Feature

How “green” are LGDs?

Sustainability is a major bone of contention in the ongoing battle between mining companies and LGD/synthetic-diamond producers. The latter have generally pitched their product as a greener alternative to natural diamonds, while the former contend that these claims are exaggerated or even false.

Sustainability is a major bone of contention in the ongoing battle between mining companies and LGD/synthetic-diamond producers. The latter have generally pitched their product as a greener alternative to natural diamonds, while the former contend that these claims are exaggerated or even false.

Given the high financial and emotional costs, it’s critical for diamond brands to help consumers discern between what’s green and what greenwashing is. And LGD may not all be as environmentally or socially friendly as they seem.Not all man-made stones have the same carbon footprint, miners argue, adding that descriptions of lab-grown as “mining-free” are untrue, since elements of the creation process — such as the reactor — rely on mined materials.

“It is also not possible to make a simplistic general comparison between natural diamonds and laboratory-grown diamonds,” states the recent Diamond Facts report from the Natural Diamond Council (NDC). “Each category has a range of production processes, geographical locations, power sources, productivity capabilities, and sustainability practices.”

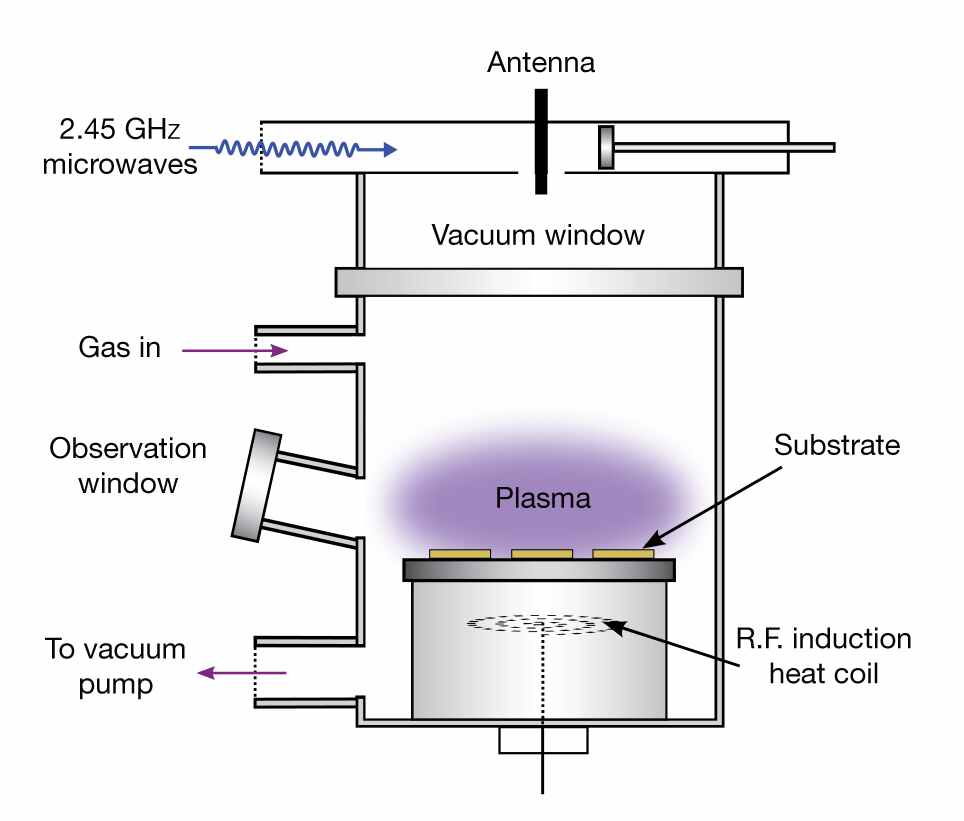

Even the carbon footprint of a given lab-grown diamond can vary wildly, according to environmental, social and governance (ESG) consultancy Sphera. If the producer uses renewable energy, a chemical vapor deposition (CVD) stone can generate as little as 17 kilograms of carbon dioxide equivalent (CO2eq) per polished carat, whereas one from a non-carbon-neutral facility in India — where the electric grid is heavily dependent on coal — can yield 260 kilograms per carat.

Truth is, science is simply not able to justify the claim that a lab-grown diamond is netting positive, or even neutral impact on the environment as of today. Like fast fashion, lab-grown diamonds can be made in weeks, or even days, and in unlimited quantities—while it takes billions of years to craft a single natural diamond.

The US Federal Trade Commission (FTC) is currently revising its Green Guides for marketing sustainable goods, and this will likely have an impact on how lab-grown and natural diamond producers present their products. FTC Green Guides explicitly discourages “broad, unqualified general environmental benefit claims like ‘green’ or ‘eco-friendly,’ ” as they are “difficult to substantiate, if not impossible.” Perhaps for this reason, the more circumspect lab-grown companies tend to use word sustainable.

Feature

More Sparkle, Less Rules: Winter 2025’s Jewelry Is All About Personality

Jewelry isn’t just an accessory this season—it’s the main character. Here’s what to stack, pin, swing, and layer now.

Forget quiet luxury—this season’s jewelry is anything but shy.

From the dramatic runways of Paris to the street style heroes in New York and Milan, to the Serene Fashion Parades of India, Fashion has many names and styles for each season. Every season is different from the previous, in terms of Fashion!

The Fall/Winter 2025 is ushering in a jewelry revival that’s less about prestige and more about personality. The mood? Think bolder, looser, minimalistic yet chunky and yet exceptionally offbeat.

Designers are ditching dainty and embracing drama: statement cuffs, grandma’s brooches (but make it cool), and necklaces so long they might get tangled in your belt loops. If your jewelry box has been playing it safe, it’s time to shake things up.

Here are the five key trends dominating the cool-weather conversation—each with just the right mix of nostalgia, irreverence, and runway-ready style.

1. Statement Cuffs: The Arm Party Is Back

Big, sculptural cuffs are taking center stage. Whether it’s polished metal, lacquered wood, or gemstone-studded creations, architectural wristwear is the bold accent every neutral coat or knit sleeve needs.✔️ Pro tip: Stack different materials for unexpected texture play, or let one oversized cuff steal the show.

2. Big Brooch Energy

The brooch is officially back—and no, it’s not just for grandmas anymore. Designers are pinning brooches to lapels, collars, and even shoes. From florals to abstract art pieces, it’s all about piling them on.

✔️ Try this: Cluster a few on your blazer or bag strap. Vintage shops & are goldmines for these.

3. Long, Layered Necklaces: The More the Merrier

Minimalists, look away. Necklaces are going long, chaotic, and charm-laden. Think layers that hit the waistband, with a mix of boho beads, bold pendants, and nostalgic trinkets. Juicy Couture flashbacks? We’re here for it.

✔️ Layer like a pro: Mix fine chains with chunky vintage finds for an eclectic, lived-in feel.

4. Fringe Earrings That Move With You

After seasons of sleek hoops and subtle studs, fringe earrings are back with a vengeance. Beaded, chained, or metallic, these swinging beauties add movement and drama—perfect for softening heavier fall silhouettes.

✔️ Best worn with: Swept-back hair, oversized scarves, and a little attitude.

5. Unexpected Placement: Jewelry Goes Rogue

Here’s where things get weird—in the best way. At McQueen, earrings tangled in hair; at Tory Burch, brooches on boots. The message is clear: wear your jewelry where you least expect it.

✔️ Fashion dare: Try a statement earring clipped to your collar, or a vintage pin on your beanie.

Jewelry this season isn’t about perfection. It’s about play. Whether you’re raiding your great-aunt’s collection or layering mismatched finds, the vibe is clear: More is more, Less can be enough and fun is fundamental.

So go ahead—say it with a brooch. Or six.

-

National News2 hours ago

National News2 hours agoThis Women’s Day, Dhirsons Jewellers Celebrates the Milestones in a Woman’s Journey

-

BrandBuzz18 hours ago

BrandBuzz18 hours agoThe Pearl Edit: Thoughtful Women’s Day Gifting by GIVA

-

BrandBuzz19 hours ago

BrandBuzz19 hours agoAugmont Launches SPOT 2.0: One Platform. Every Product. Efficient Business

-

BrandBuzz22 hours ago

BrandBuzz22 hours agoSenco Gold & Diamonds Launches “SHAPE OF YOU”- AI Application for Women’s Day Celebration