National News

Candere expands retail footprint in Maharashtra with three new stores

Brand strengthens presence in Kandivali, Nashik and Kolhapur, reinforcing its omni-channel growth strategy

Candere, the lifestyle jewellery brand by Kalyan Jewellers known for its modern and trend-led designs, has expanded its retail presence in Maharashtra with the launch of three new stores in Kandivali, Nashik, and Kolhapur. These new additions further reinforce the brand’s commitment to offering accessible, stylish, and contemporary jewellery for today’s discerning customers.

The newly launched stores mark Candere’s expanding footprint across Maharashtra, bringing its curated jewellery experience to key markets across the state. With these launches, Candere has strengthened its retail presence in Maharashtra, catering to both metropolitan and emerging urban centres. The three stores are thoughtfully designed to offer a seamless blend of digital-first convenience and personalized in-store service, ensuring every visit reflects Candere’s commitment to elegance, innovation, and exceptional shopping experiences.

Known for its lightweight, versatile, and trend-forward jewellery, Candere appeals to Gen Z, working professionals, and style-conscious individuals looking for contemporary designs at accessible price points starting from Rs.10,000. Each piece reflects the brand’s core ethos to help customers express their individuality through meaningful jewellery that fits effortlessly into their lifestyle.

To mark the launch of its new store, Candere is offering special promotions Get up to 35,000 off per carat* + Rs. 850 off per Gram on making charges.

With the launch of its new stores in Kandivali, Nashik, and Kolhapur, Candere continues to blend digital convenience with physical experience, staying true to its ethos of being an omni-channel lifestyle jewellery brand with a growing retail presence. Backed by the heritage and trust of Kalyan Jewellers, Candere continues to redefine the jewellery-buying journey, making it smarter, seamless, and more experiential.

National News

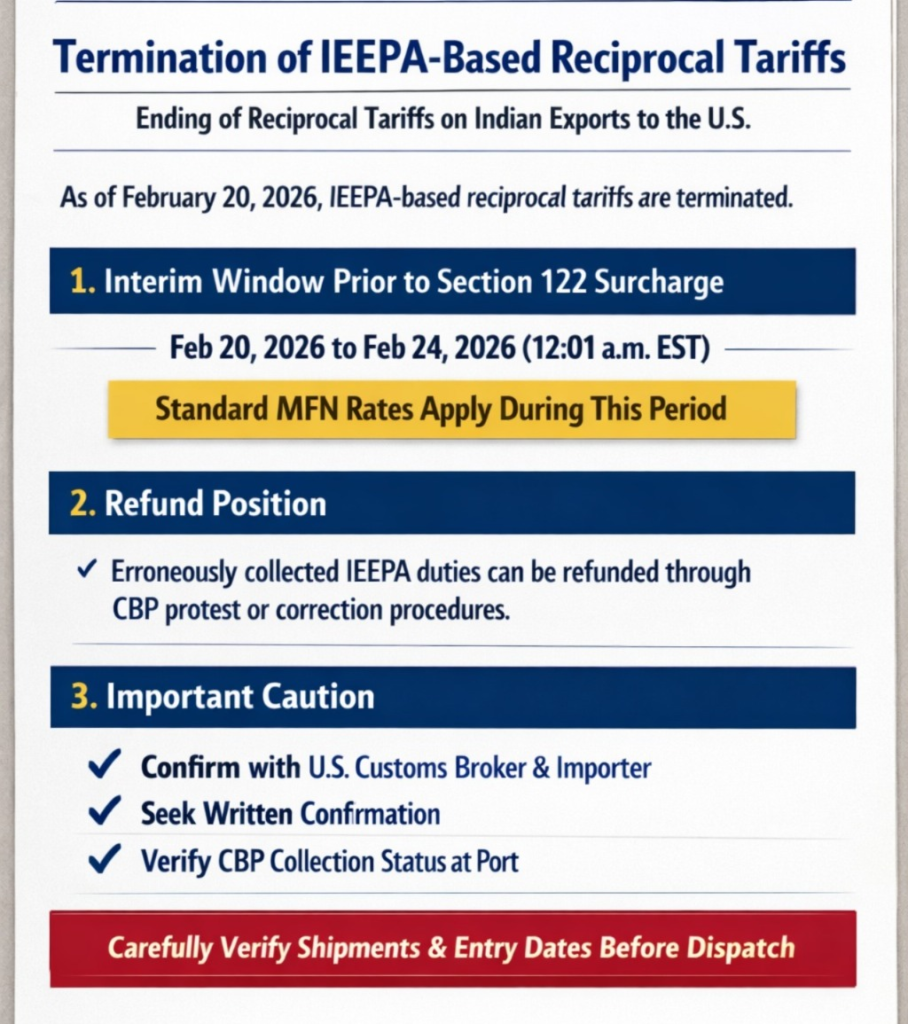

GJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

GJEPC informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

The Gem & Jewellery Export Promotion Council (GJEPC) informed all exporter members of an important interim development concerning U.S. import duties applicable to Indian exports, particularly in the gem and jewellery sector.

A letter issued by Sabyasachi Ray, Executive Director, GJEPC, addressed the Termination of IEEPA-Based Reciprocal Tariffs and outlined key implications for exporters.

Termination of IEEPA-Based Reciprocal Tariffs

Pursuant to the Executive Order dated February 20, 2026, titled “Ending Certain Tariff Actions”, the additional ad valorem duties imposed under IEEPA, including the reciprocal tariff framework under Executive Order 14257, shall no longer remain in effect and are directed to be terminated as soon as practicable.

Accordingly, entries made on or after February 20, 2026 should not be subject to the earlier IEEPA-based reciprocal tariffs.

1. Interim Window Prior to Section 122 Surcharge

A separate Presidential Proclamation dated February 20, 2026 imposes a temporary 10% surcharge under Section 122 of the Trade Act of 1974, effective 12:01 a.m. EST on February 24, 2026.

Therefore, between: February 20, 2026 – before 12:01 a.m. EST on February 24, 2026 imports into the United States should be subject only to ordinarily applicable HTSUS (MFN) rates, without the earlier reciprocal tariff, and prior to the commencement of the Section 122 surcharge.

For products such as cut and polished diamonds (where the MFN rate is ordinarily 0%), this period represents a limited operational window.

2. Refund Position (If Collected in Error or Due to Implementation Lag)

In cases where reciprocal IEEPA duties are collected due to implementation lag, such duties should be eligible for refund through the standard:

- U.S. Customs and Border Protection (CBP) protest mechanism under 19 U.S.C. §1514, or

- Post-summary correction procedures, as applicable.

However, exporters should note that there is no assurance that the refund process will not be time-consuming.

3. Important Caution for Exporters

While GJEPC is actively engaging with U.S. customs authorities and keeping customs at Bharat Diamond Bourse informed, members are strongly advised to:

- Seek confirmation from their U.S. customs broker and trade counsel

- Obtain written confirmation from their U.S. buyer/importer regarding entry treatment

- Confirm that CBP has ceased collection of the reciprocal tariff at the port of entry

Given the evolving implementation environment, entry-level verification is critical.

Members are encouraged to carefully assess:

- Shipment timing

- Entry dates

- Applicable HTS classification

before dispatching consignments, wherever applicable.

source: GJEPC

-

National News6 hours ago

National News6 hours agoGJEPC addresses issue of Termination of IEEPA-Based Reciprocal Tariffs

-

National News8 hours ago

National News8 hours agoWGC India gold market update: Price strength fuels demand Looking ahead

-

International News9 hours ago

International News9 hours agoIGI approves an investment of up to $150,000 in Saudi Arabia

-

International News6 hours ago

International News6 hours agoUS Supreme Court ruling reshapes trade landscape for Indian GJ exports