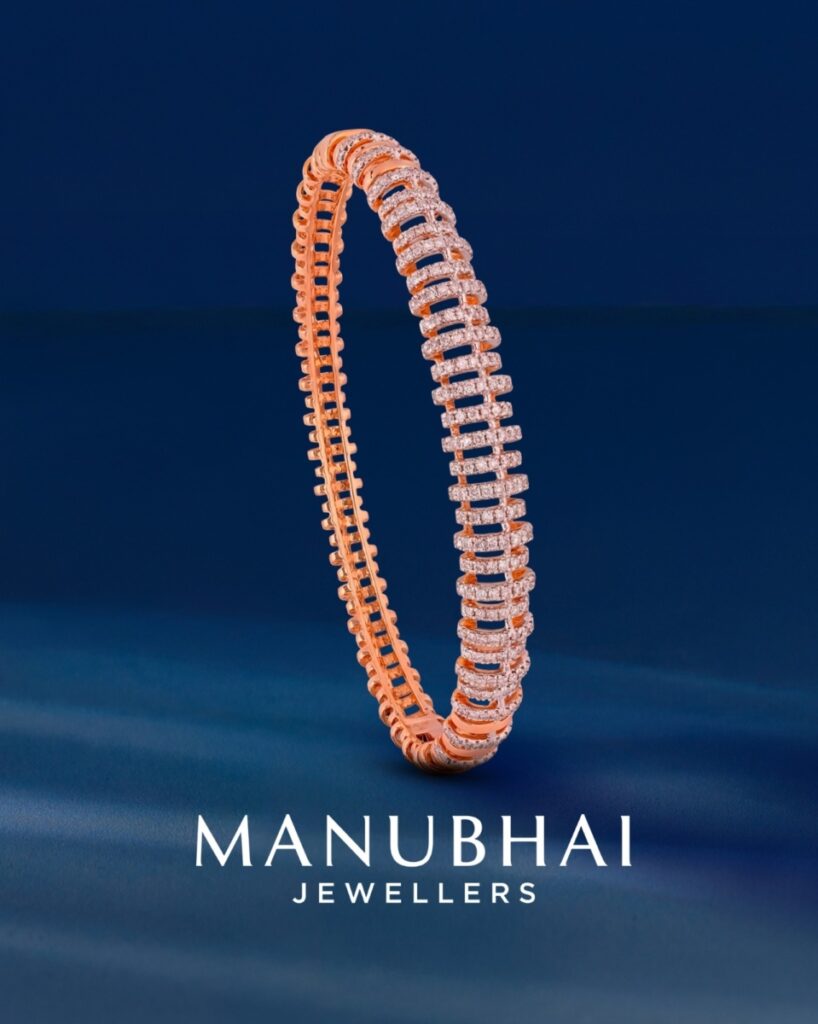

Bollywood actress, Rakul Preet embodies refined elegance in the latest showcase of Manubhai Natural Diamonds, where timeless craftsmanship meets contemporary design. Styled in sleek silhouettes adorned with luminous natural diamonds, she reflects a narrative of confidence, grace, and effortless sophistication.

The collection highlights the enduring appeal of natural diamonds — pieces that do not demand attention, yet command it with quiet brilliance. Each creation is thoughtfully designed to complement modern femininity while preserving the legacy of fine craftsmanship that defines Manubhai Jewellers.

With clean lines, radiant sparkle, and a focus on authenticity, the campaign reinforces a powerful message: true luxury doesn’t need to speak loudly — it simply glows.

-

ShowBuzz3 days ago

ShowBuzz3 days agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

International News1 day ago

International News1 day agoThe HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

-

International News1 day ago

International News1 day agoMiddle East Conflict Halts Global Diamond Trade in Dubai and Israel

-

GlamBuzz1 day ago

GlamBuzz1 day agoRakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds