National News

India’s GJ sector ready to take a major leap with India-UK FTA: GJEPC

The India-UK CEOs Forum convened in Mumbai on 8-9 October brought together business leaders from both nations to explore the opportunities unlocked by the new India-UK Comprehensive Economic & Trade Agreement (CETA). Among the distinguished participants was Kirit Bhansali, Chairman, GJEPC, who represented India’s gem and jewellery sector at the high-powered meeting.

The two-day forum focused on how the CETA signed in May this year will reshape bilateral trade by removing tariffs on 99% of Indian exports to the UK and 90% of UK exports to India.

Bhansali spoke about “Leveraging the India–UK CETA to Achieve Growth and Jobs,” alongside prominent Indian business figures including Uday Kotak, Karan Rathore, Dilip Shanghvi, Naren Goenka, Anil Agarwal, Harish Ahuja, Bhadresh Dodhia, and Namit Joshi. Each shared insights on how the agreement could boost competitiveness and create employment across key sectors.

The forum was co-chaired by Sunil Bharti Mittal, Founder & Chairman, Bharti Enterprises, and Bill Winters, Group Chief Executive, Standard Chartered, with senior government officials in attendance, including Amardeep Singh Bhatia, Secretary, Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce & Industry, who addressed participants at the opening session.

Addressing the CEOs Forum Kirit Bhansali highlighted the gem and jewellery sector’s perspective: “The India-UK Free Trade Agreement marks a pivotal moment for the Indian gem and jewellery sector, unlocking immense growth opportunities and reinforcing our global leadership. With exports to the UK set to more than double to USD 2.5 billion within three years, this partnership will not only boost trade but also generate over 140,000 new jobs, directly benefiting artisans, manufacturers, and exporters across all key segments.

The FTA strengthens India’s position as a world leader in diamonds, gold, silver, and lab-grown stones, while enabling deeper market access and collaboration with UK retailers. We at GJEPC are committed to leveraging this historic agreement to drive innovation, employment, and sustainable growth for the industry and the millions who depend on it.”

For India’s gems and jewellery sector,Kirit Bhansali’s presence underscored the industry’s growing role in the global economy. With tariff barriers easing and market access expanding, the UK offers significant potential for export growth, design collaboration, and technology-driven value addition. The CETA promises to strengthen this momentum and position India’s gem and jewellery industry for an even more prominent role in shaping the future of India–UK trade relations.

GlamBuzz

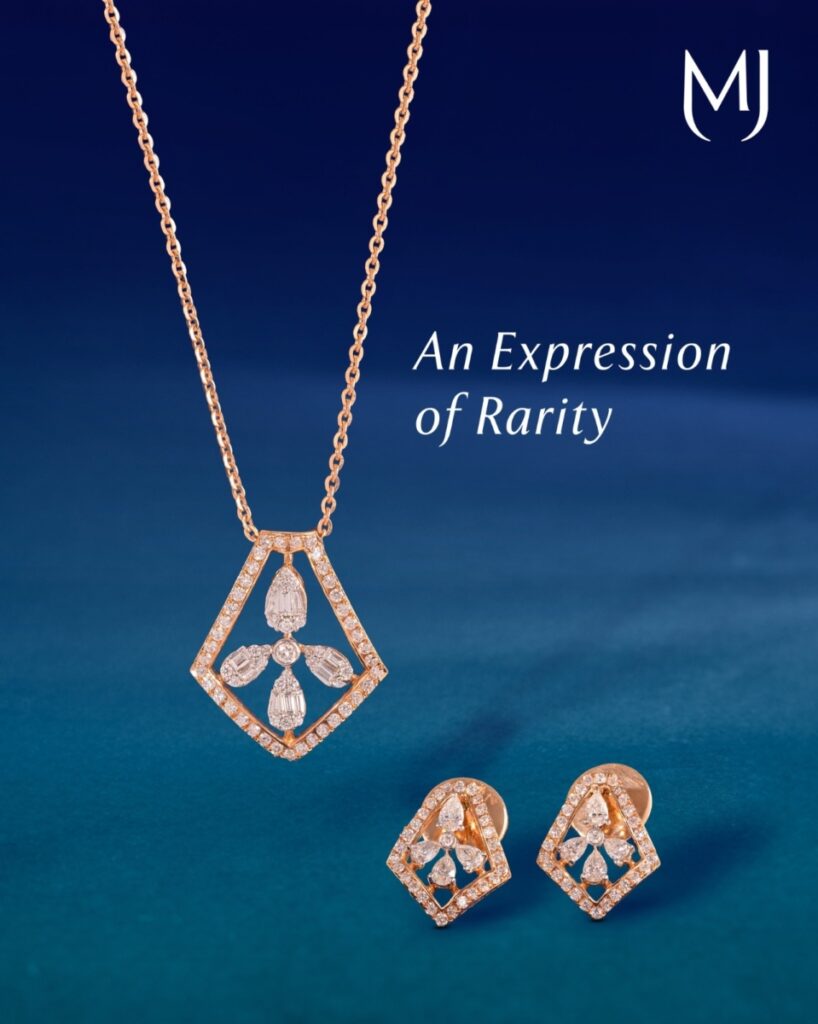

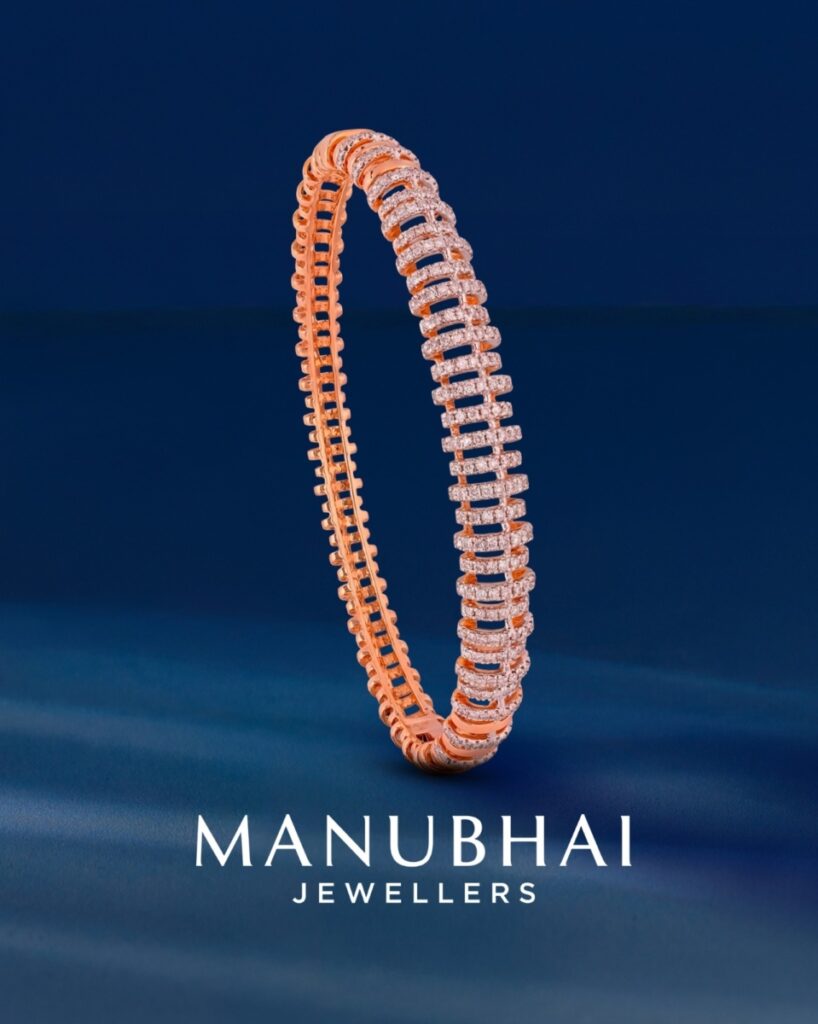

Rakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

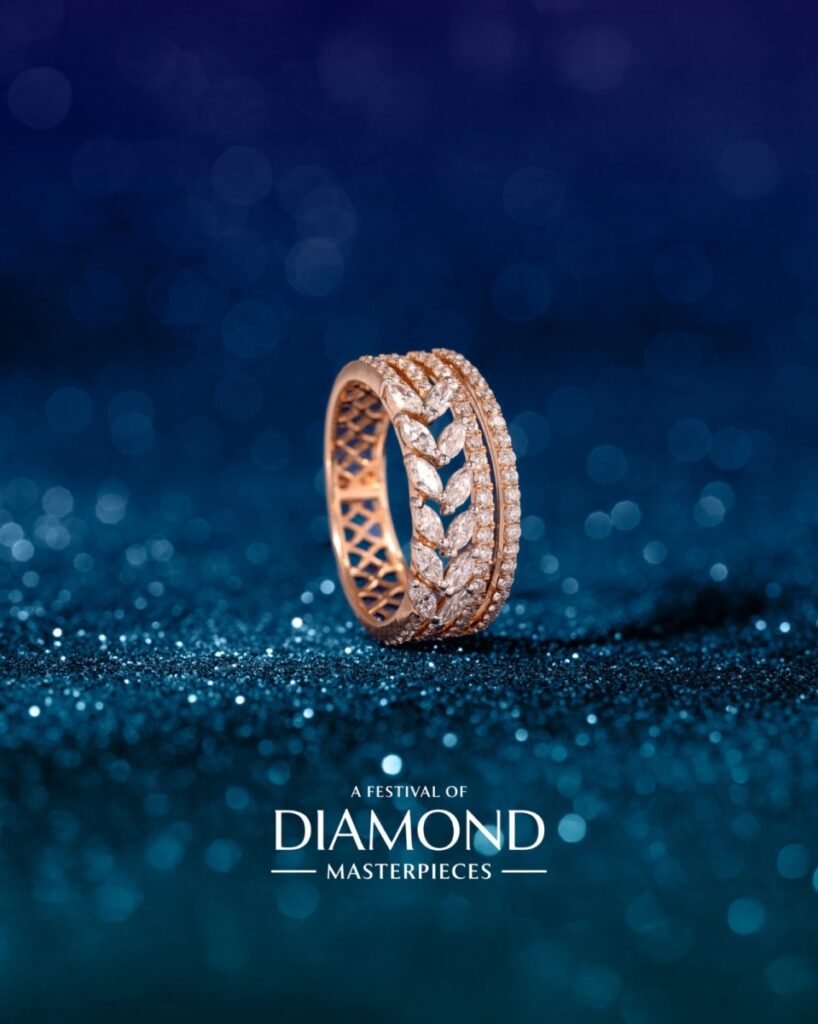

A celebration of understated luxury, luminous sparkle, and modern sophistication crafted for moments that matter.

Bollywood actress, Rakul Preet embodies refined elegance in the latest showcase of Manubhai Natural Diamonds, where timeless craftsmanship meets contemporary design. Styled in sleek silhouettes adorned with luminous natural diamonds, she reflects a narrative of confidence, grace, and effortless sophistication.

The collection highlights the enduring appeal of natural diamonds — pieces that do not demand attention, yet command it with quiet brilliance. Each creation is thoughtfully designed to complement modern femininity while preserving the legacy of fine craftsmanship that defines Manubhai Jewellers.

With clean lines, radiant sparkle, and a focus on authenticity, the campaign reinforces a powerful message: true luxury doesn’t need to speak loudly — it simply glows.

-

ShowBuzz3 days ago

ShowBuzz3 days agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

International News21 hours ago

International News21 hours agoThe HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

-

GlamBuzz24 hours ago

GlamBuzz24 hours agoRakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

-

International News1 day ago

International News1 day agoGold surges as US-Israel-Iran tensions boost safe-haven demand