International News

Jewellery sector’s growth will be fueled by a younger, diverse clientele: McKinsey & Co luxury fashion report

Jewellery sales are expected to regain momentum with 3% to 5% projected growth. An increasing number of consumers will transition from non-branded to branded jewellery.

A 2025 luxury fashion report by McKinsey & Co forecasts jewellery and leather goods to be the fastest-growing categories of the luxury goods industry through 2027. The jewellery sector’s growth will be fuelled by a younger and more diverse clientele.

The report notes that in the period 2019-2023, the jewellery category experienced a remarkable 8% CAGR (compound annual growth rate), globally. However, in 2024, growth slowed down between 2% to 4%. This year, jewellery sales are expected to regain momentum with 3% to 5% projected growth, and accelerate to 4% to 6% by 2027.

Jewellery sector’s growth in the next 3 years will be shaped by shifting customer profiles and buying behaviours. An increasing number of consumers will transition from non-branded to branded jewellery.

High jewellery sales are likely to increase in line with the growing number of ultra-high-net-worth individuals worldwide. Moreover, growing interest among younger buyers in genderless jewellery, along with luxury brands investing in technology and immersive experiences will further shape interest among digital natives and new consumers

However, the report cautions that an uncertainty in a clear segregation between lab-grown diamond and natural diamond markets could pose a challenge to this growth.

Key points:

- Jewellery to grow globally between 4%-6% through 2027: McKinsey & Co.

- High-jewellery demand to rise as the wealthy population grows worldwide.

- Global iconic jewellery brands continue to lead growth for luxury conglomerates

- Diamond-studded jewellery to see the biggest growth in India in 2025: Redseer

- India’s precious jewellery market to grow at a healthy 11-13% CAGR until 2028

- Organised jewellery sector in India to grow 20% year-on-year in FY25: Ind-Ra

International News

Gold prices in India continued to decline, modest recovery in global prices

geopolitical risks,rising energy prices continue to underpin gold demand globally.

Gold prices in India continued to decline on Thursday, marking the third straight session of losses even as global bullion prices attempted a modest recovery amid rising geopolitical tensions.

In the domestic market, 24-karat gold has fallen sharply over the past three days, with prices dropping by about ₹85,800 per 100 grams. The correction reflects a mix of global market volatility, profit-taking after recent highs, and currency movements affecting local bullion pricing.

As of Thursday morning, 24-karat gold was quoted at ₹16,451 per gram, down ₹311 from the previous session. The price of 22-karat gold slipped to ₹15,080 per gram, a decline of ₹285.

The drop in domestic prices comes even as international gold markets showed signs of stabilizing. Global bullion prices climbed back above $5,160 an ounce on Wednesday after recovering part of their earlier losses.

The rebound followed escalating tensions in the Middle East as the conflict involving the U.S., Israel and Iran entered its fifth day. Reports that Israel targeted a building where clerics were meeting to discuss the selection of a new Supreme Leader heightened geopolitical uncertainty, prompting renewed safe-haven flows into gold.

In India, however, retail bullion prices continued to reflect the recent correction.

On the derivatives side, gold futures on the Multi Commodity Exchange (MCX) were largely flat. The April 2026 contract opened at ₹1,63,265 per 10 grams, traded between ₹1,61,241 and ₹1,64,047 during the session, and was last quoted around ₹1,61,550—up marginally by ₹25, or 0.02%.

Market participants say geopolitical risks and rising energy prices could continue to underpin gold demand globally. Analysts note that if international prices hold above the $5,200 level, bullion could move toward the $5,450–$5,600 range in the near term, with price dips likely to attract strategic buying.

-

International News3 hours ago

International News3 hours agoGold prices in India continued to decline, modest recovery in global prices

-

DiamondBuzz19 hours ago

DiamondBuzz19 hours agoBotswana Diamonds rebrands as Botswana Minerals PLC

-

DiamondBuzz20 hours ago

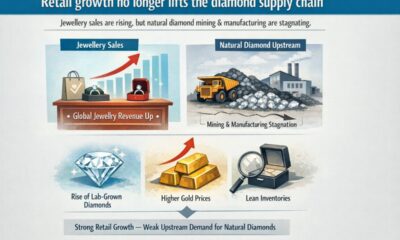

DiamondBuzz20 hours agoDespite revenue growth in jewellery sector, natural diamond upstream sees stagnation

-

International News22 hours ago

International News22 hours agoGold continues to get strength on the Middle East conflict