National News

CIBJO and AGTA Demand Full Disclosure on Irradiated Rubies and Sapphires

Trade Bodies Urge Transparency as Growing Concerns Over Color Stability and Treatment of Gemstones Persist

Rubies and sapphires are increasingly being treated with irradiation, a process that temporarily enhances their color, sparking concerns among professional trade organizations about the long-term stability of these gemstones. In a joint statement, the World Jewellery Confederation (CIBJO), the American Gem Trade Association (AGTA), and the International Colored Gemstone Association (ICA) have reiterated their call for full transparency and disclosure regarding gemstone treatments, particularly for stones sourced from Sri Lanka.

Since 1981, AGTA has advocated for a coding system to identify treated gemstones, and in 2010, CIBJO, AGTA, and ICA reached a global consensus on the disclosure of colored gemstone treatments. Despite these efforts, concerns remain, especially after the release of the 2022 statement, “Irradiation of Rubies: a Cautionary Note.” The issue of irradiated rubies and sapphires, particularly from Sri Lanka, continues to be a source of industry unease due to the temporary nature of their enhanced appearance.

AGTA has raised alarms in the U.S., where many dealers have stopped purchasing yellow, peach, and padparadscha sapphires, along with rubies from Sri Lanka, due to fears about their color stability over time. In response, the Sri Lankan Gem and Jewellery Association (SLGJA) has pledged to strengthen test reporting and encourage better disclosure practices.

CIBJO, AGTA, and ICA are urging authorities in Sri Lanka and other gemstone-producing regions to address these concerns urgently. “If the current situation persists, it will inevitably harm the industry and undermine consumer confidence in colored gemstones,” they warned.

National News

Hari Krishna Exports Mumbai Celebrates Annual Sports Day 2026 with Enthusiasm

Over 1,000 employees and families participate as Rs.3.5 lakh in prizes, gold coins and wellness recognition highlight the company’s commitment to employee well-being and team spirit.

Hari Krishna Exports Mumbai celebrated its Annual Sports Day 2026 on 22nd February with great enthusiasm, bringing together more than 1,000 employees and their families for a day of sports, unity, and celebration.

The event was graced by Chief Guest Ritu Rajesh Tawde, Mayor of Mumbai, along with respected dignitaries from the gem and jewellery industry. The programme began with the National Anthem, followed by a range of sports activities including cricket, volleyball, kabaddi, kho-kho, tug-of-war, running races, carrom, and box cricket. Employees from various departments participated with strong team spirit and sportsmanship.

A total prize pool of ₹3.5 lakh was awarded to recognise outstanding performances. Employees with perfect attendance were honoured with gold coins, and those demonstrating consistent discipline were appreciated with special rewards.

Addressing the gathering, Chairman Ghanshyambhai Dholakia said: “We are dedicated to the well-being of our employees, knowing that strong people build strong organisations. When others adopt similar efforts, it uplifts work culture across the entire industry.”

With over 60 wellness initiatives, Hari Krishna Exports continues to prioritise employee well-being and engagement. The Annual Sports Day reflects the organisation’s commitment to fostering teamwork, health, and a positive work culture.

source: Hari Krishna Exports

-

DiamondBuzz13 hours ago

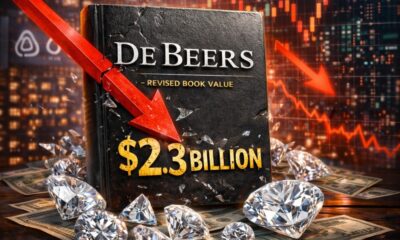

DiamondBuzz13 hours agoAnglo American cuts book value of De Beers to $2.3bn, reflects a convergence of structural and cyclical pressures

-

National News13 hours ago

National News13 hours agoHari Krishna Exports Mumbai Celebrates Annual Sports Day 2026 with Enthusiasm

-

DiamondBuzz14 hours ago

DiamondBuzz14 hours agoBAFTA 2026: De Beers Group- Desert Diamonds Emerged as the Jewellery Story of the Night

-

News15 hours ago

News15 hours agoIndia Pavilion showcases country’s finest jewellery craftsmanship at Inhorgenta Munich, Germany