JB Insights

Why gold loans are a budget friendly choice

by PRIYANK KOTHARI

Let’s be real Money management is not getting any easier these days. Everything seems to cost more, unexpected expenses pop up out of nowhere, and even with the best planning, it’s easy to feel like your savings are always being stretched.

Whether it is a medical bill, your child’s school fees, a temporary dip in your business, or just the need to stay afloat between paydays having quick and affordable access to funds can make all the difference.

That’s where gold loans quietly shine. They’re not talked about as often as personal loans or credit cards, but for many people, they turn out to be the most practical and budget-friendly way to borrow. Especially when you have got gold jewellery just sitting in your locker, doing nothing.

PRIYANK KOTHARI,DIRECTOR, ARVOG

Here are a few reasons why gold loans be one of the smartest financial tools you already have

1.Lower Interest Rates That Actually Make Sense

Let’s start with what hits your wallet the hardest interest rates. Gold loans generally come with much lower interest rates compared to personal loans or credit cards. Why? Because your gold acts as security, so lenders aren’t taking as much risk.

What that means for you: lower monthly repayments, less money lost to interest, and more control over your finances. When you’re borrowing for something important, you don’t want the cost of borrowing to be higher than the need itself and with gold loans, it usually is not.

2. You Don’t Have to Break Your Savings

We’ve all had that moment wondering if you should dip into your fixed deposit or touch the money you’ve been saving up for something else. With a gold loan, you don’t need to touch your emergency fund or long-term investments.

You’re simply borrowing against something you already own. And the best part? You get your gold back once you’ve repaid the loan. No loss, no regret. It’s like giving your gold a job with-out selling it off.

3. No Credit Score? No Problem.

Not everyone has a perfect credit score. Maybe you’re self-employed, maybe you’ve had a few hiccups in your financial journey, or maybe you’re just starting out. The good news is you don’t need a high credit score to get a gold loan.

Lenders look at the value of your gold, not your financial history. So even if traditional loans haven’t worked out for you, a gold loan could still be a solid option with less hassle and better terms.

4. Repay the Way That Works for You

One of the biggest struggles with most loans is the rigid monthly EMI structure. With gold loans, there’s more flexibility. You can choose to pay regular EMIs, go for interest-only payments, or repay the entire amount later in one shot.

This gives you the space to manage your cash flow without pressure. Whether you’re a salaried employee, a shop owner, or running a small business being able to choose how and when you repay is a huge relief.

5. It’s Quick, Simple, and Doesn’t Drown You in Paperwork

If you’ve ever taken a loan from a traditional bank, you know how tiring the process can be. Endless documents, multiple visits, long wait times. With gold loans, the process is a lot smoother.

In most cases, all you need is an ID proof, a passport-size photo, and your gold. Some lenders even offer doorstep service, and in many cases, the money is transferred within a few hours. No long queues. No run arounds.

6. No Restrictions on How You Use the Money

One of the best things about gold loans? You don’t need to explain why you’re borrowing. Whether it’s for home repairs, school fees, expanding your business, or even covering daily expenses the choice is yours.

Unlike some loans where the lender decides what’s acceptable, with gold loans, you are in full control of how the money is used. It’s your gold, and your decision.

7. You Get Your Gold Back Safe and Sound

A common fear is: What if something happens to my jewellery? It’s a valid concern especially if you’ve heard horror stories from the past. But things have changed.

Today, lenders keep your gold in insured, secure vaults, with everything properly documented and tracked. And when you repay your loan, your gold is returned to you in the same condition. Safe. Intact. No surprises.

We have always looked at gold as something we save for the future something we lock away for security. But here’s the thing sometimes, the future shows up early, and you need that security now.

You have got gold lying idle, maybe it’s time to let it work for you not just as an emotional asset, but as real financial support when you need it most.

Because at the end of the day, it’s not just about borrowing money. It’s about doing it smartly and gold loans help you do just that.Bottom of Form

Education

The New-Age Jewellery Professional: Why Tech Education for Jewellery Industry is the Biggest Growth Driver

#JbExclusive

The jewellery industry is no longer defined by craftsmanship alone. Today, it sits at the intersection of design, technology, sustainability, finance, branding, and global trade. As consumer expectations evolve and competition intensifies, structured education and continuous skill development are emerging as the most powerful growth catalysts for the sector.

For a dynamic industry like India’s jewellery market, education is not optional — it is strategic.

From Karigar to Knowledge Professional

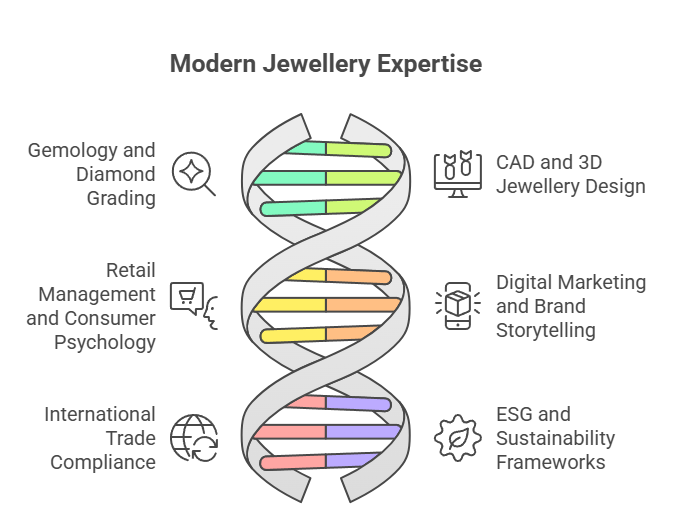

For decades, the backbone of the industry has been generational craftsmanship. While this legacy remains invaluable, modern jewellery businesses now demand professionals who understand:

- Gemology and diamond grading

- CAD and 3D jewellery design

- Retail management and consumer psychology

- Digital marketing and brand storytelling

- International trade compliance and tariffs

- ESG and sustainability frameworks

Institutions such as the Gemological Institute of America and the Indian Institute of Gems and Jewellery have played a key role in formalising education pathways, helping transform traditional artisans and retailers into globally competitive professionals.

Trend Watch: Rise of Tech-Integrated Learning

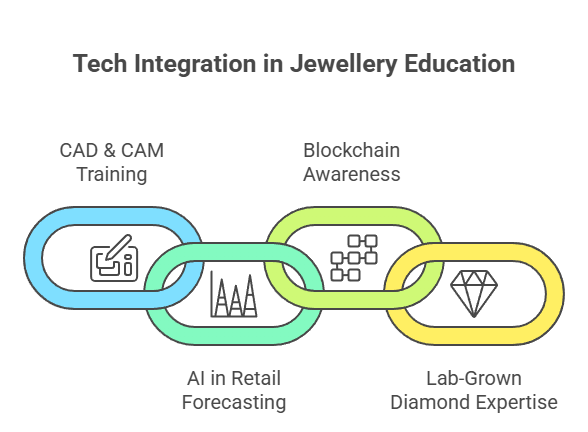

One of the strongest education trends shaping the industry is technology integration.

- CAD & CAM Training: Digital prototyping reduces costs and speeds up product development cycles.

- AI in Retail Forecasting: Data-driven inventory planning is replacing intuition-based buying.

- Blockchain Awareness: Traceability in diamonds and coloured gemstones is becoming a compliance requirement rather than a luxury.

- Lab-Grown Diamond Expertise: As lab-grown diamonds gain market share, understanding grading, pricing dynamics, and consumer positioning has become critical.

Educational programs now increasingly blend online modules with hands-on workshops, enabling faster upskilling for working professionals.

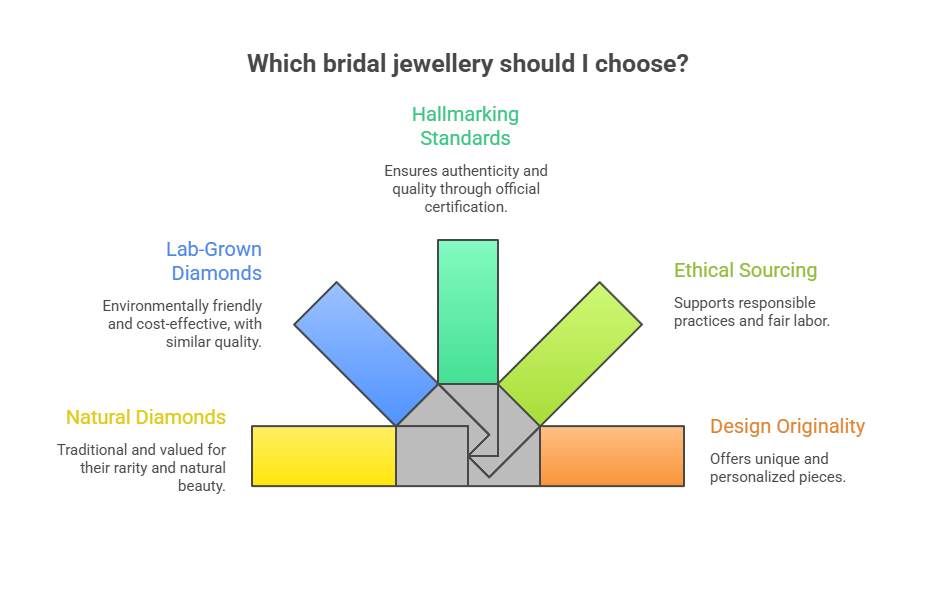

The Bridal Economy & Consumer Education

India’s bridal jewellery segment continues to drive demand, but the modern bride is informed and research-oriented. She compares:

- Natural vs lab-grown diamonds

- Hallmarking standards

- Ethical sourcing claims

- Design originality

Retailers who invest in staff education see higher trust conversion rates. Well-trained sales professionals are no longer “salespeople” — they are consultants guiding life-defining purchases.

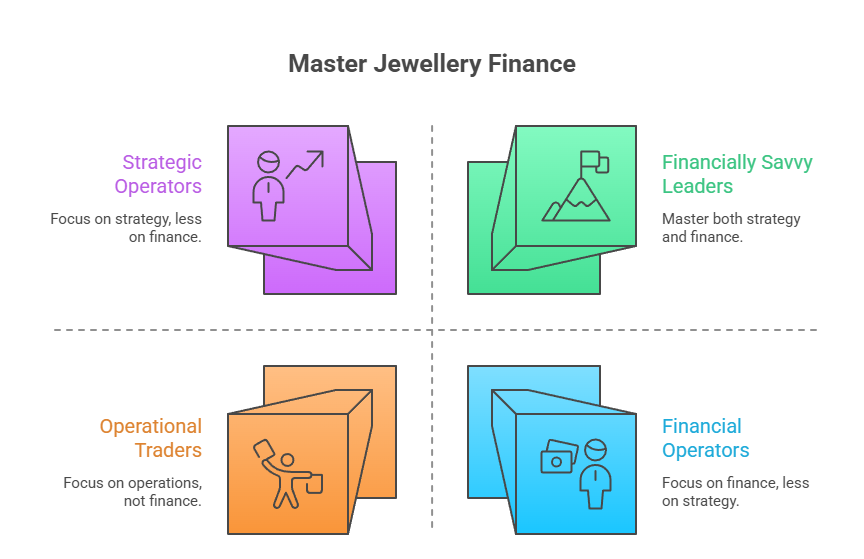

Financial Literacy in Jewellery

Another emerging area is financial education within the industry itself. With gold functioning as both adornment and asset, professionals must understand:

- Gold monetisation frameworks

- Hedging strategies

- Commodity price cycles

- Working capital management

Structured knowledge helps businesses move from being inventory-heavy traders to strategically managed enterprises.

Sustainability & Responsible Sourcing

Global buyers increasingly demand proof of ethical sourcing and environmental compliance. Education around responsible mining practices, supply-chain transparency, and ESG reporting is becoming central to export competitiveness.

Industry bodies such as the Gem & Jewellery Export Promotion Council regularly conduct seminars and workshops to align Indian exporters with evolving global standards.

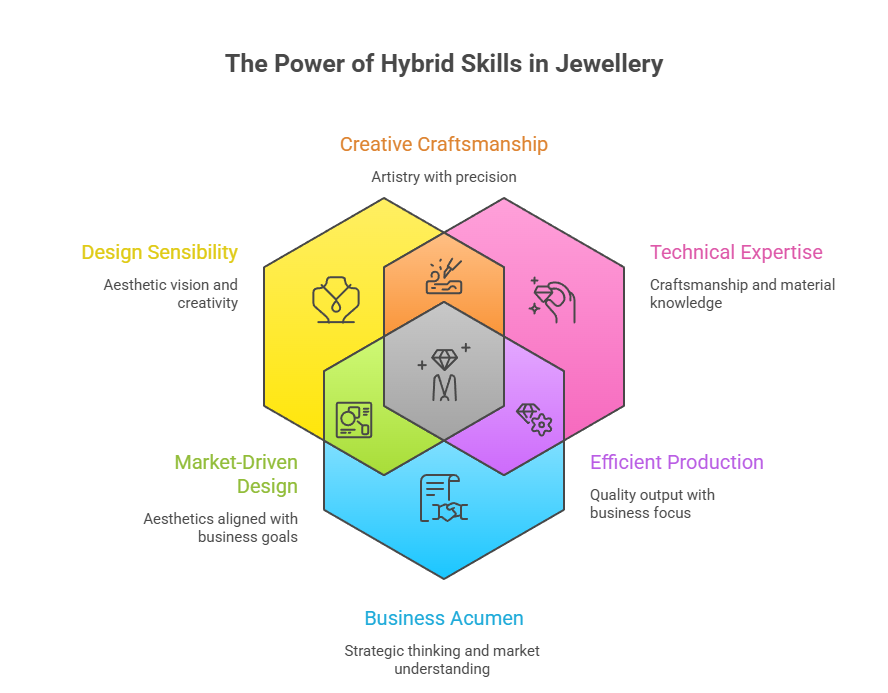

The Future: Hybrid Skills Will Win

The next generation jewellery professional will not be defined by a single skill. The future belongs to those who combine:

- Design sensibility

- Technical expertise

- Business acumen

- Digital fluency

- Ethical awareness

For a sector contributing significantly to India’s exports and employment, education is the bridge between heritage and high growth.

Knowledge is the new luxury. As the jewellery industry transitions into a more organised, tech-enabled, and globally integrated ecosystem, continuous learning will determine who leads and who lags. The sparkle of the future will not just come from diamonds — it will come from informed minds shaping the industry.

-

National News1 hour ago

National News1 hour agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration