International News

CIBJO recommends new definition of ‘recycled gold’

The World Jewellery Confederation (CIBJO) is recommending a new definition of “recycled gold״ to be used in the jewellery and watch sectors, so as to provide greater clarity and consistency both within the industry and marketplace. CIBJO will henceforth include the definition in the guidance documents it produces.

The definition, which covers recycled materials recovered during manufacturing and fabrication processes before being sold to consumers, and also gold recovered from materials after they have been sold to consumers, was developed through extensive discussions among industry experts. It is designed to set stricter criteria for secondary and circular gold supplies, and aims to improve the identification of inputs and outputs in the gold refining and fabrication processes, as well promoting transparent and responsible sourcing.

CIBJO acknowledged the contribution made by the International Standardisation Organization (ISO) in creating a draft of the definition, as part of a wider standard ISO was developing for responsibly sourced gold, a project in which CIBJO was an active participant.

“There has been growing confusion about the different names and labels for re-refined gold,” explained CIBJO President Gaetano Cavalieri. “The new definition provides a clear statement and set of criteria for recycled gold, which is more stringent than definitions for many other materials. The industry needs a clearer definition to avoid consumer confusion and greenwashing, and to enhance trading practices and supply chain transparency.”

The new definition has already being accepted as a substantial improvement by leading jewellery industry participants and associations, and key industry bodies like the London Bullion Market Association (LBMA) and the World Gold Council (WGC) are considering how to incorporate the main elements of this definition into their guidance and responsible sourcing practices. For its part, the Responsible Jewellery Council (RJC) has already included a definition based on the same criteria in its updated Chain of Custody standard.

International News

Gold prices climbed above $4,250 ahead US ISM Manufacturing PMI release

US spot Gold prices climbed above $4,250 early Monday, touching a six-week high as investors turned cautious ahead of the upcoming US ISM Manufacturing PMI release. The yellow metal is poised for further upside momentum if it secures a sustained daily close above the crucial $4,250 resistance level.

The US Dollar opened December on a softer note, pressured by rising expectations that the Federal Reserve may announce a rate cut next week. Growing market confidence in easing monetary conditions has boosted the appeal of non-yielding assets such as gold.

Analysts note that a decisive break and close above $4,250 could reinforce bullish sentiment and pave the way for an extended rally in the days ahead. As global markets await fresh cues from the US economic calendar, gold continues to benefit from a favorable macroeconomic backdrop and robust safe-haven demand.

-

BrandBuzz7 hours ago

BrandBuzz7 hours agoMCA raises “small company” thresholds – up to ₹10 cr capital & ₹100 cr turnover from 1st December 2025, major relief for jewellery trade

-

JB Insights8 hours ago

JB Insights8 hours agoWomen Leaders Driving the Luxury Renaissance

-

National News12 hours ago

National News12 hours agoSHINESHILPI Announces the Launch of The Shine House, India’s Biggest B2B Jewellery Hub

-

National News10 hours ago

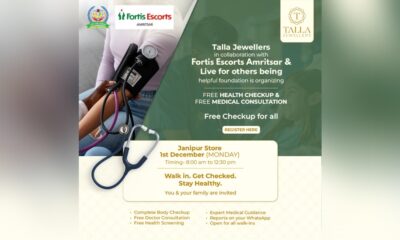

National News10 hours agoTalla Jewellers Successfully Hosts Free Health Checkup Camp with Fortis Escorts Amritsar and Live For Others Foundation