National News

DGFT notifies revised HS codes for precious metal imports

The Directorate General of Foreign Trade (DGFT), Ministry of Commerce & Industry, has updated the rules for importing gold, silver, and platinum following announcements made in this year’s Union Budget. The new rules are effective from 1 May 2025, and include revised HS codes for precious metals and clarify who can import them. A similar notification has already been issued by the Central Board of Indirect Taxes and Customs (CBIC).

For gold (including gold plated with platinum)—unwrought or in semi-manufactured forms, with 99.5% or higher purity—imports are restricted to:

Nominated agencies notified by the RBI (for banks) or DGFT (for other agencies),

Qualified Jewellers (as notified by IFSCA) through the India International Bullion Exchange (IIBX),

Valid India-UAE TRQ holders (as notified by IFSCA) importing via IIBX, with physical delivery through IFSCA-registered vaults in SEZs.

Additionally, gold dore imports are allowed for licensed refineries under the Actual User (AU) condition.

Silver and platinum imports have also been aligned with purity-specific conditions, with imports either permitted freely or routed through authorised agencies.

National News

GJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

GJEPC informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

The Gem & Jewellery Export Promotion Council (GJEPC) informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

A letter issued by Sabyasachi Ray, Executive Director, GJEPC, addressed the Termination of IEEPA-Based Reciprocal Tariffs and outlined key implications for exporters.

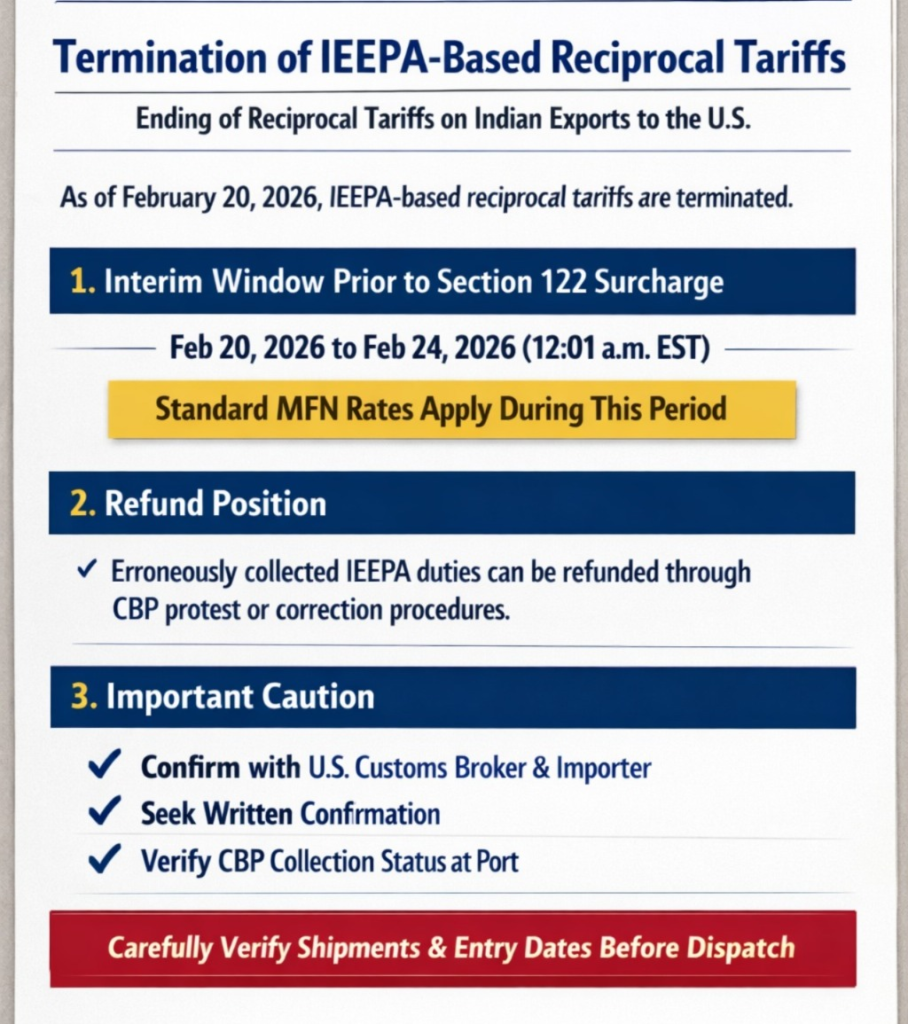

Termination of IEEPA-Based Reciprocal Tariffs

Pursuant to the Executive Order dated February 20, 2026, titled “Ending Certain Tariff Actions”, the additional ad valorem duties imposed under IEEPA, including the reciprocal tariff framework under Executive Order 14257, shall no longer remain in effect and are directed to be terminated as soon as practicable.

Accordingly, entries made on or after February 20, 2026 should not be subject to the earlier IEEPA-based reciprocal tariffs.

1. Interim Window Prior to Section 122 Surcharge

A separate Presidential Proclamation dated February 20, 2026 imposes a temporary 10% surcharge under Section 122 of the Trade Act of 1974, effective 12:01 a.m. EST on February 24, 2026.

Therefore, between: February 20, 2026 – before 12:01 a.m. EST on February 24, 2026 imports into the United States should be subject only to ordinarily applicable HTSUS (MFN) rates, without the earlier reciprocal tariff, and prior to the commencement of the Section 122 surcharge.

For products such as cut and polished diamonds (where the MFN rate is ordinarily 0%), this period represents a limited operational window.

2. Refund Position (If Collected in Error or Due to Implementation Lag)

In cases where reciprocal IEEPA duties are collected due to implementation lag, such duties should be eligible for refund through the standard:

- U.S. Customs and Border Protection (CBP) protest mechanism under 19 U.S.C. §1514, or

- Post-summary correction procedures, as applicable.

However, exporters should note that there is no assurance that the refund process will not be time-consuming.

3. Important Caution for Exporters

While GJEPC is actively engaging with U.S. customs authorities and keeping customs at Bharat Diamond Bourse informed, members are strongly advised to:

- Seek confirmation from their U.S. customs broker and trade counsel

- Obtain written confirmation from their U.S. buyer/importer regarding entry treatment

- Confirm that CBP has ceased collection of the reciprocal tariff at the port of entry

Given the evolving implementation environment, entry-level verification is critical.

Members are encouraged to carefully assess:

- Shipment timing

- Entry dates

- Applicable HTS classification

before dispatching consignments, wherever applicable.

source: GJEPC

-

News50 minutes ago

News50 minutes agoIndia Pavilion inaugurated at Bangkok Gem and Jewelry Fair

-

International News1 hour ago

International News1 hour agoGJ exporters hasten US shipments amid tariff uncertainty

-

New Premises2 hours ago

New Premises2 hours agoVerlas Brings New York’s Next-Gen Diamond Jewellery to India

-

National News2 days ago

National News2 days agoGJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs