International News

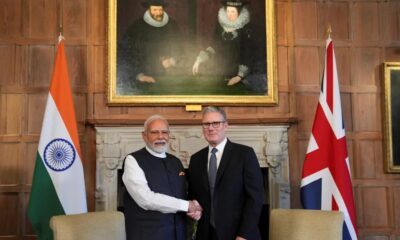

India, UK sign historic free trade agreement FTA; gems and jewellery, leather, textiles sectors stand to gain

The United Kingdom and India signed a historic free trade agreement (FTA), boosting bilateral trade by around $34 billion annually. The FTA, signed during Prime Minister Narendra Modi’s visit to the UK, includes tariff cuts, improved mobility for professionals, and market access guarantees that together mark one of India’s most comprehensive trade pacts.

The FTA offers duty-free access to the UK’s $23 billion market, giving Indian MSMEs a strong advantage over other countries in labour-intensive sectors such as gems and jewellery, leather and footwear, textiles. India’s gems and jewellery exports to the UK are currently valued at $941 million, with jewellery alone accounting for $400 million. With the UK importing $3 billion worth of jewellery annually, India’s exports are expected to double in 2–3 years.

The deal took three years to reach and also commits to a new India-UK plan to tackle illegal migration.Opponents had warned the deal could undercut British workers due to extended social security terms, but UK Business Secretary Jonathan Reynolds said this was “completely wrong” and Indian workers on temporary secondment to the UK would get the same deal already offered to many other countries.

The trade deal is expected to ensure comprehensive market access for Indian goods across all sectors and India will gain from tariff elimination on about 99 per cent of tariff lines (product categories) covering almost 100 per cent of the trade values, the officials said.

After signing the landmark deal, the two prime ministers are also expected to unveil an “UK-India Vision 2035” to take their partnership to new heights in a time of rapid global change.

The UK said Indian consumers will benefit from improved access to the best British products — from soft drinks and cosmetics to cars and medical devices — as average tariffs will drop from 15 per cent to 3 per cent after the FTA kicks in.

International News

WGC REPORT: 2025 Chinese gold jewellery consumer insights

The Chinese gold jewellery market presents a paradox: declining volume demand but rising consumer spending. Ray Jia, Research Head, ChinaWorld Gold Council says despite tonnage demand falling 49% since its 2013 peak, Chinese consumers spent RMB84 billion on gold jewellery in Q1 2025 alone, representing a 29% quarterly increase. This shift reflects gold’s dual role as both fashion accessory and investment vehicle in an uncertain economic climate.

Market Overview

Current Market Dynamics:

- Gold jewellery ownership reaches 81% among Chinese consumers, up from 62% in 2019

- Young consumers (18-24) show 62% ownership rates, significantly higher than other jewellery types

- Self-purchase dominates, with 79% buying for themselves versus 41% for others

- In-store purchases remain preferred (81%), though online channels are growing rapidly

Economic Context: The market faces both cyclical and structural headwinds. China’s economy remains stuck in a prolonged transition phase between passive destocking and active restocking, while demographic shifts including declining birth rates and marriages reduce traditional demand drivers.

Consumer Insights

Purchase Motivations:

- Cultural significance and traditional value remain primary drivers

- Investment and value preservation increasingly important amid economic uncertainty

- Quality, craftsmanship, and style personalization are top functional requirements

- Joy, confidence, and self-reward drive emotional purchase decisions

Key Barriers:

- Affordability concerns due to surging gold prices

- Lack of occasion-specific positioning

- Design limitations that don’t match evolving consumer preferences

Market Opportunities

Immediate Growth Potential:

- 67% of consumers would consider purchasing gold jewellery within 12 months

- 75% of previous buyers likely to repurchase

- 27% of non-purchasers open to first-time buying

Strategic Recommendations:

1. Strengthen Occasion-Based Marketing

Gold jewellery underperforms other jewellery types during key occasions like Chinese Valentine’s Day and Mother’s Day. Enhanced emotional positioning and targeted marketing campaigns could capture these missed opportunities.

2. Emphasize Quality and Assurance

Consumers prioritize quality, trust, and guarantees when making jewellery purchases. Brands should leverage warranties, transparency, and craftsmanship messaging to differentiate from competitors.

3. Target Key Consumer Segments

- Brand-Oriented Trendsetters (20%): Focus on trendy designs from recognized brands

- Purposeful Consumers (15%): Emphasize investment value and environmental responsibility

- Traditionalists (27%): Highlight cultural heritage and superior craftsmanship

Future Outlook

While tonnage demand may continue declining due to macro pressures and demographic shifts, value-based growth opportunities remain strong. The gold price relative to Chinese household income remains at historical averages, suggesting room for continued spending growth.

Success will depend on the industry’s ability to innovate product designs, strengthen emotional connections with consumers, and effectively communicate gold’s unique value proposition as both cultural artifact and financial asset.

Key Metrics

- Market Penetration: 81% gold jewellery ownership

- Young Consumer Adoption: 62% among 18-24 age group

- Purchase Intent: 67% considering purchase within 12 months

- Quarterly Spending: RMB84 billion (Q1 2025)

- Demand Decline: 49% volume decrease since 2013 peak

International News

LVMH Veteran Katia de Lasteyrie Launches SPKTRL, a Discreet Tech-Enabled Jewelry Brand

The brand debuts with a revolutionary “quiet tech” product: a screenless, diamond signet ring that uses light and color to silently communicate key digital messages.

Katia de Lasteyrie, a seasoned luxury expert and former innovation lead at LVMH’s Watches & Jewelry division, has launched SPKTRL—a pioneering jewelry brand that merges high craftsmanship with discreet technology.

Pronounced “Spectral,” SPKTRL’s first creation features a lab-grown CVD diamond that lights up in personalized hues via a minimalist app. A soft blue might signal a message from a loved one, while a vivid magenta could indicate an urgent work alert—each color tailored to the wearer’s priorities. Designed to reduce digital noise, SPKTRL reframes connectivity with elegance and intention.

Unlike traditional wearables that prioritize function over form, the SPKTRL ring is crafted as a luxury object first, indistinguishable from classic Place Vendôme high jewelry. Yet beneath its elegant exterior lies advanced embedded tech, invisible to the eye but deeply intuitive in function.

Manufactured in France, the titanium and high-precision metal ring is designed to symbolize power and wisdom. The use of lab-grown diamonds—optically identical to mined stones and already applied in quantum tech—further reflects the brand’s forward-thinking ethos.

SPKTRL champions a new art de vivre, says Lasteyrie: “Our technology doesn’t aim to replace your phone or make you faster—it gives you back control. The stone is the interface, and color is the language.” By turning essential messages into subtle visual cues, the brand invites users to reclaim their time and attention in a mindful, modern way.

With SPKTRL, de Lasteyrie draws on nearly two decades of experience at Christie’s, Chanel, and LVMH, uniting heritage craftsmanship with innovation. The launch signals a bold new category in luxury—tech-augmented jewelry that’s as emotionally intelligent as it is visually refined.

International News

Solid growth in Richemont’s jewellery sales

Richemont’s distribution channels, retail sales rose 6% CCY (3% reported) to €3.734 billion, online retail matched that pace at €323 million, and wholesale and royalty income grew 6% CCY (2% reported) to €1.355 billion.

Richemont reported a 6% year-on-year sales increase at constant currency (CCY) to €5.4 billion for Q1 ending June 30, 2025.At actual exchange rates, growth stood at 3%, with currency headwinds weighing on results. Despite a challenging global backdrop, the performance signals a steady recovery from last year’s luxury market slump.

Jewellery remained the standout segment, with the company’s four Maisons — Cartier, Van Cleef & Arpels, Buccellati, and Vhernier — posting strong 11% growth to €3.914 billion. This marks the third straight quarter of double-digit growth, supported by both jewellery and watches, and driven by all regions except Japan.

However, the Specialist Watchmakers division struggled, with sales falling 7% to €824 million due to weaker performance in China, Hong Kong, Macau, and Japan. Double-digit growth in the Americas provided partial relief.

Richemont’s ‘Other’ division — which includes fashion and accessories brands — saw a 1% drop at CCY and 4% decline on a reported basis, totaling €674 million. While Peter Millar, Alaïa, Chloé, and Watchfinder showed strength, no update was given on Dunhill, Delvaux, Montblanc, or other labels.

Regionally, Europe (+11% to €1.295 billion), the Americas (+10% reported, +17% CCY to €1.335 billion), and the Middle East & Africa (+11% reported, +17% CCY to €524 million) all performed well. Asia Pacific was flat at CCY but down 4% reported (€1.731 billion), while Japan declined sharply (-15% CCY, -13% reported) to €527 million due to tough comparatives and reduced tourist spending.

-

New Premises3 weeks ago

New Premises3 weeks agoMalabar Gold & Diamonds Inaugurates Landmark Integrated Manufacturing Site in Hyderabad, Cementing Its Position as a Global Manufacturing Leader

-

National News2 months ago

National News2 months agoEmmadi Silver Jewellery Launches First Karnataka Store with Grand Opening in Bengaluru’s Malleshwaram

-

BrandBuzz4 months ago

BrandBuzz4 months agoMia by Tanishq Unveils ‘Fiora’ Collection This Akshaya Tritiya: A Celebration of Nature’s Blossoms and New Beginnings

-

GlamBuzz2 months ago

GlamBuzz2 months agoGokulam Signature Jewels Debuts in Hyderabad with Glamorous Launch at KPHB