JB Insights

A Sparkling Outlook for the 2025 colored gemstone Market:

Key Trend: The colored gemstone market is experiencing a surge in demand and prices, outpacing diamonds and presenting a bright outlook for 2025. This is driven by consumer desire for unique pieces, investor interest in tangible assets, and challenges facing the diamond industry.

Market Drivers:

- Rising Prices: Colored gemstone prices have increased significantly over the past decade, with further rises expected in 2025 due to supply constraints, increased mining costs, and growing demand for high-quality, traceable stones.

- Diamond Industry Challenges: Controversy surrounding Russian diamonds and the growth of lab-grown diamonds are contributing to the rise of colored gems.

- Investment Potential: High-value clients are increasingly viewing investment-grade gemstones as a hedge against other assets.

- Consumer Preference: Consumers are seeking unique and colorful alternatives to traditional diamond jewelry.

- Supply Chain Issues: Artisanal mining practices, limited funding, and a declining workforce pose challenges to consistent supply. Increased mining costs and logistical expenses further exacerbate the issue.

- Responsible Sourcing: Growing interest in ethically sourced gems is creating opportunities for suppliers who prioritize transparency and community benefit.

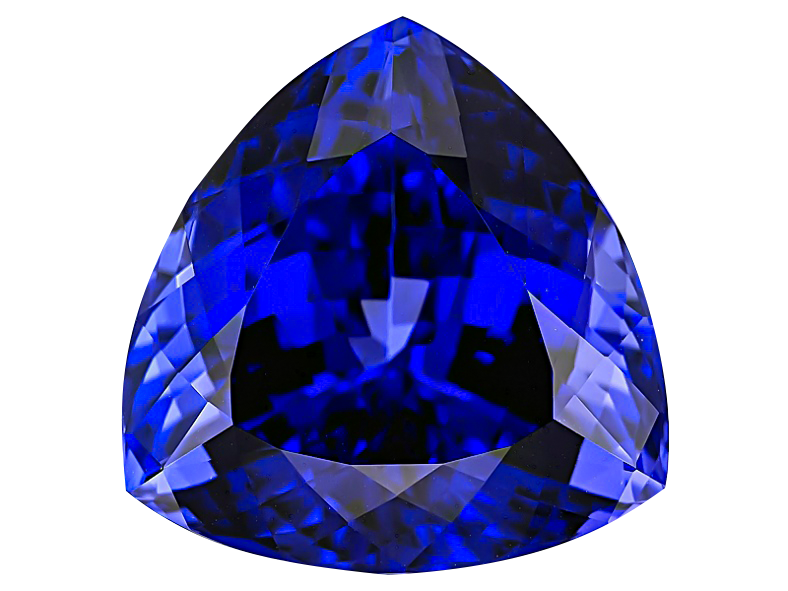

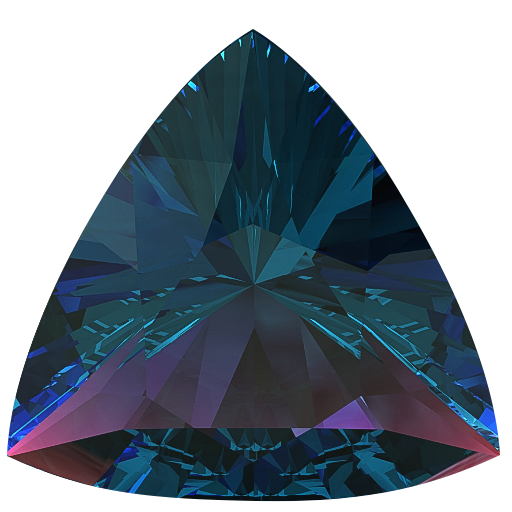

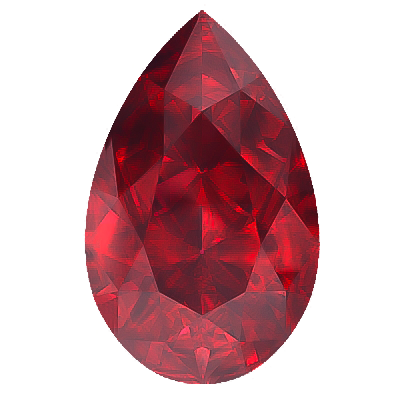

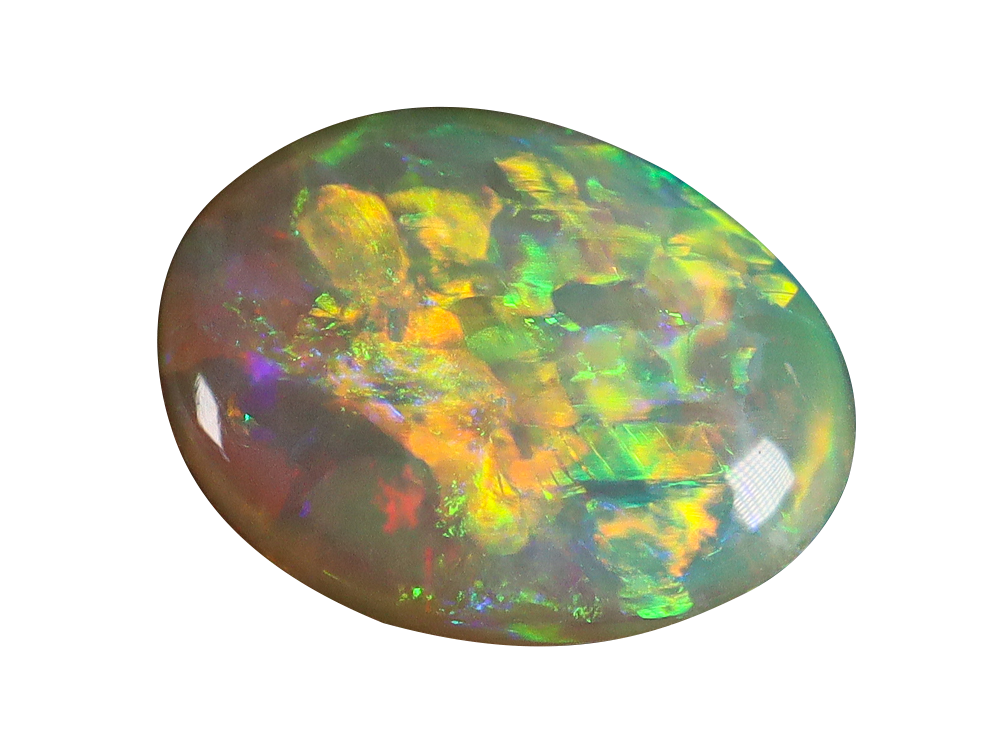

Top Performing Gemstones:

- Emeralds: Expected to be a star performer in 2025, particularly Colombian emeralds, due to growing awareness of their origin and sustainable practices.

- Sapphires: Teal, green, and particularly Montana sapphires continue to be in high demand. Australian sapphires, especially bicolor stones, are also gaining popularity.

- Spinels: Neon-pink Mahenge spinels and Vietnamese cobalt-blue spinels are attracting attention from collectors. Gray and lavender spinels also appeal to a broader consumer base.

- Other Rising Stars: Paraiba tourmalines, black opals, garnets (especially spessartite and Fanta garnet), imperial topaz, zircons, and yellow chrysoberyls are gaining traction.

Challenges:

- Price Resistance: Growing price resistance among traders, particularly for mid-tier goods, is a potential concern.

- Sourcing Difficulties: Sourcing high-quality colored gems remains a challenge due to the artisanal nature of much of the mining industry.

- Workforce Shortage: A decline in the mining workforce threatens long-term supply.

- Nuances in Quality and Pricing: The lack of standardized pricing lists and the subjective nature of quality assessment create complexities for newcomers to the market.

The synthetic issue

Synthetic colored stones have been available on the market for longer than their diamond counterparts and are generally considered a harmless subcategory. However, a rise in cases of synthetics getting mixed in with natural gems could change this feeling of security.

The problem appears to affect small goods more But because the industry is experiencing a shortage of natural stones, he warns, the issue could become more acute. Indeed, the undisclosed mix of stones is one of the most talked-about topics right now in the colored-gem industry.

, says Columbia Gem House’s Eric Braunwart, who has been investigating the topic.

“It opens the door for some of the less-ethical players to decide, ‘Well, let’s slide some [synthetics] into the natural parcels,’” he explains. “It’s not a new issue in color, but I think it is something that the industry overall will need…to spend some more time looking at.”

, says Monica Stephenson of Anza Gems and Moyo Gems. “This issue really highlights the importance of knowing origin and trust in traceable sources.”

Outlook:

The colored gemstone market is poised for continued growth in 2025. While price increases are expected to continue, particularly for high-quality stones, the market is also seeing increased interest in ethically sourced and unique gems. The Tucson gem shows will provide a key indicator of market strength and price stability. A proactive approach to purchasing, prioritizing quality and responsible sourcing, will be crucial for success in this dynamic market.

JB Insights

V.K.¬Ý Jewels: Building trust through consistency, precision and customer-centricity

Industry leader in precision gold manufacturing, V.K. Jewels is renowned for pioneering “paper casting” technology. They specialize in CZ-studded gold jewellery that marries grand aesthetics with lightweight efficiency. By integrating AI-driven design and a robust B2B network, V.K. Jewels offers retailers a competitive edge through consistent quality and trend-forward innovation. Witness the journey of a brand built on trust and technological excellence.

The Beginning, Evolution, Milestones

V.K. Jewels was founded in 1993 in Rajkot by Vijay Kotak with limited resources but a strong vision — to bring quality craftsmanship, reliability, and trust to the jewellery manufacturing space. Starting with silver casting, the company gradually built trust through consistency, precision, and customer-centricity.

With Hiren Kotak entering the business, key milestones included the transition into CZ-studded gold jewellery, expansion into plain gold casting, adoption of lightweight and paper casting techniques, and building a strong B2B dealer network across India.

Today, V.K. Jewels stands as one of the biggest casting jewellery manufacturers in India, known for paper-casting jewellery, innovation, volume capability, and market responsiveness.

Early Challenges & Growth Strategy

In the early 90s, the jewellery market was highly competitive, fragmented, and dominated by traditional players. Limited capital and evolving market preferences posed challenges.

Visionary decisions such as focusing on manufacturing excellence, investing in modern casting technology, and building long-term dealer relationships helped V.K. Jewels scale rapidly. A strong emphasis on lightweight jewellery and consistent superior quality enabled the brand to differentiate itself and become one of India’s leading manufacturers.

Product Offering

Core Product Lines

V.K. Jewels offers a wide range of CZ-studded jewellery and plain gold casting jewellery, including rings, pendants, earrings, bangles, bracelets, chains, and bridal sets.

The collections cater to multiple segments — from mass-market daily wear to premium bridal and festive jewellery — enabling retailers and wholesalers to serve diverse customer needs efficiently.

Portfolio Expansion Beyond Silver

Starting from silver casting, V.K. Jewels expanded into gold casting and CZ jewellery to meet evolving consumer demands for affordability, design variety, and lighter weight.

The portfolio now supports both wholesale and corporate brands of India with ready-to-sell designs, fast-moving collections, and trend-driven styles suited for modern consumers.

Top-of-the-Line Products

Flagship Products – Strong Visual Appeal

V.K. Jewels’ lightweight CZ-studded necklaces, daily wear rings, and earrings are among its top performers. These products are preferred by high-end wholesalers, retailers, and corporates due to their excellent finishing, competitive pricing, fast inventory turnover, and strong visual appeal.

The use of paper casting ensures reduced gold weight without compromising on design aesthetics.

Bestseller Highlights

The bestselling categories include CZ-studded necklace sets and rings, known for their rich look, lightweight structure, and durability. Customers appreciate their premium finish, long-wear comfort, and excellent value proposition, making them a favourite choice for wedding and festive purchases.

Design Innovation & Quality

Ensuring Innovation & Quality

V.K. Jewels continuously invests in design research, CAD development, and market trend analysis. A dedicated design team works closely with production to ensure every piece meets modern style expectations while maintaining high manufacturing standards.

Rigorous quality checks at every stage ensure precision and durability.

Quality Assurance & Ethical Practices

The company follows strict quality control processes, including material verification, multi-stage inspections, and standardised finishing protocols.

Ethical sourcing and responsible manufacturing practices reinforce brilliance, durability, and trust.

Network of Wholesalers & Retailers

Distribution Network

V.K. Jewels has built a strong nationwide distribution network with wholesalers, retailers, and corporate brands across major jewellery hubs.

Supporting the Network Amid Rising Gold Prices

With rising gold prices, V.K. Jewels supports partners through lightweight designs, paper casting innovations, competitive pricing, faster stock rotation, and consistent supply.

This enables retailers to maintain margins while offering attractive, high-demand products.

Plans for Growth & Expansion

Short-Term & Long-Term Strategies

Short-term plans include expanding the dealer network and introducing new trend-aligned collections.

Long-term strategies focus on scaling exports, entering international markets, expanding product categories, and strengthening global brand visibility.

Scaling Manufacturing Capacity

The company is investing in expanded infrastructure, modern machinery, and skilled manpower to enhance production capacity while maintaining quality and timely delivery.

Continuous process optimisation ensures scalability without compromising craftsmanship.

Technology, AI & Automation Integration

V.K. Jewels integrates advanced CAD/CAM technologies, automation in casting and finishing, and digital quality control systems.

The adoption of AI-driven design analysis, demand forecasting, and production planning tools enhances efficiency, accuracy, and operational optimisation.

JbExclusive: Digital View

-

International News13 hours ago

International News13 hours agoTanishq USA & Bibhu Mohapatra Unveil ‘She Is the Balance’ at Manhattan for Fall 2026

-

National News13 hours ago

National News13 hours agoGJEPC & Mumbai Customs Host Session on Hand-Carried Jewellery Exports

-

DiamondBuzz14 hours ago

DiamondBuzz14 hours ago¬ÝStructural challenges continue to weigh on the diamond sector:ICRA

-

GlamBuzz16 hours ago

GlamBuzz16 hours agoDua Lipa Stuns in Bulgari’s Rare Black Diamond Necklace at Berlin Premiere