International News

A new collection to celebrate ruby month- Arayian x Gemfields

Ruby is the fiery birthstone for the month of July – and to mark the arrival of this sultry summer month comes a new collaboration featuring gems from Gemfields’ ruby mine in Mozambique.

The Arayian Jewellery x Gemfields capsule collection harnesses the allure and talismanic properties of Mozambican rubies in an array of designs, from elegant dangling ‘chandelier’ earrings to diamond-encrusted ruby rings, classic bracelets, and rich statement necklaces.

Renowned for its bold use of coloured gemstones and red-carpet-worthy designs, Arayian’s pieces are a perfect showcase for rubies from Montepuez Ruby Mining, located on one of the world’s most significant ruby deposits and majority-owned by Gemfields, a world-leading responsible miner and marketer of coloured gemstones. Though the deposit was only discovered in 2009, Montepuez has been the source of some of the most exquisite gems the world has ever seen, putting Mozambique firmly on the map when it comes to rubies.

Arayian is renowned for working with some of the finest coloured gemstones from selected suppliers, and then expertly cutting these and managing the entire process in-house, from sourcing to creation, to ensure the most exceptional quality. The new collection features refined, timeless designs, created by Arayian’s team of master artisans to highlight the natural beauty of each gemstone, with subtle modern elements woven into classic forms, resulting in pieces that feel current yet enduring: worthy of being passed down generations.

Arayian shares Gemfields’ passion for responsible practices, making it an ideal brand partner. Gemfields strives to operate with transparency, legitimacy and integrity at every stage of the mining process, ensuring that profits from sales of its coloured gemstones – rubies from Mozambique and emeralds from the Kagem mine in Zambia – bring tangible benefit back to their countries of origin, positively impacting communities.

“Each piece from the Arayian Jewellery x Gemfields collection features responsibly mined Mozambican rubies, chosen for their vivid colour and unique character,” says Elena Basaglia, Gemfields’ Head of Partnerships and Product – Downstream. “Gemfields takes great pride in seeing these gems showcased in striking designs that capture the glamour of the red carpet and the strength of the women who wear them,” adds Basaglia. Gemfields is delighted to see these treasures from Mozambique shining brightly in this exciting new collection – perfectly timed for ruby month, a high point of the year! The Arayian Jewellery x Gemfields ruby collection ranges from USD 7,500 to USD 150,000 and is available from 1 July 2025 on Arayian.com

International News

Gold prices climbed above $4,250 ahead US ISM Manufacturing PMI release

US spot Gold prices climbed above $4,250 early Monday, touching a six-week high as investors turned cautious ahead of the upcoming US ISM Manufacturing PMI release. The yellow metal is poised for further upside momentum if it secures a sustained daily close above the crucial $4,250 resistance level.

The US Dollar opened December on a softer note, pressured by rising expectations that the Federal Reserve may announce a rate cut next week. Growing market confidence in easing monetary conditions has boosted the appeal of non-yielding assets such as gold.

Analysts note that a decisive break and close above $4,250 could reinforce bullish sentiment and pave the way for an extended rally in the days ahead. As global markets await fresh cues from the US economic calendar, gold continues to benefit from a favorable macroeconomic backdrop and robust safe-haven demand.

-

BrandBuzz11 hours ago

BrandBuzz11 hours agoMCA raises “small company” thresholds – up to ₹10 cr capital & ₹100 cr turnover from 1st December 2025, major relief for jewellery trade

-

JB Insights12 hours ago

JB Insights12 hours agoWomen Leaders Driving the Luxury Renaissance

-

National News16 hours ago

National News16 hours agoSHINESHILPI Announces the Launch of The Shine House, India’s Biggest B2B Jewellery Hub

-

National News14 hours ago

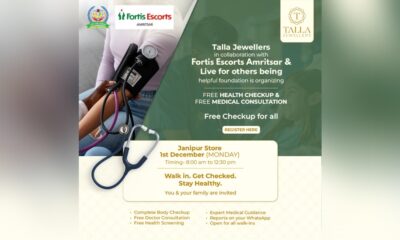

National News14 hours agoTalla Jewellers Successfully Hosts Free Health Checkup Camp with Fortis Escorts Amritsar and Live For Others Foundation