National News

MCX, NSE withdraw additional margins on gold, silver futures

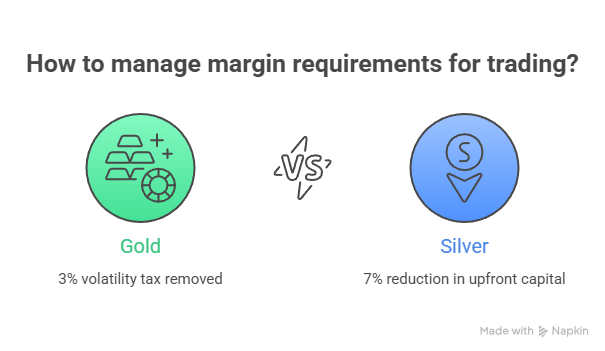

The Multi Commodity Exchange of India (MCX) and the National Stock Exchange of India (NSE) withdrew hefty additional margin requirements on gold and silver futures. The decision marks a pivot from the defensive crouch exchanges adopted earlier this month to curb excessive speculation.

India’s leading commodity exchanges move to lower the cost of trading precious metals, signaling that the recent bout of “blood and thunder” volatility in the bullion market may finally be cooling.

The rollback, effective Feb. 19, removes a 3% additional margin on gold contracts and a 7% surcharge on silver. For traders, the move is a welcome relief, effectively freeing up capital that had been locked away as collateral during a period of wild price swings.

A Wild Ride for Bullion

The extra margins were originally slapped on Feb. 4 as a circuit-breaker of sorts. At the start of the year, gold prices had surged nearly 35% in a frantic January rally, fueled by a cocktail of geopolitical jitters and institutional inflows.

However, the “everything-up” trade eventually hit a wall. Prices have since cooled by roughly 15%, allowing regulators to breathe a sigh of relief.

“The exchanges are essentially saying the fever has broken,” said one Mumbai-based commodities analyst. “By lowering the barrier to entry, they are inviting liquidity back into the pits, which had thinned out as trading costs spiked.”

The Margin Game

Margin requirements are the primary tool exchanges use to ensure traders can cover potential losses. When volatility spikes, exchanges hike these requirements to prevent a domino effect of defaults.

- Gold: Traders no longer face the 3% “volatility tax.”

- Silver: The more volatile sibling sees a significant 7% reduction in required upfront capital.

- Market Impact: The move is expected to boost participation from both hedgers—jewelers looking to lock in prices—and speculative day traders.

Global Echoes

The maneuvers in Mumbai mirror a broader global recalibration. Markets worldwide have been struggling to find a “new normal” for precious metals. Late last month, the CME Group took similar action on Comex gold and silver futures following one of the steepest price declines in decades.

The stabilization in India is particularly crucial as the country remains one of the world’s largest consumers of physical gold. While the domestic market appears to be finding its footing, analysts warn that macroeconomic shifts—particularly regarding emerging market ETF inflows—could still trigger fresh turbulence.

National News

Govt. Raises Jewellery Drawback Rates to Offset Rising Precious Metal Costs

Revised Rates Under Chapter 71 Aim to Boost Export Margins and Ease Working Capital Pressures Amid Soaring Gold and Silver Prices

The Government of India has revised duty drawback rates for specific jewellery tariff items under Chapter 71 through Notification No. 21/2026–Customs (N.T.), dated 16 February 2026, issued by the Ministry of Finance (Department of Revenue). The move is expected to enhance exporters’ cost recovery, improve margins, and strengthen global price competitiveness for Indian jewellery shipments amid record-high gold, silver and platinum prices that have increased working capital pressures for manufacturers.

The amendment updates the schedule of Notification No. 77/2023–Customs (N.T.). For tariff item 711301, the drawback rate has been increased from 524.27 to 639.59. For tariff items 711302 and 711401, the rate has been raised from 6,317.22 to 9,089.33.

GJEPC has represented this issue in meetings with officials from the Department of Commerce as well as NITI Aayog, stressing the need to revise drawback rates in line with rising input costs faced by exporters and enhance ease of doing business.

The higher drawback amounts are also likely to support exporters’ cash flow by returning a larger portion of duties paid on inputs after export realisation, which is particularly beneficial for MSMEs.

-

New Premises57 minutes ago

New Premises57 minutes agoTanishq adds 18th UAE store in Dubai

-

National News3 hours ago

National News3 hours agoGovt. Raises Jewellery Drawback Rates to Offset Rising Precious Metal Costs

-

International News19 hours ago

International News19 hours agoTanishq USA & Bibhu Mohapatra Unveil ‘She Is the Balance’ at Manhattan for Fall 2026

-

National News18 hours ago

National News18 hours agoGJEPC & Mumbai Customs Host Session on Hand-Carried Jewellery Exports