National News

Govt tightens import controls on platinum jewellery to curb misuse of FTA

The government has tightened import controls on select platinum jewellery categories by imposing licensing requirements until April 30, 2026, to curb misuse of free trade agreements (FTAs), particularly with ASEAN nations. A DGFT notification revised the import policy for these items from “Free” to “Restricted,” making licences mandatory for imports.

The government on Monday restricted imports of unstudded articles of platinum jewellery until 30 April 2026, following the misuse of the zero per cent import clause.Until now, such articles, with 90% gold content, could be freely imported. However, some traders were importing these at zero duty from Indonesia under the India-Asean free trade agreement over the past few weeks and converting them into gold bars, evading the 6% duty on gold imports.

Officials said the step follows instances of traders exploiting duty differentials under the India-ASEAN FTA to route precious metals into India by declaring them as unstudded jewellery. Thailand has been identified as a key source of such practices. Authorities noted that some traders were attempting to bypass tariffs for quick gains, and the new restrictions aim to prevent such circumvention while strengthening rules of origin for future compliance. Consignments were landing at Amritsar and Delhi airports, and the jewellery was melted and converted into platinum bars, which were then sold in the domestic market, evading a 6.4% duty on such bars due to their 90% gold content.

GlamBuzz

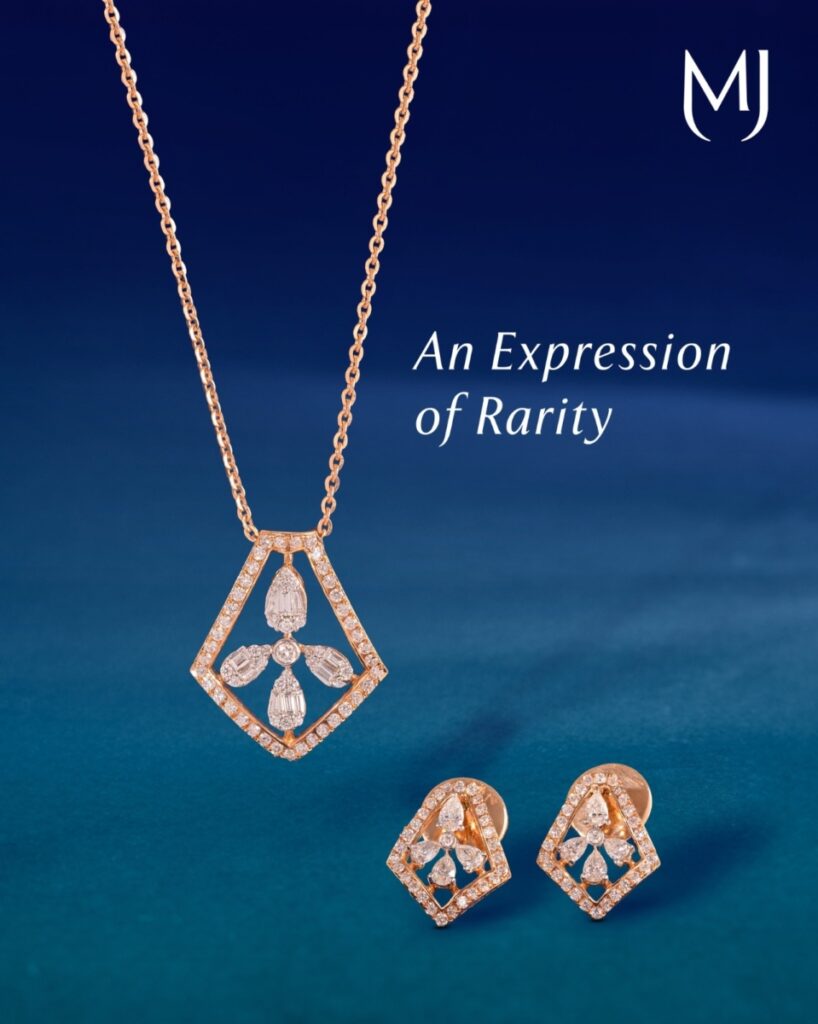

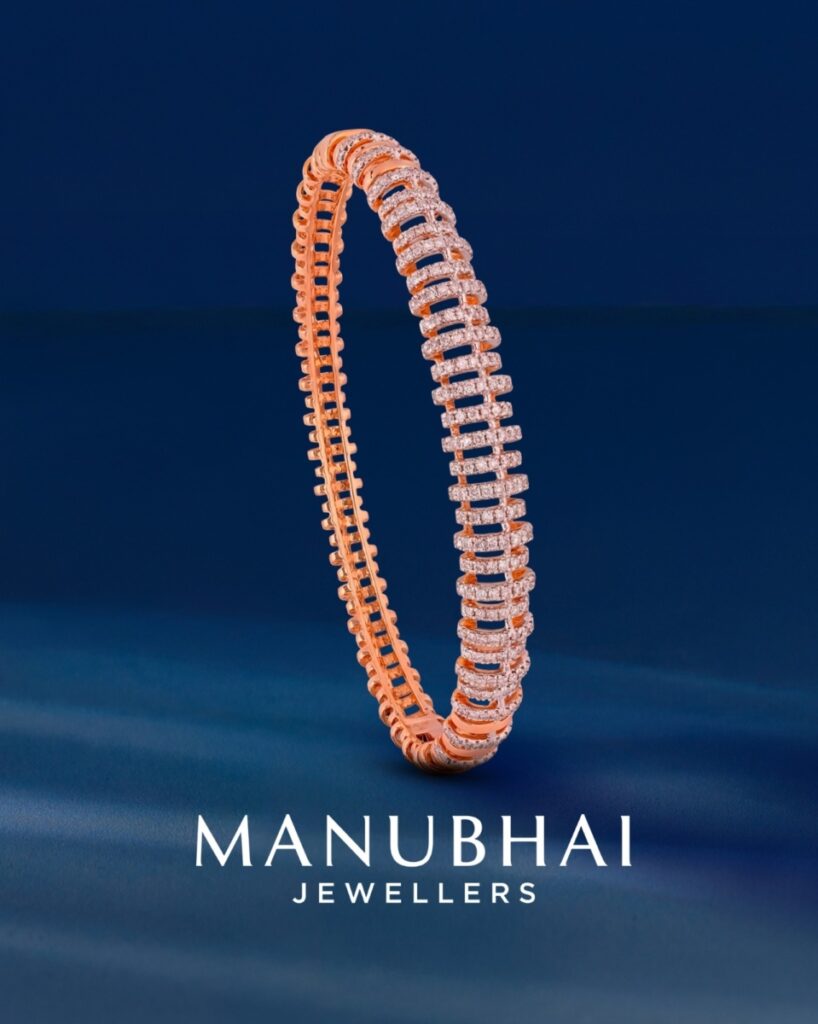

Rakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

A celebration of understated luxury, luminous sparkle, and modern sophistication crafted for moments that matter.

Bollywood actress, Rakul Preet embodies refined elegance in the latest showcase of Manubhai Natural Diamonds, where timeless craftsmanship meets contemporary design. Styled in sleek silhouettes adorned with luminous natural diamonds, she reflects a narrative of confidence, grace, and effortless sophistication.

The collection highlights the enduring appeal of natural diamonds — pieces that do not demand attention, yet command it with quiet brilliance. Each creation is thoughtfully designed to complement modern femininity while preserving the legacy of fine craftsmanship that defines Manubhai Jewellers.

With clean lines, radiant sparkle, and a focus on authenticity, the campaign reinforces a powerful message: true luxury doesn’t need to speak loudly — it simply glows.

-

ShowBuzz3 days ago

ShowBuzz3 days agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

International News1 day ago

International News1 day agoThe HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

-

GlamBuzz1 day ago

GlamBuzz1 day agoRakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

-

International News1 day ago

International News1 day agoGold surges as US-Israel-Iran tensions boost safe-haven demand