National News

Legacy brand PNG Jewellers receives IAGES accreditation

India’s gold industry is set to achieve the highest standards of ethical and responsible business practises followed, as more gold entities receive their Indian Association for Gold Excellence and Standards (IAGES) accreditation. Joining the fast-growing pan India network of verified gold retailers is the leading legacy brand PNG Jewellers (PN Gadgil Jewellers Ltd) that has received its IAGES accreditation.

IAGES is a Self-Regulatory Organisation established by and for the Indian gold industry to standardise the entire gold value chain for proprietors who own businesses in gold refining, bullion trading, manufacturing, assaying and hallmarking, retailing and digital gold selling.

With a legacy spanning over 194 years, PNG Jewellers stands amongst India’s oldest and most respected jewellers, renowned for its trust, excellence, and craftsmanship. Strengthening its already rigorous internal practices, PNG Jewellers has now earned IAGES accreditation, following a thorough assessment and verification by an independent third-party assessor.

“Each decade, we aim to better governance, process integrity and responsible sourcing practices across our operations, while meeting changing consumer expectations. The IAGES accreditation verifies and reinforces our highest internal standards for the benefit of our consumers. All registered gold entities in India should work towards accreditation so that the industry can be united in building long-term credibility and trust with customers,” said Dr. Saurabh Gadgil, Chairman & Managing Director, PNG Jewellers.

“We welcome PNG Jewellers to the IAGES network. Their long-standing legacy and reputation gets a further boost with this accreditation, adding another layer of trust and confidence amongst buyers. In a country where gold has been bought by generations across the strata of society to celebrate different emotions, a consumer-friendly framework has always been amiss. IAGES fills in that gap,” says Kaushlendra Sinha, CEO, IAGES.

As more jewellery brands join the IAGES framework, the Indian gold industry moves closer towards formalisation and sector-wide credibility. IAGES is currently running a nationwide consumer awareness campaign titled #PehlaCheckIAGES to inform consumers to always check for an IAGES accreditation before choosing their gold retailer.

source :PNG Jewellers

National News

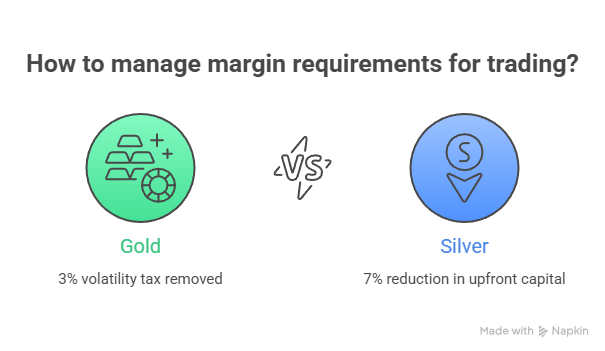

MCX, NSE withdraw additional margins on gold, silver futures

The Multi Commodity Exchange of India (MCX) and the National Stock Exchange of India (NSE) withdrew hefty additional margin requirements on gold and silver futures. The decision marks a pivot from the defensive crouch exchanges adopted earlier this month to curb excessive speculation.

India’s leading commodity exchanges move to lower the cost of trading precious metals, signaling that the recent bout of “blood and thunder” volatility in the bullion market may finally be cooling.

The rollback, effective Feb. 19, removes a 3% additional margin on gold contracts and a 7% surcharge on silver. For traders, the move is a welcome relief, effectively freeing up capital that had been locked away as collateral during a period of wild price swings.

A Wild Ride for Bullion

The extra margins were originally slapped on Feb. 4 as a circuit-breaker of sorts. At the start of the year, gold prices had surged nearly 35% in a frantic January rally, fueled by a cocktail of geopolitical jitters and institutional inflows.

However, the “everything-up” trade eventually hit a wall. Prices have since cooled by roughly 15%, allowing regulators to breathe a sigh of relief.

“The exchanges are essentially saying the fever has broken,” said one Mumbai-based commodities analyst. “By lowering the barrier to entry, they are inviting liquidity back into the pits, which had thinned out as trading costs spiked.”

The Margin Game

Margin requirements are the primary tool exchanges use to ensure traders can cover potential losses. When volatility spikes, exchanges hike these requirements to prevent a domino effect of defaults.

- Gold: Traders no longer face the 3% “volatility tax.”

- Silver: The more volatile sibling sees a significant 7% reduction in required upfront capital.

- Market Impact: The move is expected to boost participation from both hedgers—jewelers looking to lock in prices—and speculative day traders.

Global Echoes

The maneuvers in Mumbai mirror a broader global recalibration. Markets worldwide have been struggling to find a “new normal” for precious metals. Late last month, the CME Group took similar action on Comex gold and silver futures following one of the steepest price declines in decades.

The stabilization in India is particularly crucial as the country remains one of the world’s largest consumers of physical gold. While the domestic market appears to be finding its footing, analysts warn that macroeconomic shifts—particularly regarding emerging market ETF inflows—could still trigger fresh turbulence.

-

New Premises2 hours ago

New Premises2 hours agoTanishq adds 18th UAE store in Dubai

-

National News1 hour ago

National News1 hour agoMCX, NSE withdraw additional margins on gold, silver futures

-

National News4 hours ago

National News4 hours agoGovt. Raises Jewellery Drawback Rates to Offset Rising Precious Metal Costs

-

International News20 hours ago

International News20 hours agoTanishq USA & Bibhu Mohapatra Unveil ‘She Is the Balance’ at Manhattan for Fall 2026