National News

Indian Jewellery market has grown from $50b to $80bn in 6 years: Motilal Oswal

Motilal Oswal Financial Services Ltd (MOFSL) suggest that the size of the Indian jewellery retail sector was close to USD80bn (INR6,400b) in FY24.

Motilal Oswal Financial Services Ltd (MOFSL) suggest that the size of the Indian jewellery retail sector was close to USD80bn (INR6,400b) in FY24.There are multiple drivers in the industry leading to such rapid growth, driven by rising disposable income (higher per capita growth in double digits), an improving mix for regular wear (beyond weddings and investment-led), enhanced product offerings (design, diamonds, etc.), trust-building through hallmarking, and a better buying experience at organized retail outlets Within this landscape, organized retail accounted for about 36-38% and comprised both pan-India and regional players.

The remainder of the jewellery retail sector continued to be dominated by the unorganized/local players, comprising over 500,000 local goldsmiths and jewelers. The total gold consumption in India was attributed to 66% for jewellery and remaining 34% for bars & coins.

India’s gold supply is dominated by imports

The gold market experienced notable fluctuations in imports from FY18 to FY20, reaching 980 tonnes in FY19 before declining to 720 tonnes in FY20. This volatility was led by various factors, including declines in global gold prices, buoyant economic conditions leading to heightened disposable incomes, and substantial demand for gold due to traditional celebrations and weddings. However, in FY20, a significant drop occurred due to escalating import duties and the initial stages of an economic slowdown.

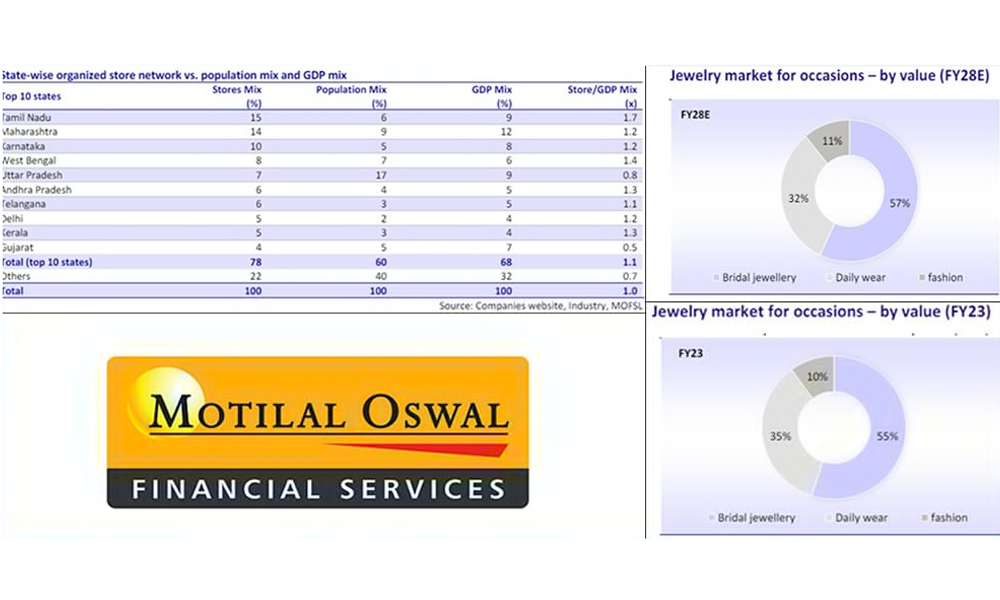

Top 10 states contribute 78% of the organized retail network

We captured the store locator for top 18 organized retailers to analyze the statelevel competitive landscape and market mix of each player. The top 10 states contribute 78% of the organized retail network of over 2,000 stores. These states contribute 60% of the total population and 68% of the GDP. Tamil Nadu, Maharashtra, Karnataka, West Bengal, and Uttar Pradesh are the top 5 states with a store mix of 15%, 14%, 10%, 8% and 7%, respectively.

Gold consumption patterns in India

Jewellery for occasions

Weddings and festivals are the primary reasons for the purchase of jewellery in India. Bridal jewellery still accounts for a significant portion of demand, contributing 55% to the total jewellery demand. Daily wear jewellery accounts for 30-35% of the Indian jewellery market. Players are strategically focusing on manufacturing lightweight pieces to cater to the preferences of younger consumers, especially those who desire daily wear gold jewellery that complements western-style attire. Fashion jewellery, on the other hand, contributes nearly 10% to the Indian jewellery market.

Jewellery by product category

Bangles and chains are the primary contributors to domestic jewellery consumption, accounting for 60-70% of total sales. These are preferred as daily wear by women. Necklaces contribute around 15-20% to the sales volume, with their sales surging during special occasions, such as festivals and weddings. The remaining 5-15% of sales is attributed to rings and earrings.

BrandBuzz

The Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

Timeless pearl creations from GIVA that honour the quiet strength, elegance, and individuality of modern women.

For generations, pearls have defined timeless elegance — an evergreen classic that transcends trends and seasons. Effortlessly refined, they carry a quiet sophistication that has remained relevant across eras.

Neither fleeting nor ornamental, pearls embody a kind of understated luxury, graceful, enduring, and always in style.

This Women’s Day, GIVA celebrates women who are building, leading, choosing, and redefining life on their own terms. Women who don’t need to be loud to be powerful, because their presence speaks for itself.

In that spirit, pearls make for a meaningful gift. Timeless yet modern, they move effortlessly from everyday moments to milestone celebrations, making them a thoughtful way to honour the women who inspire us, whether it’s a mentor, a friend, a colleague, or even yourself.

Here are some pearl pieces that make for perfect Women’s Day gifts.

Stay With Me Golden Pendant With Link Chain

For the one who wears her heart unapologetically. A radiant pearl drop pendant set in gold-plated 925 silver, designed with an elegant lattice motif that blends timeless romance with modern craftsmanship. From the Barkha Singh x GIVA Glow in Motion collection, this piece celebrates intricate CNC artistry while offering a refined statement for everyday elegance.

Gold Pearl Centred Diamond Earrings

Elegant and timeless, these 18K BIS-hallmarked gold earrings feature a delicate circular motif with a luminous pearl at the centre, accented by sparkling lab-grown diamonds below. Designed for everyday luxury, they blend classic sophistication with modern brilliance, making them a graceful statement for any occasion.

Rose Gold On Mom’s Path Bracelet

A heartfelt rose gold-plated bracelet crafted in 925 silver, featuring a charming baby shoe motif with enamel detailing, a delicate pearl accent, and a subtle “mom” engraving. Thoughtfully designed to celebrate the unbreakable bond between a mother and her child, it makes for a meaningful keepsake.

Anushka Sharma Silver Drops of Pearls Set

Inspired by the hidden beauty of ocean pearls, the Anushka Sharma Silver Drop of Pearl Set captures effortless elegance with a graceful pearl drop and sparkling zircon accents. Crafted in 925 silver, the set includes a delicate pendant and matching earrings designed to add timeless charm to any look.

Rose Gold Glam Drops Necklace

Graceful and statement-making, this rose gold-plated lariat necklace in 925 silver features a central oblong pearl with delicate cascading strands ending in luminous pearls. Elegant yet contemporary, it’s the perfect piece to elevate evening looks and special occasions with effortless glamour.

-

BrandBuzz12 hours ago

BrandBuzz12 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz13 hours ago

BrandBuzz13 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz16 hours ago

BrandBuzz16 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration

-

National News17 hours ago

National News17 hours agoKushals Fashion Jewellery Curates Special Women’s Day Edit Celebrating Strength, Style and Self-Expression