National News

MCX silver price surges â‚ą9,000 on bullish global trends

Silver markets opened with robust momentum today, propelled by a sustained rally in COMEX silver prices, bolstering bullish sentiment among traders. MCX silver rates gapped higher at Rs.2,39,041 per kg, swiftly climbing to an intraday peak of Rs.2,43,443 per kg, as global cues reinforced key support levels around $70 per ounce.​

The March silver contract edged lower by Rs.73, or 0.03%, to settle at Rs.235,800 per kg, marking a retreat from its record high of Rs.2,54,174 per kg on December 29—a drop of nearly Rs.19,000. Domestic trading remained range-bound amid a shortened session on Thursday, with MCX closed for the evening and limited international cues.​

COMEX silver traded firmly green since early Friday, holding above critical $70/oz support, while Wednesday’s international futures plunged $7.33 (9.37%) to $70.89/oz. International markets reopen today, poised to steer domestic trends amid ongoing volatility.​

Ponmudi R, CEO at Enrich Money, affirms a resilient long-term bullish structure despite short-term pressures, with support at the rising channel and 20-day EMA near Rs.2,08,994. A decisive move above Rs.2,36,000 could ignite fresh upside targeting Rs.2,45,000–Rs.2,60,000 in the medium term, favoring accumulation on dips.​

National News

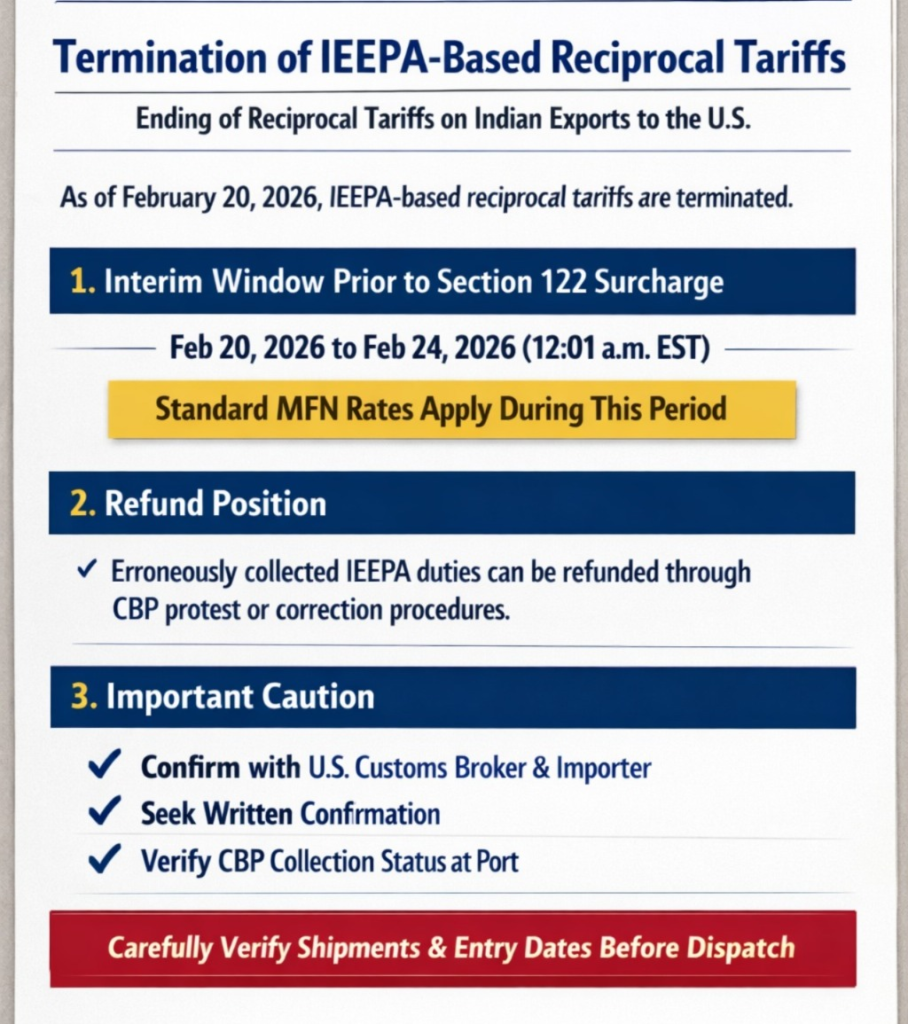

GJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

GJEPC informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

The Gem & Jewellery Export Promotion Council (GJEPC) informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

A letter issued by Sabyasachi Ray, Executive Director, GJEPC, addressed the Termination of IEEPA-Based Reciprocal Tariffs and outlined key implications for exporters.

Termination of IEEPA-Based Reciprocal Tariffs

Pursuant to the Executive Order dated February 20, 2026, titled “Ending Certain Tariff Actions”, the additional ad valorem duties imposed under IEEPA, including the reciprocal tariff framework under Executive Order 14257, shall no longer remain in effect and are directed to be terminated as soon as practicable.

Accordingly, entries made on or after February 20, 2026 should not be subject to the earlier IEEPA-based reciprocal tariffs.

1. Interim Window Prior to Section 122 Surcharge

A separate Presidential Proclamation dated February 20, 2026 imposes a temporary 10% surcharge under Section 122 of the Trade Act of 1974, effective 12:01 a.m. EST on February 24, 2026.

Therefore, between: February 20, 2026 – before 12:01 a.m. EST on February 24, 2026 imports into the United States should be subject only to ordinarily applicable HTSUS (MFN) rates, without the earlier reciprocal tariff, and prior to the commencement of the Section 122 surcharge.

For products such as cut and polished diamonds (where the MFN rate is ordinarily 0%), this period represents a limited operational window.

2. Refund Position (If Collected in Error or Due to Implementation Lag)

In cases where reciprocal IEEPA duties are collected due to implementation lag, such duties should be eligible for refund through the standard:

- U.S. Customs and Border Protection (CBP) protest mechanism under 19 U.S.C. §1514, or

- Post-summary correction procedures, as applicable.

However, exporters should note that there is no assurance that the refund process will not be time-consuming.

3. Important Caution for Exporters

While GJEPC is actively engaging with U.S. customs authorities and keeping customs at Bharat Diamond Bourse informed, members are strongly advised to:

- Seek confirmation from their U.S. customs broker and trade counsel

- Obtain written confirmation from their U.S. buyer/importer regarding entry treatment

- Confirm that CBP has ceased collection of the reciprocal tariff at the port of entry

Given the evolving implementation environment, entry-level verification is critical.

Members are encouraged to carefully assess:

- Shipment timing

- Entry dates

- Applicable HTS classification

before dispatching consignments, wherever applicable.

source: GJEPC

-

National News14 hours ago

National News14 hours agoGJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

-

National News16 hours ago

National News16 hours agoWGC India gold market update: Price strength fuels demand Looking ahead

-

International News17 hours ago

International News17 hours agoIGI approves an investment of up to $150,000 in Saudi Arabia

-

National News16 hours ago

National News16 hours agoIndia’s polished diamond exports dip by 3.6 per cent yoy in  January 2026