DiamondBuzz

GJEPC addresses key India challenges at IDMA’s 23rd Presidents’ Meeting in New York

Anoop Mehta, Co Convener, Diamond Panel Committee and in the capacity of being the representative of GJEPC at IDMA delivered a compelling address at the International Diamond Manufacturers Association’s (IDMA) 23rd Presidents’ Meeting in New York. Also present at the event was Sabyasachi Ray, Executive Director, GJEPC, reaffirming the Council’s commitment to addressing industry concerns and strengthening global partnerships.

A key concern is the impact of the G7 sanctions on Russian diamonds. Mehta acknowledged India’s commitment to ethical sourcing but warned that the sudden reduction in Russian rough supply-down by 37%-poses significant challenges. The sanctions could destabilise not only India’s diamond industry but also the global pipeline, with small workshops particularly vulnerable to rising traceability costs.

Mehta’s speech underscored the challenges and opportunities facing India’s diamond industry. highlighting the sector’s resilience amid global disruptions. He revealed that India’s rough diamond ports declined by 18% in volume and 34% in value e the past two years, while polished exports fell.

DiamondBuzz

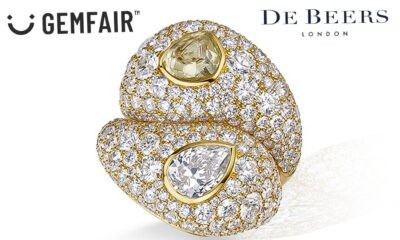

Gemfair and De Beers London have launched a capsule jewellery collection featuring ethically sourced artisanal diamonds.

This launch marks the first time that GemFair’s ethically sourced, artisanal-mined diamonds are featured in jewellery, bringing their story of supporting livelihoods to consumers

De Beers Group is pleased to announce a collaboration between GemFair, the company’s programme to help formalise the artisanal and small-scale diamond mining (ASM) sector, and its luxury jewellery brand, De Beers London, to bring the story and beauty of GemFair’s ethically sourced, artisanal diamonds to consumers for the first time.

GemFair is a first-of-its-kind sourcing initiative that aims to transform standards and livelihoods for artisanal diamond miners by providing fair value purchasing, training to improve mining and working practices and a formal and traceable route-to-market for ethically sourced artisanal diamonds. Through GemFair’s proprietary digital tools and third‑party‑verified assurance programme, eligible diamonds can be traced from mine site to market.

GemFair is also part of Building Forever – De Beers Group’s industry-leading commitment to sustainability – transforming rarity into responsibility by supporting meaningful impact that endures beyond diamonds for countries, communities and ecosystems. The programme’s success is measured through improvements in standards, support of livelihoods in both mining and alternative livelihoods like farming and fishing, and traceability rather than production volume, reflecting its long-term, systems-based approach.

The capsule collection with De Beers London translates this journey into a series of creations that pair rough and polished GemFair diamonds, offering a rare and tangible expression of transformation. Comprising twelve unique pieces, the capsule collection celebrates the House’s intimate relationship with the source. Sculpted by the quiet force of rivers, each diamond was individually selected for its character and quality. The polished diamonds were handcrafted exclusively for the capsule, while the rough diamonds remain as nature intended – an authentic and powerful tribute to the Earth’s raw beauty. Through ‘Toi & Moi’ rings and the ‘Modern Lines’ set, each piece reflects a continuous dialogue between discovery and craftsmanship, honouring both the origin of the diamond and the artistry that reveals it.

Beyond this capsule, GemFair is now a registered supplier to De Beers London for future collections, having met the House’s rigorous standards for quality and responsible sourcing. This partnership marks an important step in strengthening the connection between exceptional diamonds, the people who discover them, and the finished jewellery piece.

Emmanuelle Nodale, CEO of De Beers London, said: “We’re proud to be the first jeweller to launch a collection featuring GemFair ethically sourced diamonds, bringing not just their beauty but also the powerful story of artisanal miners to our clients. By introducing both rough and polished diamonds within the same creation, we offer a rare and tangible connection to each diamond’s path, from its discovery in ancient riverbeds to its transformation into a jewel.

These pieces carry not only the beauty of the diamond itself, but also the human stories behind it — stories of pride, opportunity and meaningful impact for artisanal mining communities. This collection marks an important step in our ongoing commitment to GemFair and to raising awareness of the programme’s important work.”

De Beers Group launched GemFair to lead industry efforts to formalise a transparent route to market for artisanal diamond miners, which accounts for around 10 per cent of global diamond supply by value and provides a vital source of livelihood for millions of people in some of the poorest parts of the world.

The programme launched in 2018 in the Kono region of Sierra Leone, where it continues to operate today. De Beers chose Sierra Leone to establish the GemFair programme because the government has made substantial efforts to include artisanal mining in its regulation and the country has transformed following the civil conflict that ended more than two decades ago.

Sandrine Conseiller, CEO of De Beers Brands & Diamond Desirability said: “Today’s luxury is defined not only by craftsmanship but by conscience. As part of our commitment to Building Forever, GemFair plays a vital role in supporting livelihoods by formalising artisanal mining and creating fair, traceable routes to market. For the first time, we are bringing these diamonds to consumers through this new collection with De Beers London with pieces that celebrate the beauty of natural diamonds while telling a story of the producers’ empowerment and transformation.

It’s an important step in our efforts to translate rarity to responsibility and create meaningful impacts that endure beyond diamonds.”

Today, there are more than 500 artisanal mine sites participating in GemFair, which in turn support approximately 7,000 direct and many more indirect livelihoods. Since launching, GemFair has purchased more than 20,000 diamonds from participating miners and conducted more than 5,700 compliance visits to participating sites. GemFair has also launched a programme to reclaim artisanal mine sites once mining has ended to help improve safety and environmental practices within the sector. Since 2020, the programme has converted almost 160 abandoned mine pits to agricultural use and donated over 1,000 kilograms of rice, fruit and vegetable seedlings for local communities, supporting food security and providing an alternative source of livelihoods.

Steve Allan, Head of GemFair, said: “The collaboration with De Beers London marks a significant milestone for GemFair as our beautiful, ethically-sourced artisanal diamonds are sold in a dedicated jewellery collection for the first time. GemFair makes a tangible difference to the lives of the artisanal miners involved in the programme and it’s a great privilege to help tell their stories through the diamonds that we source and sell.

We’ve come a long way since starting out as a pilot programme trying to establish a model for something that had never been done before. It’s very rewarding to see GemFair diamonds set in such stunning jewellery pieces, representing a real full circle moment.”

-

BrandBuzz4 days ago

BrandBuzz4 days agoRanbir Kapoor Joins PNG Jewellers as the new Ambassador, Ushering in a New Chapter of Legacy and Modernity

-

New Premises4 days ago

New Premises4 days agoAimee Baruah Opens Grand Showroom of Manik Chand Nand Kishore Jewellers in Dibrugarh

-

National News4 days ago

National News4 days agoBakul Limbasiya Receives Prestigious APO National Award for LGD Pioneering

-

Appoinment4 days ago

Appoinment4 days agoTiffany & Co. Strengthens Leadership with David Ponzo as Deputy CEO