National News

GJ exports up by 19.64% while imports witnessed a 36.01% rise during November 2025

As per the data released by GJEPC, the overall gross exports of Gems & Jewellery at US$ 2510.86 million (Rs. 22300.45 crores) in the month of November 2025 shows a growth of (+)19.64% (+25.93% in Rs. term) as compared to US$ 2098.59 million (Rs. 17708.59 crores) for the same period of previous year. On the other hand, the overall gross imports of Gems & Jewellery at US$ 1894.92 million (Rs. 16834.79 crores) in month of November 2025 shows a growth of (+)36.01% (+43.18% in Rs. term) as compared to US$ 1393.23 million (Rs. 11757.49 crores) for the same period of previous year.

While, from April to November 2025, the overall gross exports of Gems & Jewellery at US$ 18867.43 million (Rs. 164219.21 crores) is showing a growth of (+)0.07% (+3.99% in Rs term) as compared to US$ 18854.83 million (Rs. 157912.81 crores) for the same period of previous year and the overall gross imports of Gems & Jewellery at US$ 13820.863 million (Rs. 120137.91 crores) is showing a growth of (+)6.87% (+10.98% in Rs. term) as compared to US$ 12932.06 million (Rs. 108250.6 crores) for the same period of previous year. Steady exports and rising imports indicate strong domestic demand, active manufacturing, and confidence ahead of the festive and wedding seasons.

The strong growth in both export and import of gems and jewellery in November 2025 reflects a revival in global demand and renewed confidence across the value chain. Higher exports indicate improved international market traction, better price realization, and increased competitiveness of Indian products, while the sharp rise in imports highlights proactive raw material sourcing and capacity expansion by manufacturers to meet the demand in upcoming holiday season in the West, and wedding season in the domestic market. Together, this balanced export–import growth underscores robust trade activity, strategic inventory build-up, and a positive outlook for sustained sectoral growth.

Along with this, multiple factors beyond seasonal demand, like product diversification into lightweight and contemporary designs, appealed to younger global consumers, while improved market access through trade agreements like the India-UAE CEPA enhanced competitiveness.

Cut and Polished Diamonds: The overall gross export of Cut & Polished diamonds at US$ 919.74 million (Rs. 8168.96 crores) in month of November 2025 is showing a growth of (+)38.03%(+45.23% in Rs. Term) as compared to US$ 666.34 million (Rs. 5624.88 crores) for the same period of previous year. This reflects a clear revival in global demand, supported by improved consumer sentiment, restocking by international buyers, and enhanced value addition by Indian diamantaires. Higher growth in rupee terms further indicates better price realization and currency support, pointing to a healthy recovery and positive momentum for the diamond sector. India being the Global hub for diamond processing, is the preferred destination for majority of international players, hence reflecting an upsurge in cut and polished diamond exports.

Since, April to November 2025, the overall gross Exports of Cut & Polished diamonds at US$ 8195.54 million (Rs. 71333.75 crores) is showing a decline of (-)8.76% (-5.15% Rs. term) as compared to US$ 8982.71 million (Rs. 75204.36 crores) for the same period of previous year and the overall gross imports of Cut & Polished diamonds at US$ 895.14 million (Rs. 7823.48 crores) is showing a growth of (+) 0.1% (+4.47% Rs. term) as compared to US$ 894.26 million (Rs. 7488.87 crores) for the same period of previous year.

Similarly, the overall gross imports of Cut & Polished diamonds at US$ 191.0 million ( Rs. 1696.53 crores) in month of NOV 2025 is showing a growth of(+) 253.49% (+272.09% in Rs. term) as compared to US$ 54.03 million (Rs. 455.94 crores) for the same period of previous year. to US$86.16 million (Rs. 720.13 crores) for the same period of the previous year.

Moreover, despite a moderation in overall exports during April–November 2025, the sharp rise in imports, particularly the significant surge in November 2025 reflects renewed confidence among manufacturers and traders.

The substantial increase in inventory purchases was driven by strong festive and wedding season demand, expectations of improved retail sales, and strategic stocking in anticipation of price stabilization and future export recovery. This import growth indicates healthy domestic demand and a proactive industry outlook rather than market weakness.

Rough Diamonds: Gross imports of rough diamonds at US$ 7377.20 million (Rs 63996.64 crores) in APR 2025 – NOV 2025 have shown a growth of (+) 4.69% (+ 8.56% Rs. term) compared with the imports at US$ 7046.79 million (Rs. 58951.2 crores) for previous year. This is due to the demand during the ongoing wedding season and to a great extent, also the holiday season in overseas markets.

Platinum: Provisional gross export of Platinum Jewellery for the period of April 2025 – July 2025 at US$65.18 million (Rs. 558.73 crores) shows growth of 14.11% (17.2% Rs. term) over the comparative figure of US$57.12 million (Rs. 476.73 crores) for the previous year. The metal’s attractiveness as a premium yet inexpensive alternative to gold attracted younger consumers, and new and modern lightweight designs were increasing export orders. The 14.11% growth in platinum jewellery exports reflects strong market acceptance of platinum as a premium yet cost-effective alternative to gold. Rising interest from younger consumers, along with innovative, lightweight and modern designs, has boosted export orders, reinforcing platinum jewellery’s expanding global appeal and positive growth outlook.

Polished Lab Grown Diamonds: Provisional gross export of Polished Lab Grown Diamonds for the period November 2025 at US$ 76.09 million (in Rs. 675.92 crores) shows a growth of (+) 10.55% (+16.33% in Rs. term) over the comparative figure of US$ 68.83 million (Rs. 581.02 crores) for the previous year. The 10.55% growth in polished lab-grown diamond exports in November 2025 highlights rising global acceptance of sustainable and cost-effective alternatives to natural diamonds. Strong rupee growth further reflects improving demand, competitive pricing, and expanding market penetration, reinforcing the segment’s positive long-term growth potential.

Gold Jewellery: The total gross export of Gold Jewellery at US$ 1219.53 million (Rs. 10831.06 crores) in month of NOV 2025 is showing a decline of (-) 0.92% (+4.3% in Rs. term) as compared to US$ 1230.84 million (Rs. 10384.1 crores) for the same period of previous year. With the wedding season beginning in India, retailers have started witness the rise on inventories, supported by renewed consumer confidence and expectations of gold prices going up.

Although gold jewellery exports in November 2025 showed a marginal decline of 0.92% in US dollar terms, the 4.3% growth in rupee value reflects underlying price strength and currency support. With the wedding season commencing in India, rising retailer inventories signal renewed consumer confidence and strong domestic demand, driven by expectations of higher gold prices ahead. This positive sentiment is likely to remain sustained atleast for the next quarter. Besides, diversification in products in lightweight, contemporary designs and benefits of being part of trade agreements like the India-UAE CEPA made us competitive, leading to strong growth in the sector during the month.

Silver Jewellery: Provisional gross export of Silver Jewellery for the period APR 2025 – NOV 2025 at US$ 929.94 million (Rs. 8133.93 crores) shows growth of (+) 29.69% ( +35.44% Rs. term) over the comparative figure of US$ 717.03 million (Rs. 6005.76 crores) for previous year. This reflects rising global demand for affordable luxury, increased preference for silver as a value-driven alternative to gold, and improved design innovation and export competitiveness by Indian manufacturers. Favorable currency movement and expanded market reach have further supported this robust performance, indicating a healthy and sustainable growth trajectory for the segment.

Coloured Gemstones: Provisional gross export of Coloured Gemstones for the period April to November 2025 at US$116.66 million (in Rs. 998.03 crores) shows growth of 1.93% (4.48% in Rs. term) over the comparable figure of US$114.45 million (Rs. 955.25 crores) for the previous year. The niche market for bespoke and high-value gemstone jewellery remained robust, underpinned by innovation in gemstone cutting and jewellery design techniques.

GlamBuzz

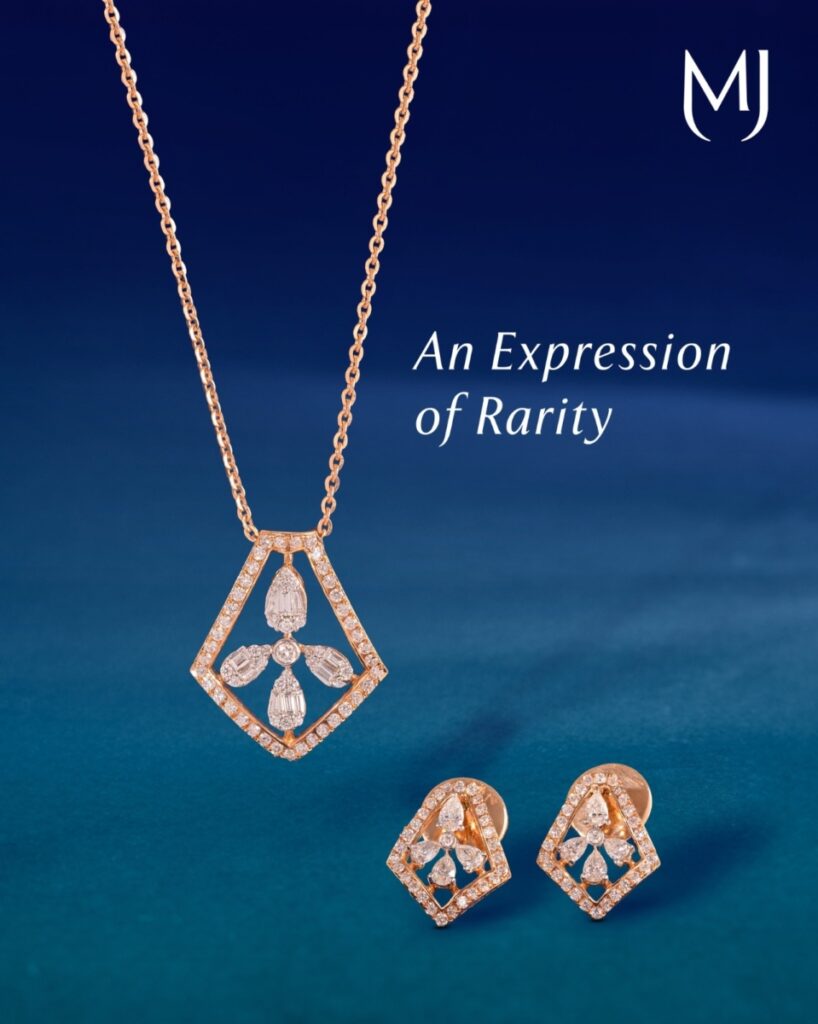

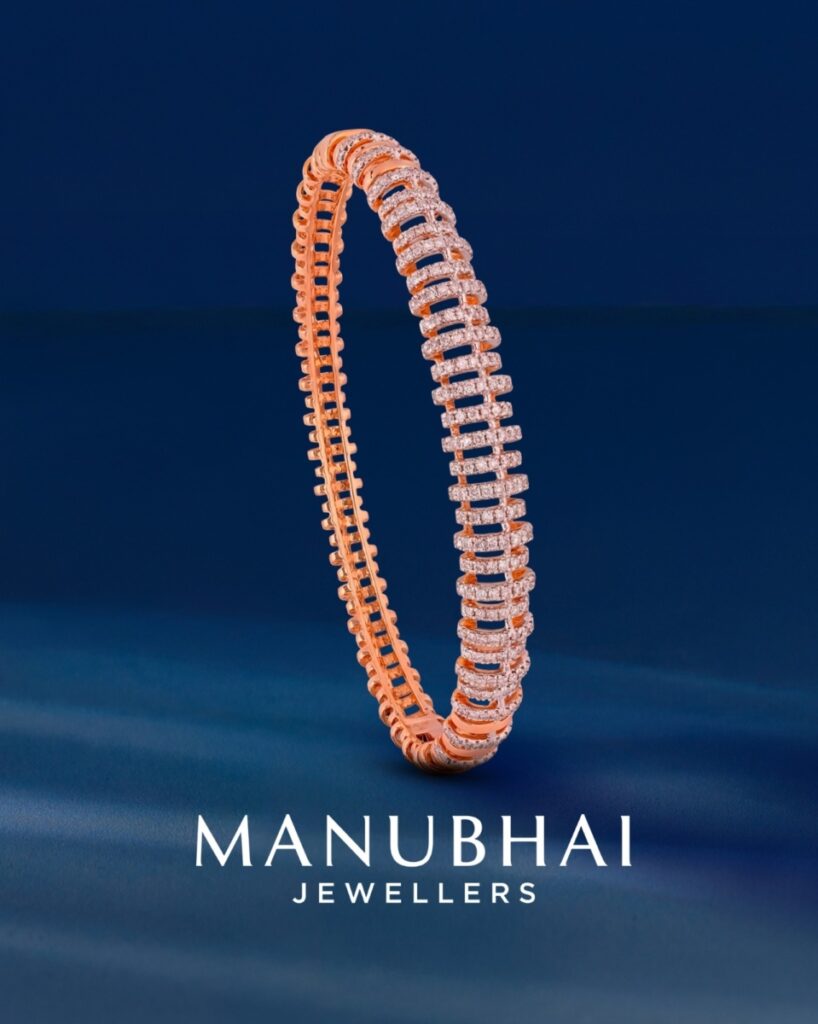

Rakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

A celebration of understated luxury, luminous sparkle, and modern sophistication crafted for moments that matter.

Bollywood actress, Rakul Preet embodies refined elegance in the latest showcase of Manubhai Natural Diamonds, where timeless craftsmanship meets contemporary design. Styled in sleek silhouettes adorned with luminous natural diamonds, she reflects a narrative of confidence, grace, and effortless sophistication.

The collection highlights the enduring appeal of natural diamonds — pieces that do not demand attention, yet command it with quiet brilliance. Each creation is thoughtfully designed to complement modern femininity while preserving the legacy of fine craftsmanship that defines Manubhai Jewellers.

With clean lines, radiant sparkle, and a focus on authenticity, the campaign reinforces a powerful message: true luxury doesn’t need to speak loudly — it simply glows.

-

ShowBuzz3 days ago

ShowBuzz3 days agoIndia International Bullion Summit 2026: A Defining Platform Shaping India’s Bullion & Jewellery Ecosystem

-

International News2 days ago

International News2 days agoThe HK International Diamond, Gem & Pearl Show opens today; The HK International Jewellery Show starts Wednesday

-

GlamBuzz2 days ago

GlamBuzz2 days agoRakul Preet Radiates Timeless Glamour in Manubhai Jewellers’s Natural Diamonds

-

International News2 days ago

International News2 days agoMiddle East Conflict Halts Global Diamond Trade in Dubai and Israel