International News

Signet Jewelers to close stores, reduce staff amid declining sales

Signet Jewelers Ltd. is planning to revamp its business following a disappointing fourth-quarter and fiscal year. Signet announced plans to close, renovate, and relocate stores and reduce it senior leadership by 30 percent after reporting a 7 percent drop in annual sales. The moves are part of the retailer’s new turnaround plan, “Grow Brand Love,” which also includes emphasizing brand loyalty over store banners.

The jewelry giant’s plans include a new turnaround plan that encompasses leadership changes, store closures and renovations, and a focus on brand loyalty.It will focus on creating a clear distinction between brands to attract new and loyal customers that see themselves reflected in the DNA of each brand.

Its three largest brands, Kay, Zales, and Jared, have high consumer awareness, but growth has been “elusive” so the company will work on building brand loyalty.The company plans to add more design-focused jewelry into its assortment to promote gifting and self-purchasing while also expanding its position in the bridal market, which has been struggling in the wake of the COVID-19 pandemic.

The strategy will require a reorganization, including reducing the ranks of its senior leadership by 30 percent.The company also said that it will be evaluating 150 underperforming stores, primarily in malls, over the next two years and decide whether they should be closed or improved.There are also plans to renovate 200 locations and possibly relocate another 200.

For the quarter ended Feb. 1, Signet’s overall sales totaled $2.35 billion, down 6 percent year-over-year and below its expectations.same-store sales slipped 1 percent.For the full year, sales totaled $6.7 billion, down 7 percent year-over-year and also falling short of expectations.Same-store sales fell 3 percent

International News

Gold prices climbed above $4,250 ahead US ISM Manufacturing PMI release

US spot Gold prices climbed above $4,250 early Monday, touching a six-week high as investors turned cautious ahead of the upcoming US ISM Manufacturing PMI release. The yellow metal is poised for further upside momentum if it secures a sustained daily close above the crucial $4,250 resistance level.

The US Dollar opened December on a softer note, pressured by rising expectations that the Federal Reserve may announce a rate cut next week. Growing market confidence in easing monetary conditions has boosted the appeal of non-yielding assets such as gold.

Analysts note that a decisive break and close above $4,250 could reinforce bullish sentiment and pave the way for an extended rally in the days ahead. As global markets await fresh cues from the US economic calendar, gold continues to benefit from a favorable macroeconomic backdrop and robust safe-haven demand.

-

BrandBuzz8 hours ago

BrandBuzz8 hours agoMCA raises “small company” thresholds – up to ₹10 cr capital & ₹100 cr turnover from 1st December 2025, major relief for jewellery trade

-

JB Insights9 hours ago

JB Insights9 hours agoWomen Leaders Driving the Luxury Renaissance

-

National News13 hours ago

National News13 hours agoSHINESHILPI Announces the Launch of The Shine House, India’s Biggest B2B Jewellery Hub

-

National News11 hours ago

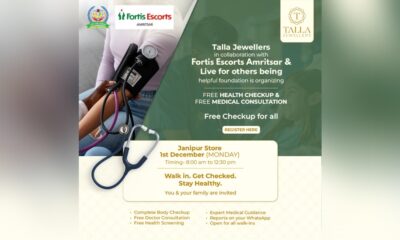

National News11 hours agoTalla Jewellers Successfully Hosts Free Health Checkup Camp with Fortis Escorts Amritsar and Live For Others Foundation