International News

Precious Metals start rallying as geopolitical tensions reignite AUGMONT BULLION REPORT

- While weaker-than-expected US consumer inflation data supported speculations of Federal Reserve rate reduction, rising US-Iran tensions rekindled demand for safe-haven assets, causing gold and silver to trade near Rs 98,000 and Rs 106,000, respectively.

- Iran threatened to strike US bases if negotiations over its nuclear program failed, so the US government ordered diplomatic employees to leave Baghdad.

- A 50 basis point rate cut by the Fed before the end of the year is now priced into the markets, and traders are keeping a careful eye on the PPI data that is due later today in anticipation of more hints ahead of the US central bank’s policy meeting next week.

- In the trade arena, Trump declared on Wednesday that a framework about tariff rates had been agreed upon by American and Chinese negotiators, resulting in an agreement to restore a precarious truce in the US-China trade war.

Technical Triggers

- Gold prices are expected to edge higher towards its resistance of $3425(~Rs 99000) in the near term.

- Silver is consolidating in a range of $36.5(~Rs 106,000) and $37 (~Rs 107,000) after a sharp rally. The next target is $38 (~Rs 111,000) if this positive momentum continues.

Support and Resistance

| Commodity | Support Level | Resistance Level |

|---|---|---|

| International Gold | $3275/oz | $3425/oz |

| Indian Gold | ₹95,000/10 gm | ₹99,000/10 gm |

| International Silver | $35.5/oz | $38/oz |

| Indian Silver | ₹1,05,000/kg | ₹1,11,000/kg |

International News

Gold prices climbed above $4,250 ahead US ISM Manufacturing PMI release

US spot Gold prices climbed above $4,250 early Monday, touching a six-week high as investors turned cautious ahead of the upcoming US ISM Manufacturing PMI release. The yellow metal is poised for further upside momentum if it secures a sustained daily close above the crucial $4,250 resistance level.

The US Dollar opened December on a softer note, pressured by rising expectations that the Federal Reserve may announce a rate cut next week. Growing market confidence in easing monetary conditions has boosted the appeal of non-yielding assets such as gold.

Analysts note that a decisive break and close above $4,250 could reinforce bullish sentiment and pave the way for an extended rally in the days ahead. As global markets await fresh cues from the US economic calendar, gold continues to benefit from a favorable macroeconomic backdrop and robust safe-haven demand.

-

BrandBuzz9 hours ago

BrandBuzz9 hours agoMCA raises “small company” thresholds – up to ₹10 cr capital & ₹100 cr turnover from 1st December 2025, major relief for jewellery trade

-

JB Insights10 hours ago

JB Insights10 hours agoWomen Leaders Driving the Luxury Renaissance

-

National News14 hours ago

National News14 hours agoSHINESHILPI Announces the Launch of The Shine House, India’s Biggest B2B Jewellery Hub

-

National News12 hours ago

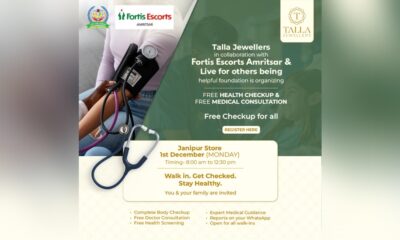

National News12 hours agoTalla Jewellers Successfully Hosts Free Health Checkup Camp with Fortis Escorts Amritsar and Live For Others Foundation